Incorporating ACH NOC automation into commercial banking solutions can offer enhanced digital efficiency, accuracy, and user experience.

Automation is no longer a luxury but a necessity for banks and credit unions offering commercial banking solutions. Among the many processes that can benefit from automation, ACH Notifications of Change (NOCs) stand out as an area where efficiency, accuracy, and user satisfaction can be significantly enhanced. For financial institutions, automating ACH NOCs is a strategic move that can streamline operations, reduce errors, and improve compliance, all while providing better service to business account holders. Here’s why your bank or credit union should consider automating this crucial aspect of ACH transactions.

Understanding ACH NOCs

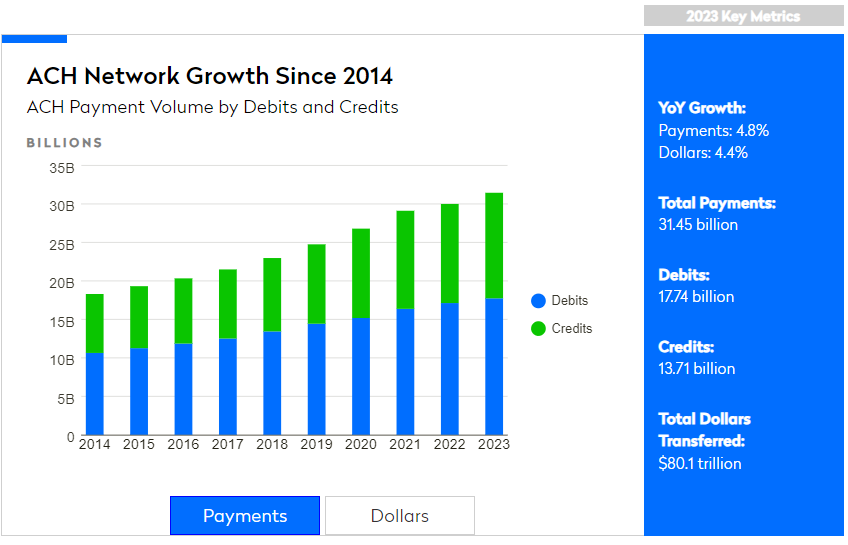

Before diving into the benefits of automation, let’s first understand what ACH NOCs entail. ACH payments are electronic transactions that move funds between accounts at different financial institutions. These transactions are governed by National Automated Clearing House Association (Nacha), Regulation E, and Uniform Commercial Code (UCC) rules, which ensure ACH payments are processed smoothly and accurately.

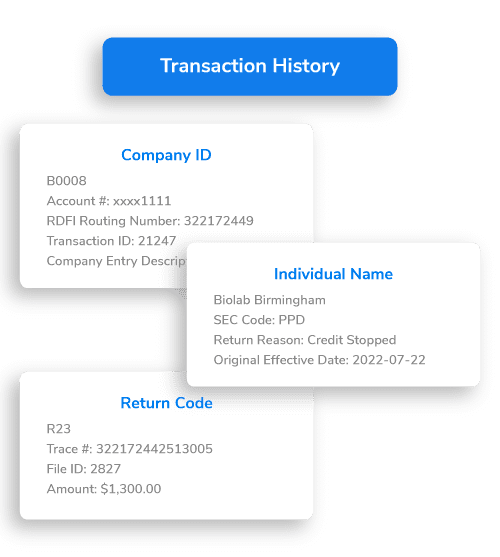

However, sometimes the information provided in an ACH transaction—such as an account number or routing number—is incorrect or outdated. When this happens, the receiving financial institution sends an ACH NOC back to the originator, indicating what information needs to be updated for future transactions. These NOCs are crucial for maintaining the accuracy of ACH payments and ensuring that funds are transferred correctly in the future.

Incorporating Positive Pay & ACH Reporting solutions can further enhance this process by providing an additional layer of notification to originators and Originating Depository Financial Institution (ODFIs) about NOCs. This proactive approach not only complements the role of ACH NOCs but also strengthens overall payment security and accuracy with treasury management solutions.

