Checks may be old-school, but they’re still a business essential. Even in a world of instant payments and digital wallets, businesses continue to rely on them. But with that reliance comes a risk—check fraud is on the rise.

According to the 2024 AFP Payments Fraud and Control Survey Report, checks continue to be the most vulnerable payment method, with 65% of respondents reporting fraud attacks involving checks.

The good news? Financial institutions already have a proven fraud-fighting tool: check positive pay. The bad news? Adoption is far too low. Only 29% of U.S. financial institutions are satisfied with their current positive pay usage rates.

It’s time for banks and credit unions to stop reacting to fraud—and start preventing it with check positive pay.

So, what’s holding back adoption? Why aren’t more businesses and financial institutions jumping on board? And most importantly—how can we fix it?

Let’s dive into the latest Datos Insights report, break down the numbers, and map out a proactive game plan.

First, let’s talk numbers. 94% of bank executives reported an increase in business clients hit by fraud in 2023. That’s almost everyone. And when fraud hits, it hits hard.

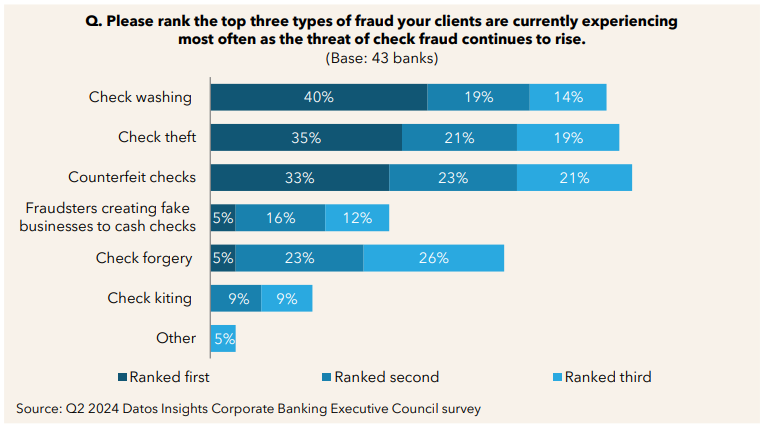

And what’s behind these staggering losses? Check washing—the #1 type of check fraud in 2024.

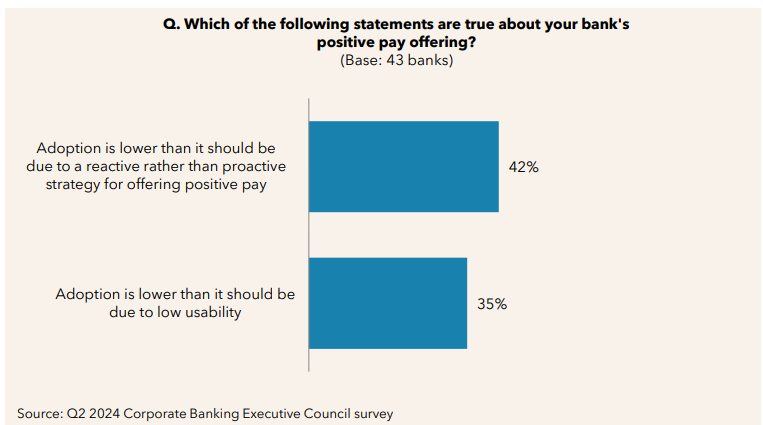

Despite these terrifying numbers, check positive pay adoption rates remain low. About 65% of financial institutions have less than half of their treasury service clients using positive pay, and 39% have less than 25% adoption.

So why isn’t this fraud-fighting superhero getting the love it deserves?

