Today’s financial consumers live in a world where their personal finances are digitized and at their disposal 24/7. They can digitally open and fund savings accounts or investment accounts, instantly move money, view a detailed transaction history, monitor their credit score, apply for loans, and pay their bills directly from a smartphone. The below is an analysis of the adoption and usage of today’s trendiest digital savings products through the lens of the spending behavior of 2.5 million account holders across twenty U.S. based financial institutions.

In April 2023, Apple Card’s high-yield savings account emerged, brought to life through a partnership with Goldman Sachs. In a matter of months, adoption soared and they reportedly accumulated over $10 billion in deposits.

As time went on, among Apple Card users, 97 percent opted to have their Daily Cash rewards seamlessly funneled into this savings haven.

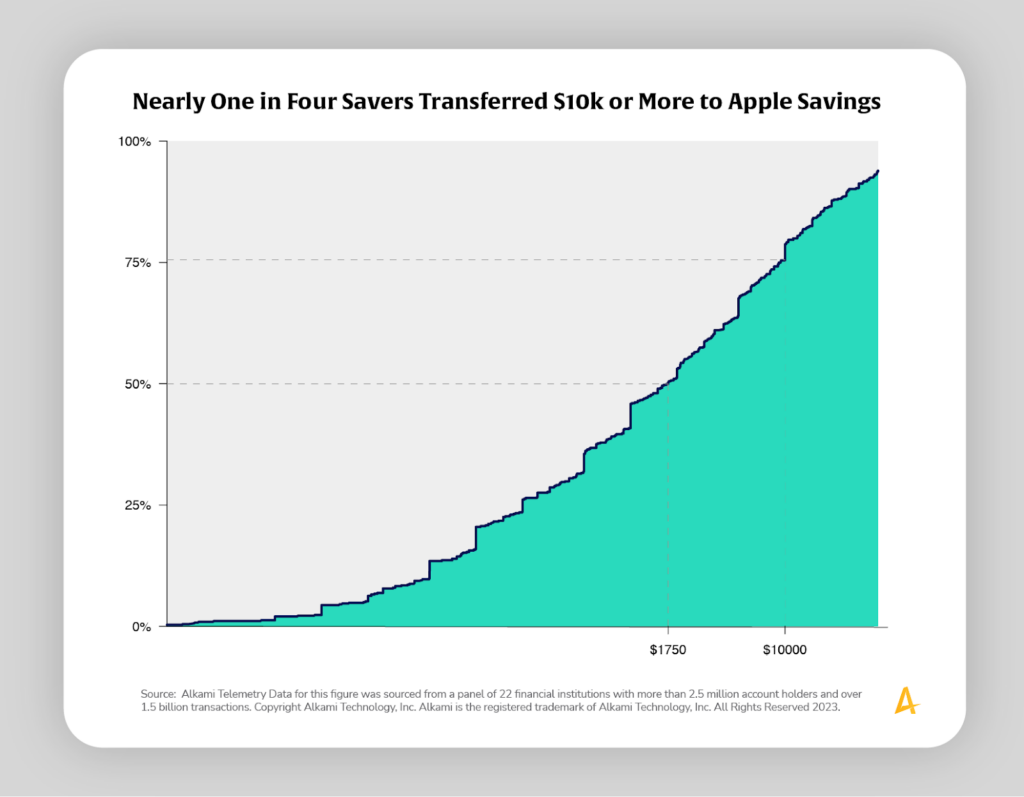

Furthermore, out of the 2.5 percent of Apple Card users who bolstered their savings, a median transfer amount of $1,750 was observed. And astonishingly, almost one in four users entrusted Apple Savings with $10,000 or more.

Another digital contender appeared within the data: fintech budgeting apps such as Rocket Money. Designed for easy saving through automated deposits or the famous “rounding up” strategy.

