As with many industries segueing into 2024, financial institutions can benefit from exploring the wealth building trends of past years as predictors for future performance. To this end, we’re taking a closer look at Alkami’s Telemetry Data, following our transaction enrichment process, from 2022-2023 to shed light on the banking industry and what might be expected for the road ahead.

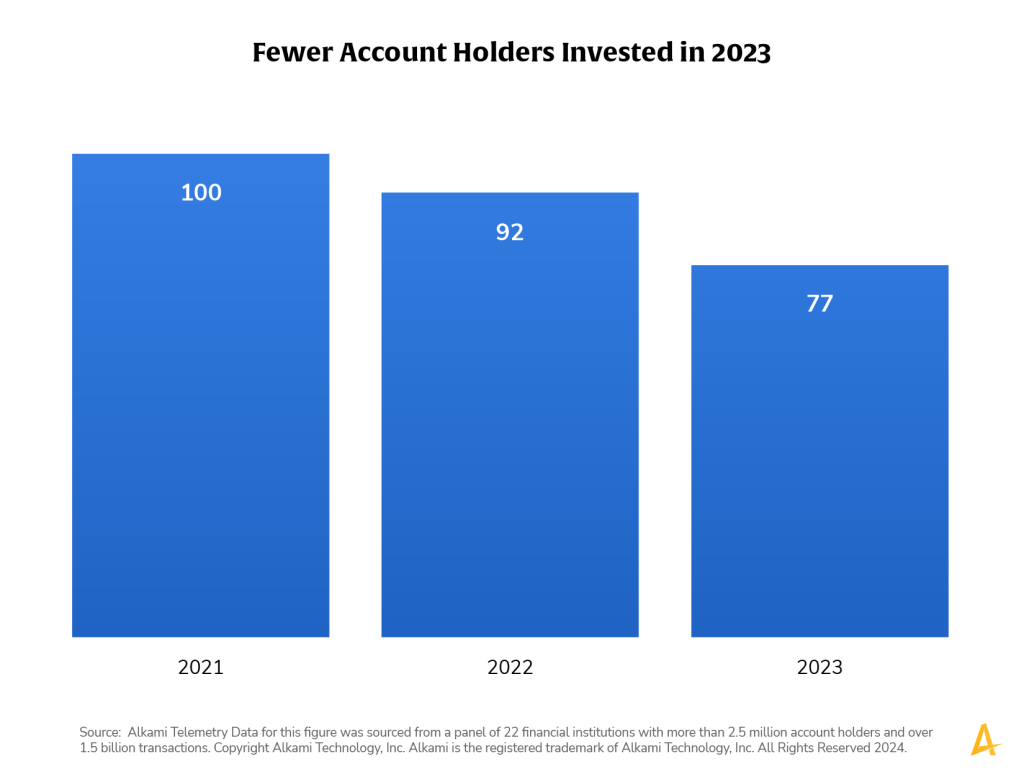

While the country managed to avoid an official recession in 2023, account holders are continuing to withhold funds from investment accounts. Alkami’s telemetry data indicates that 16.3% fewer account holders sent money to their investment accounts compared with 2022. This continued the trend from 2021 where 8% fewer moved their money accordingly.

While the economy and the Federal Reserve (the Fed) may appear to be stabilizing, the reduced investment by account holders reflects two probable influences. Inflation, up 3.4% over the past 12-month period, continues to be a factor that may limit consumer saving and investing as consumers are paying more for daily expenses such as electric and grocery bills. In addition, risk averse consumers may be more attracted to certificates of deposit (CDs) and money market accounts as opposed to investment accounts more subject to market volatility.