The Challenge of Manual Processing

In many legacy commercial banking solutions, ACH NOCs have been processed manually, which involves several steps:

- Receiving the NOC: The financial institution receives the NOC, often in a batch with other transactions.

- Reviewing the NOC: An employee reviews the notification to determine what information needs to be updated.

- Updating Records: The relevant account records are manually updated to reflect the correct information by the originator or ODFI.

- Communicating with the Originator: The originator of the transaction is notified of the changes.

While this process may seem straightforward, it is time-consuming and prone to human error. A small mistake in reviewing or updating information can lead to failed transactions, customer or member dissatisfaction, and even compliance issues.

The Benefits of Automation in Commercial Banking Solutions

Automating ACH NOC processing can alleviate these challenges and offer numerous benefits for banks and credit unions.

- Increased Efficiency

Automation dramatically speeds up the ACH NOC processing workflow. Instead of manually reviewing and updating records, automated systems can instantly process ACH NOCs as they are received. This not only saves time but also frees up employees to focus on more complex tasks that require human judgment and expertise.

- Improved Accuracy

Human error is a significant risk in manual processing, especially when dealing with large volumes of ACH transactions. Automated systems, however, are designed to handle repetitive tasks with precision, ensuring that updates are made correctly every time. By reducing the risk of errors, banks and credit unions can avoid costly mistakes and ensure that funds are transferred without issues.

- Enhanced Compliance

Compliance with Nacha rules is non-negotiable for financial institutions. Manual processing of ACH NOCs can lead to compliance breaches if notifications are not handled promptly and accurately. Automated systems are programmed to adhere to Nacha guidelines, ensuring that ACH NOCs are processed within the required timeframes and that all necessary updates are made. This reduces the risk of non-compliance and the associated penalties.

- Cost Savings

While there is an initial investment in automation technology, the long-term cost savings can be substantial. Automating NOC processing reduces the need for manual labor, which can lower staffing costs. Additionally, by minimizing errors and compliance issues, banks and credit unions can avoid the financial penalties and reputational damage associated with failed transactions.

- Better User Experience

Business account holders expect their transactions to be processed quickly and accurately. Delays or errors in ACH payments can lead to frustration and a loss of trust in the financial institution. By automating ACH NOC processing, banks and credit unions can ensure that account records are updated promptly, reducing the likelihood of payment failures and improving the overall user experience. This can lead to higher satisfaction and loyalty, which are crucial in today’s competitive banking environment.

- Scalability

As banks and credit unions grow, the volume of ACH transactions—and consequently, the number of NOCs—will increase. Manual processing may not be able to keep up with this growth, leading to bottlenecks and inefficiencies. Automated systems, on the other hand, can easily scale to handle higher volumes of transactions without compromising speed or accuracy. This scalability ensures that financial institutions can continue to provide excellent service as they expand.

Implementation Considerations in Commercial Banking Solutions

While the benefits of automating ACH NOC processing are clear, it’s important to approach implementation thoughtfully. Financial institutions should start by assessing their current ACH processing workflows and identifying areas where automation can be most impactful. Selecting the right ACH reporting solution is also crucial—look for solutions that integrate seamlessly with existing systems including your online banking platform and offer support for compliance and security.

Training staff to use the new system is another critical step. Even with automation, employees will need to understand how to oversee the process and handle exceptions when they arise. Providing comprehensive training ensures that your team can effectively manage the transition to automated ACH NOC processing.

Automating ACH NOCs: The Key to Streamlining Operations and Enhancing Trust

Automating ACH NOCs offers numerous benefits for banks and credit unions. By enhancing efficiency, accuracy, compliance, and user experience, automation can transform the way financial institutions handle ACH transactions. Staying ahead of the curve with automated ACH reporting solutions will be key to maintaining competitiveness and delivering the best possible service. Some core ACH processing and Electronic Bill/Invoice Presentment and Payment solutions allow the ODFI to receive and store NOCs sent to their originators, so routing number and/or account information can be automatically changed on behalf of the originator, when another outgoing entry is originated to the previous routing and account number combination.