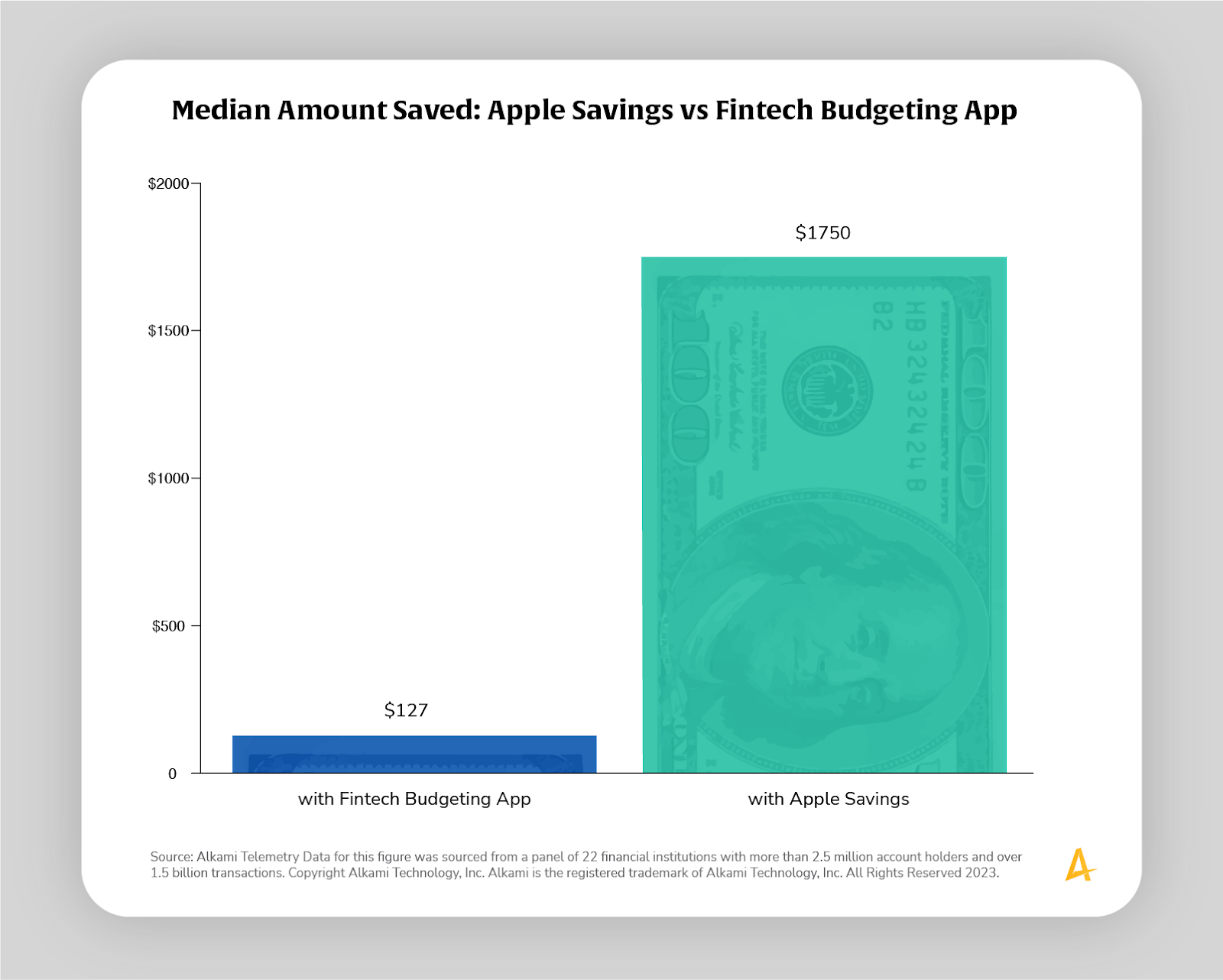

When compared to Apple Savings, something intriguing surfaced.

Savers using the fintech app displayed a different savings behavior altogether. Their median transfer was a modest $127, a far cry from Apple Savings users, who stashed away a median of $1,750.