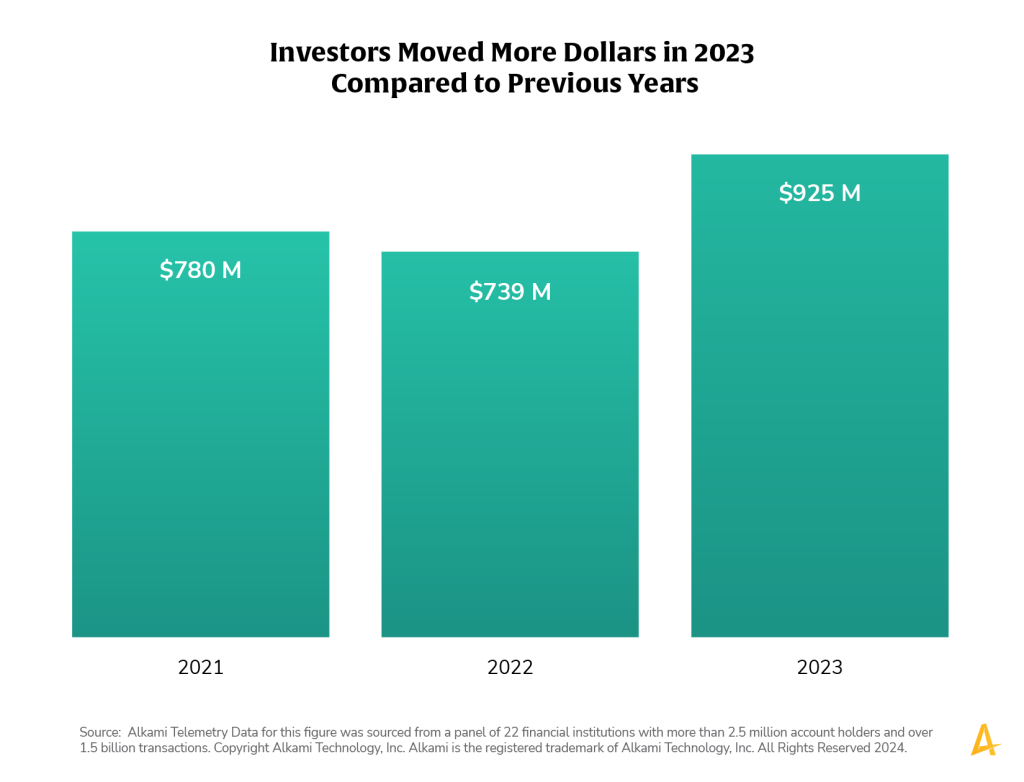

While the overall number of account holders moving money into investment accounts dwindled in past years, 2023 notably demonstrated a decrease in individual investors, but an increase in the total dollars moved to investment accounts. Our data shows that consumers interested in investing in the market were willing to invest more funds overall than compared to 2021 and 2022 independently.

Investors poised with cash reserves in 2023 saw potential and opportunity to invest in spite of rising inflation and rising interest rates. Clearly, these markers impacted different consumer bases in different ways as they looked to grow their money in the face of several risk factors.

Account holder messaging around both investment and saving should be a priority for financial institutions as consumers respond uniquely to the economic climate and desire to increase their capital. Larger overall balances could be an indicator of potentially more risk-tolerant investors, and financial institutions can use this to message around wealth management services. Account holders with lower balances may be more of a match for financial products such as CDs and high-interest money market accounts.

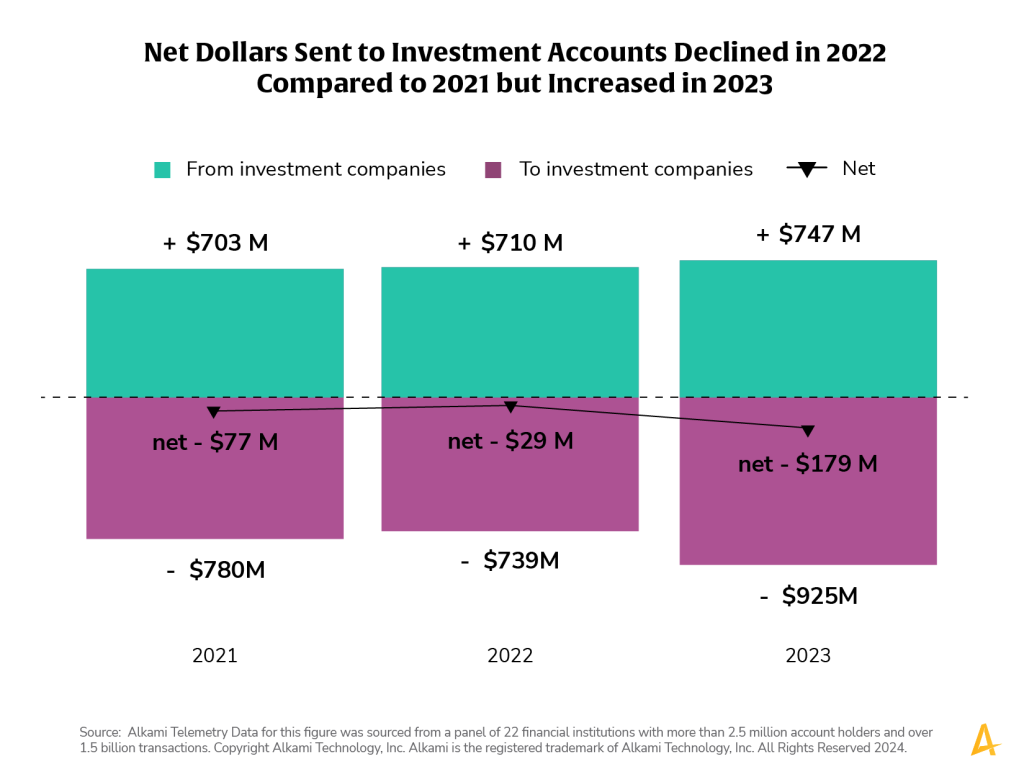

In 2023, investors withdrew more money from their investment accounts as compared to 2022. In contrast to this trend, however, the dollars transferred to investment accounts, as well as overall net investment, increased in 2023.

