Application (app) fatigue refers to the mental and emotional exhaustion brought on by the overwhelming number of digital applications constantly vying for our attention. With countless notifications, updates, and tasks competing for our focus, it’s no surprise that users feel drained.

In fact, research from the Economist Intelligence Unit reveals that over a third of global executives expect most financial transactions to be handled through a single super app within the next decade. This trend is largely fueled by consumers’ increasing frustration with managing multiple apps and their growing preference for more streamlined digital experiences.

Your account holders are already juggling busy personal and professional lives. Adding more digital banking solutions to the mix can make managing finances feel even more overwhelming. Instead of asking how to capture their attention, the real questions should be:

The answer? Be the institution they can’t live without.

Understanding your account holders and their digital fatigue is key. By providing a seamless, integrated online banking platform, you position yourself as a trusted partner rather than just another app competing for attention.

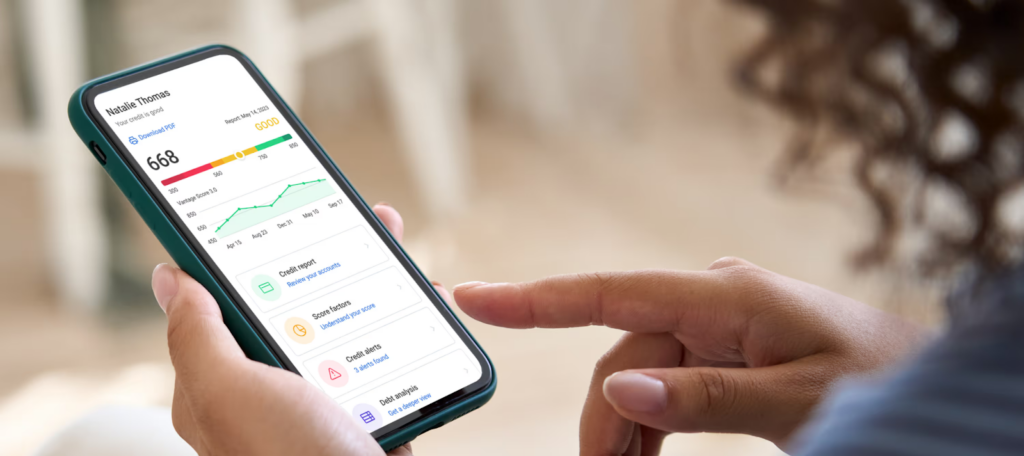

That’s why Alkami has partnered with Array to deliver a full suite of credit monitoring solutions (My Credit Manager) paired with credit-level insights for lending opportunities (Offers Engine). These tools not only help consumers stay informed about their credit but also keep them engaged within the banking app by delivering personalized experiences and relevant financial offers.

Integrated seamlessly into the user’s digital banking experience, these tools eliminate the need for multiple apps and platforms.

Companies that excel in personalization generate 40% more revenue than their competitors, and our personalized display ads have helped clients increase ad click-through rates by 3x-4x.

For your account holders, this means a more seamless digital experience—where they can explore relevant financial offers without sifting through multiple websites or marketplaces. Less time spent searching means more time for what truly matters—whether that’s managing their finances more efficiently or simply enjoying life.

As digital banking evolves, so do account holders’ expectations for personalized experiences—from customized financial offers to AI-driven insights. But while personalization makes banking more convenient, it also introduces new security risks. What good is a seamless, tailored experience if fraud prevention and identity protection don’t keep up?

Today’s cyber threats are more sophisticated than ever. Fraudsters use AI to mimic voices and create deepfake identities, while stolen credentials can grant bad actors full access to financial accounts. Meanwhile, account holders are already overwhelmed with managing multiple apps—one for banking, another for credit monitoring, and yet another for identity protection. The result? More digital fatigue and greater security vulnerabilities.

To truly enhance the digital banking experience, financial institutions must integrate identity protection into their platforms—just like they do with personalized financial tools. Instead of requiring users to download yet another app for fraud monitoring, banks and credit unions can offer:

When security works alongside personalization, account holders get the best of both worlds: a customized digital banking experience without the added complexity.

Array is a leading financial innovation platform helping financial institutions get compelling consumer products to market – faster. Our embedded products include credit monitoring and identity protection that increase digital engagement, provide non-interest income opportunities and promote financial wellness. Financial institutions also leverage Array’s Offers Engine to unlock hyper-targeted marketing for their credit offers.

Array is a proud sponsor of Alkami Co:lab and will be showcasing our suite of solutions that help financial institutions build stronger relationships with their account holders.