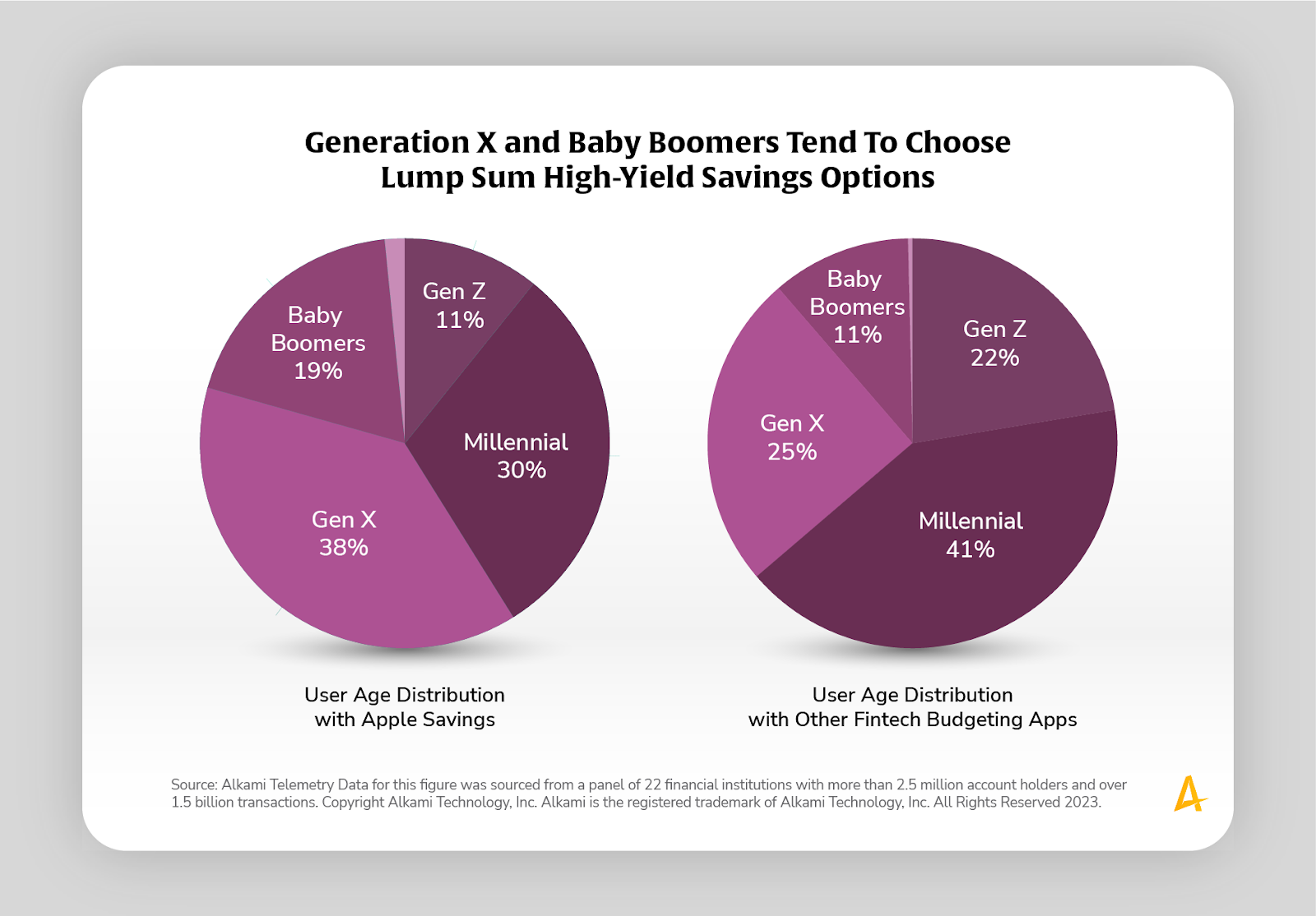

A fascinating nuance is the generational distribution in the world of digital finance. Data revealed that savers using budgeting apps tend to be younger, with a staggering 62 percent hailing from millennials and Generation Zers (Gen Z). Meanwhile, a mere 41 percent of Apple savers fell into these youthful demographics.

This revelation suggests that Apple savers find themselves at a more mature financial stage, contrasting with their younger fintech app counterparts, who are likely still in the early stages of their financial journey.