These divergent behaviors demonstrate varied investor tendencies in the wake of today’s economy. While some investors are making strides and investing more than ever before, others are taking a more conservative approach. In fact, those that tend to be more risk averse may be selling investments in response to increased costs and reduced savings.

Financial institutions stand to benefit from keeping a close eye on specific account holder transaction data. By personalizing messaging and product marketing to match individual consumer behavior, financial institutions have a greater opportunity to engage with consumers and potentially reclaim investor dollars with products better attuned to the account holder.

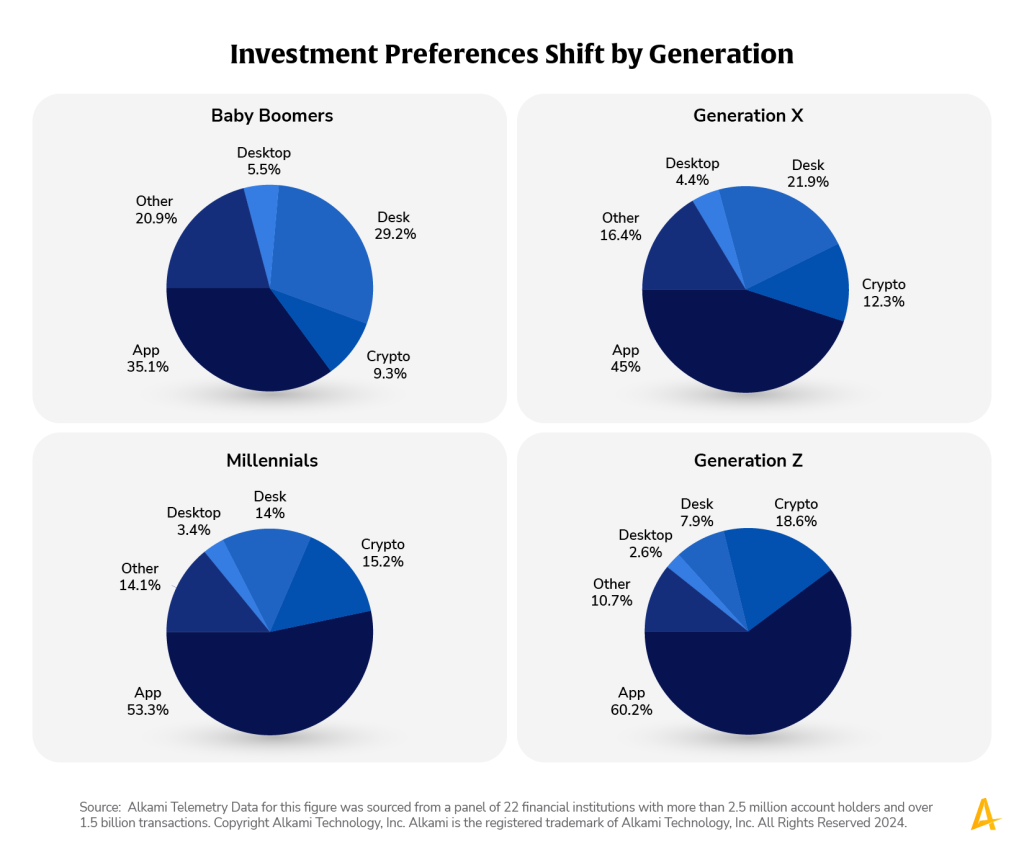

When it comes to how consumers are choosing to initiate and manage their investments, clear trends come through when comparing generational tendencies. This gap may be further deepened by the wide range of options available to Americans looking to open investment accounts.

Traditional desk native brokerages, or those established well before the age of the computer, include stalwarts such as Schwab and Vanguard. However, these long-standing financial institutions have experienced competition from app-native solutions developed for consumers to initiate trading from mobile devices. These include brands such as Robinhood, Acorn and Stash.

Alkami data validates the common perception that different generations have clearly different investment preferences. Traditional investment brands consistently performed better with older generations. For example, Baby Boomers were more than twice as likely than Millennials to use a desk-native option while Generation Y was 1.7x more likely to use an app-native solution than compared to the Baby Boomer generation.

Financial institutions stand to benefit from keeping a close eye on specific account holder transaction data. By personalizing messaging and product marketing to match individual consumer behavior, financial institutions have a greater opportunity to engage with consumers and potentially reclaim investor dollars with products better attuned to the account holder.