Unlocking the Power of Treasury Management Solutions in Commercial Banking

Treasury management solutions are a cornerstone of commercial banking, playing a vital role in the efficient handling of a company’s short-term receivables, payables, and overall cash position.

Treasury Management involves a range of activities aimed at optimizing liquidity, managing investments, and mitigating financial risks. Banks and credit unions provide treasury management services as part of their commercial banking solutions to support businesses in streamlining their financial operations, ensuring smooth cash flow and strengthening financial health. This blog will delve into how treasury management works, its benefits for banks, credit unions, and commercial end users, what regulatory requirements exist today, and what financial institutions need in their treasury management toolset.

How It Works

Treasury management encompasses several key functions essential for effective financial administration: cash management, investment management, risk management, debt management, and financial reporting and analysis.

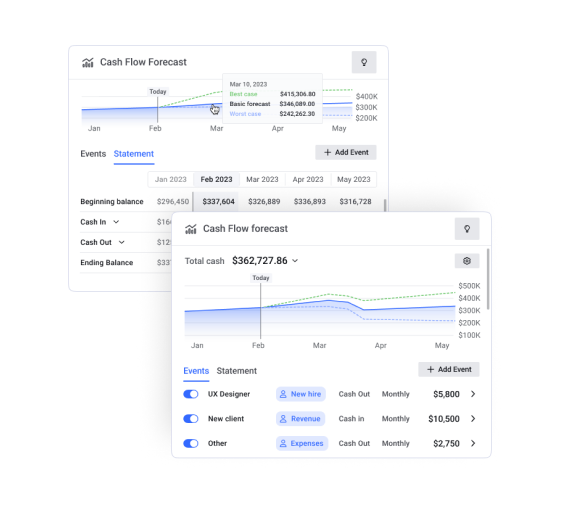

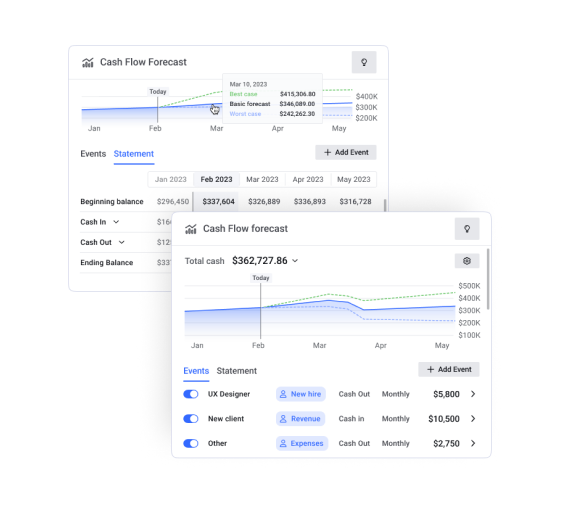

Cash management, or the inflow and outflow of cash to ensure a business can meet its financial obligations, also ensures the business or commercial enterprise is maximizing the efficiency of its cash usage. Cash management techniques include forecasting cash flow, managing receivables and payables, and maintaining optimal liquidity levels.

Treasury management solutions in the area of investment management help businesses allocate surplus funds into various investment opportunities. The goal is to generate returns while maintaining the right balance of risk and access to cash.

When it comes to risk management, identifying and mitigating risks is crucial. This includes managing risks in interest rates, foreign currencies, and short-term credit through various hedging strategies and financial instruments.

Effective treasury management also involves strategizing the use of short-term debt, ensuring favorable terms, and managing repayment schedules to optimize financial performance.

Providing accurate and timely financial reports helps in strategic decision-making. Advanced treasury management solutions offer real-time data and analytics, which are invaluable for tracking financial health and performance.

Treasury Management Solutions Benefits for Banks and Credit Unions

- Enhanced Liquidity Management: Treasury management solutions enable banks and credit unions to maintain optimal liquidity for themselves and their commercial clients, ensuring businesses can meet their short-term obligations while taking advantage of investment opportunities. Financial institutions also have a treasury area to help manage the collection of inbound payments to be applied to earning assets, outbound disbursements, overnight borrowings, and other funding activities.