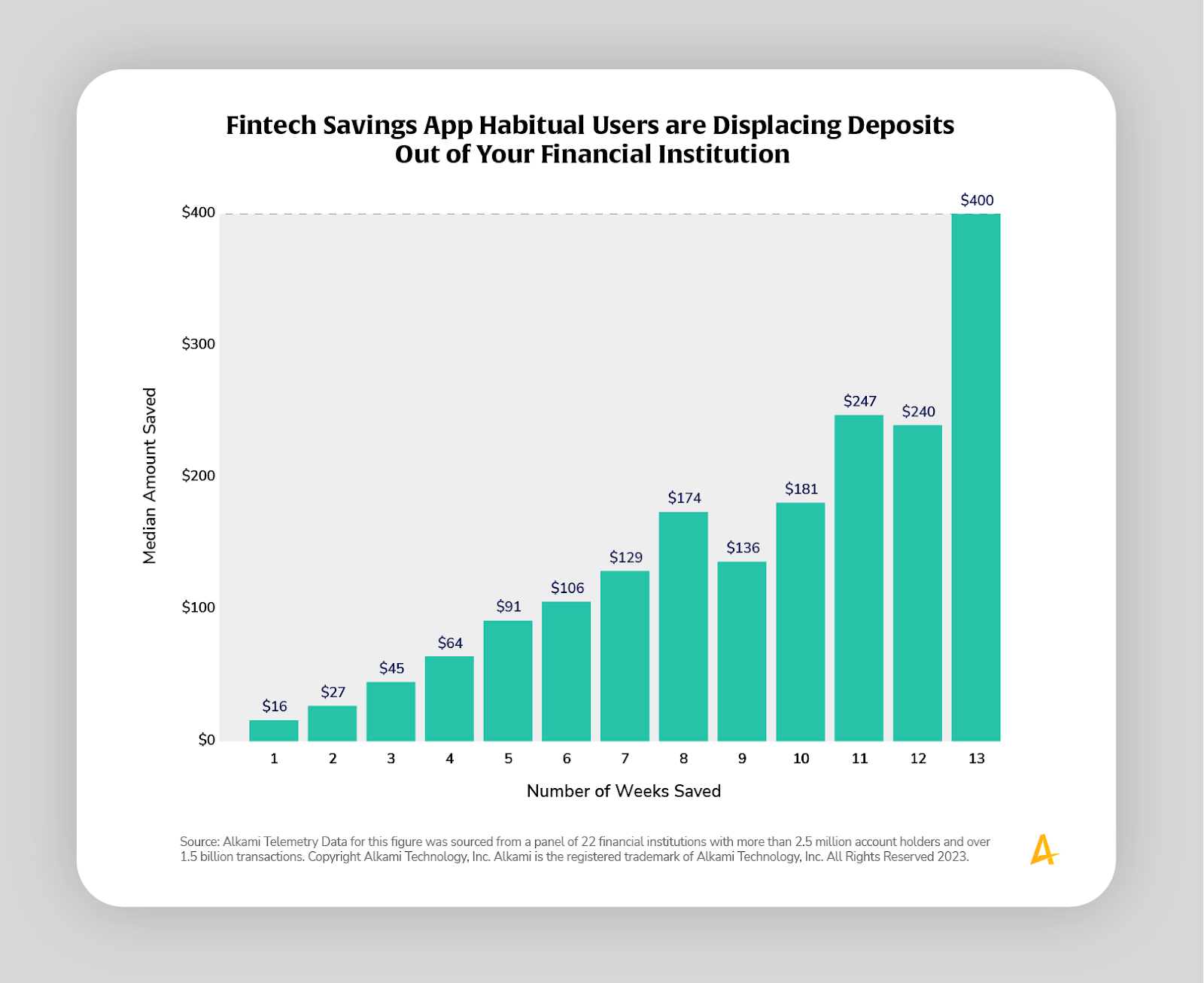

Now, let’s explore the role of consistency. Account holders who harness the savings features of fintech budgeting apps often transfer smaller amounts initially. But when we examine that trend over 13 weeks, savers who maintained a consistent savings habit reap a bountiful reward. Those who transferred funds diligently achieved a median savings amount of $400, a stark contrast to the mere $16 of intermittent savers.

These insights, analyzed from millions of account holders, are a testament to the dynamic nature of the financial world. As consumers adapt to these and other trends, financial institutions can create stickiness with account holders by offering the types of solutions they most desire.

Source: Alkami Telemetry Data for this analysis was sourced from a panel of 22 financial institutions with more than 2.5 million account holders and over 1.5 billion transactions.