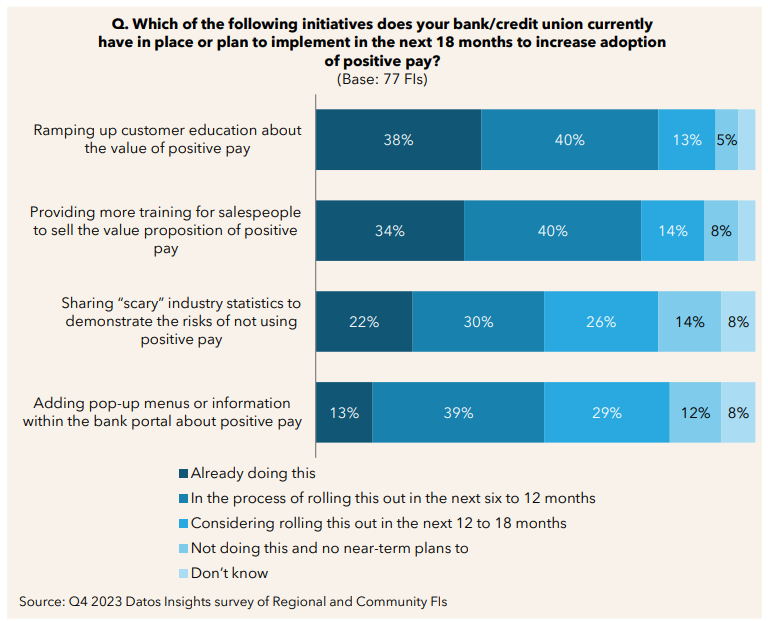

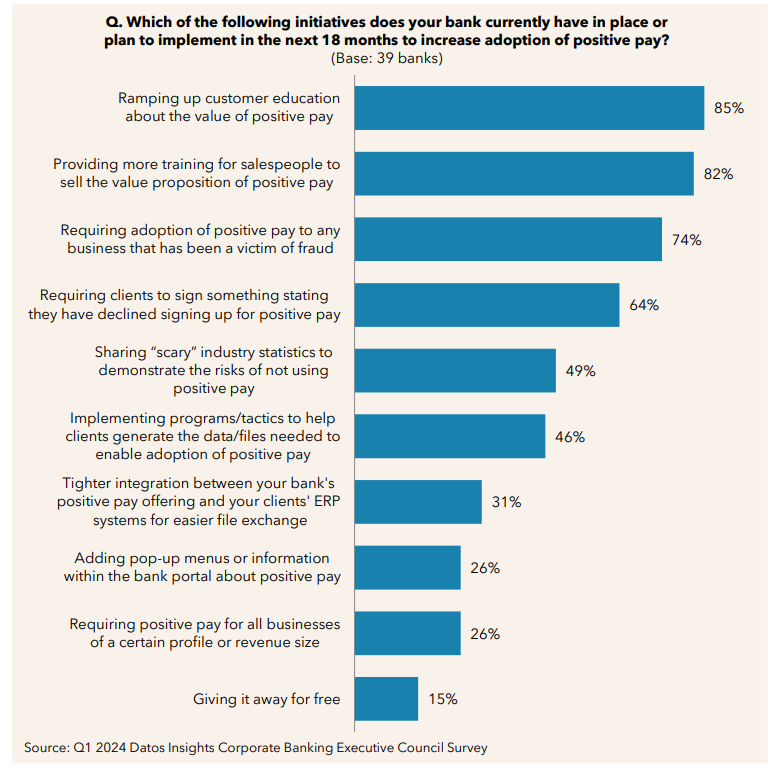

The good news? Change is coming. Over 75% of banks expect check positive pay adoption to rise in the next two years. But they need a solid plan. Here’s how financial institutions can turn the tide:

Right now, only 25% of financial institutions believe their business clients truly understand fraud risks. That’s a problem. Because when fraud happens, it’s already too late.

Think about it—your clients already invest in insurance to protect their business from disasters, and in many cases, they’re required to have multiple types of coverage. So why should they second-guess protecting their business’ accounts? Check positive pay is like insurance for their bank account, preventing fraud before it drains their funds. But if they don’t understand its value, they won’t adopt it.

That’s where your financial institution comes in. You have the opportunity to educate and protect your business clients, making check positive pay a natural part of their financial toolkit. Here’s how:

It’s time to stop waiting for clients to ask about check positive pay and start making it a key part of your financial institution’s fraud prevention strategy. Many financial institutions only bring up positive pay after a fraud incident. Instead, your sales teams should be equipped to proactively promote it as an essential business tool.

Here’s how financial institutions can drive better adoption through sales teams:

With fraud on the rise, high-risk businesses should not have the option to go unprotected. Yet, only 41% of banks currently plan to make check positive pay mandatory for these clients. Given the growing threat of check fraud, this percentage should be much higher. Implementing check positive pay for vulnerable businesses isn’t just a best practice—it’s an essential safeguard that protects both financial institutions and their clients. By proactively enrolling high-risk businesses, banks can dramatically reduce fraud exposure and strengthen client trust.

Certain businesses are more susceptible to fraud due to their transaction volume, industry, or history of past incidents. These include:

By identifying and requiring check positive pay for high-risk clients, financial institutions can take a proactive stance against fraud, rather than waiting for another attack to happen.

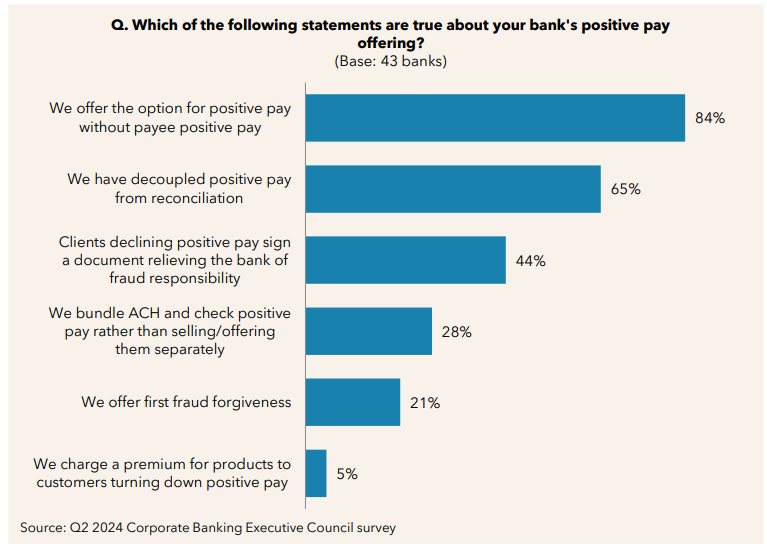

Why stop at check fraud when businesses face multiple payment threats? Fraudsters don’t limit themselves to one attack method, so financial institutions shouldn’t rely on a single defense. Bundling check positive pay with other fraud prevention tools creates a stronger, more comprehensive layer of protection while increasing product adoption and revenue opportunities for banks.

Here’s how financial institutions can enhance their fraud-fighting strategy:

By bundling these tools together, financial institutions can deliver greater value to businesses, enhance fraud protection across all payment types, and strengthen long-term client retention. After all, preventing fraud isn’t just about stopping losses—it’s about building trust, security, and a smarter way to bank.

Check positive pay isn’t new—it’s been around for decades. But with fraud exploding and financial institutions losing money, it’s more critical than ever.

So here’s the bottom line: banks and credit unions need to stop waiting for fraud to strike and start offering positive pay proactively. With better education, sales strategies, usability, and bundling, adoption will rise—and fraudsters will lose.

Because let’s be honest: the only thing worse than fraud is knowing you could have prevented it but didn’t.