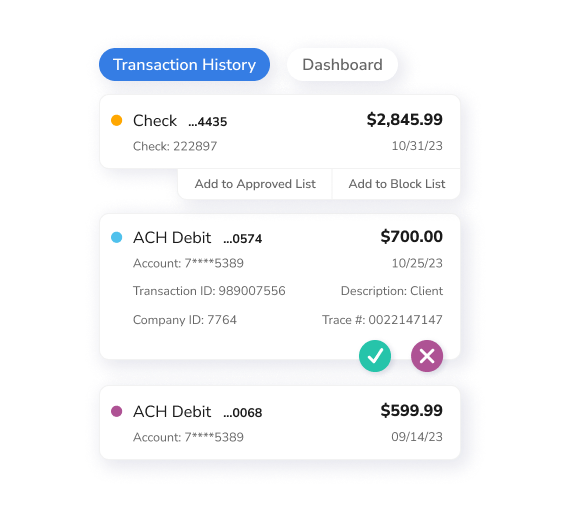

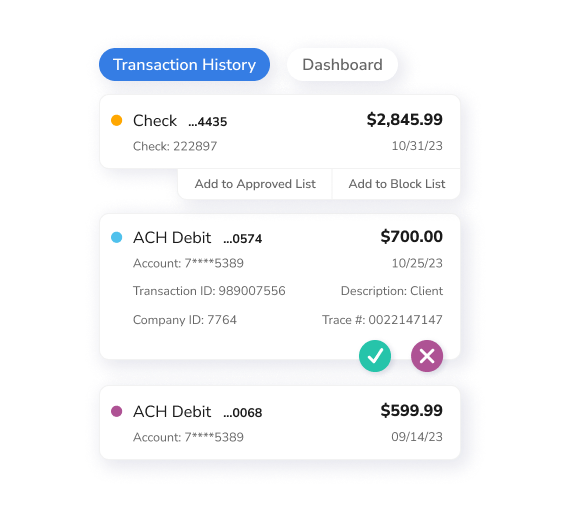

- Improved Risk Management: These solutions provide tools for identifying and mitigating transaction and anti-fraud risks, protecting institutions against market volatility, interest rate fluctuations, and other financial uncertainties.

- Operational Efficiency: Automation of treasury functions reduces manual errors and streamlines processes, allowing financial institutions to allocate resources more effectively and focus on strategic growth.

- Satisfaction: By offering a complete suite of treasury management solutions, banks and credit unions can provide more reliable and efficient services to their account holders or members, enhancing satisfaction and loyalty.

Treasury Management Solutions Benefits for End Users

- Optimized Cash Flow: Businesses can manage their cash flow more effectively, ensuring they have sufficient liquidity to meet their operational needs and minimizing the risk of cash shortages.

- Enhanced Investment Returns: With professional investment management services, commercial account holders can achieve better returns on their surplus funds, contributing to overall financial health.

- Risk Mitigation: Access to advanced risk management tools helps businesses safeguard their assets and operations from potential financial threats.

- Operational Streamlining: Automating financial processes saves time and reduces administrative burdens, allowing businesses to focus on optimizing their business, growing revenue streams, and achieving strategic goals.

Top Rules, Regulations, and Standards for U.S. Treasury Professionals

Financial institutions, technology providers, and treasury management professionals must navigate a complex regulatory landscape to ensure compliance and safeguard financial operations. While this is an ever expanding area, below are just a few of the regulations treasury management professionals must consider:

Dodd-Frank Wall Street Reform and Consumer Protection Act

- Purpose: Enacted in response to the 2008 financial crisis, and it aims to reduce risks in the financial system.

- Impact: Imposes stricter regulations on banks and credit unions to protect consumers and prevent another economic meltdown. It includes the Volcker Rule, which limits banks’ ability to engage in proprietary trading and certain investments.

Bank Secrecy Act (BSA) / Anti-Money Laundering (AML) Regulations

- Purpose: Designed to prevent money laundering, terrorist financing, and other financial crimes.

- Impact: Requires financial institutions to keep detailed records of transactions, report suspicious activities, and implement AML programs. Businesses dealing with significant cash transactions also have compliance obligations.

Sarbanes-Oxley Act (SOX)

- Purpose: Established to protect investors from fraudulent accounting activities by corporations.

- Impact: Imposes stringent recordkeeping and reporting requirements on publicly-traded companies. Ensures accuracy and reliability in corporate disclosures.

Office of Foreign Assets Control (OFAC) Regulations

- Purpose: Administers and enforces economic and trade sanctions based on U.S. foreign policy and national security goals.

- Impact: Financial institutions must screen transactions against OFAC’s list of sanctioned individuals and entities. Non-compliance can result in heavy penalties.

By understanding and complying with these regulations, treasury management professionals can mitigate risks, ensure financial stability, and maintain the integrity of their financial operations. This regulatory awareness not only protects the institution but also enhances trust and credibility with clients and stakeholders.

In Conclusion

To stay competitive and provide the best treasury management solutions, financial institutions need to:

- Adopt Advanced Technology: Implementing cutting-edge treasury management solutions with real-time analytics, automation, and comprehensive reporting capabilities.

- Deploy Multi-Layered Data Security: Protecting sensitive financial information through stringent cybersecurity measures and compliance with industry regulations.

- Provide Continuous Training: Offering ongoing training and support to staff to ensure proficiency in the latest tools and technologies.

- Focus on Account Holder Needs: Continuously gathering feedback from clients to refine and enhance treasury management services to meet their evolving needs.

By focusing on these aspects, banks and credit unions can enhance their treasury management offerings, attracting more clients and retaining existing ones. Embracing modern treasury management solutions is not just about improving internal operations; it’s about delivering superior value to customers and members and staying ahead in the competitive landscape of commercial banking solutions and digital banking platforms.

Additional Resources from Alkami