For everyday purchases, consumers like to shop online – and not just for “nice to have” items. Consumers turn to technology to buy groceries, order pet supplies, pick out new clothes, and schedule appointments, all from their mobile phones.

Often when shopping online, consumers no longer need to enter their card information because the retailer saves the card credentials from their last purchase or encourages them to pay via digital wallet. Similarly, many physical stores now offer tap-to-pay points of sale, which let users quickly choose a card from their device’s digital wallet when they make their in-store purchase. If people expect convenience and personalization when shopping, why wouldn’t they expect the same from their digital banking platform?

For years, the banking industry has discussed appealing to the “cashless consumer” with frictionless payment experiences. Since the COVID-19 pandemic, many businesses across the nation have stopped accepting cash payments. This pivot happened in an instant, and pushed consumers to quickly adopt digital wallets or rely heavily on physical cards.

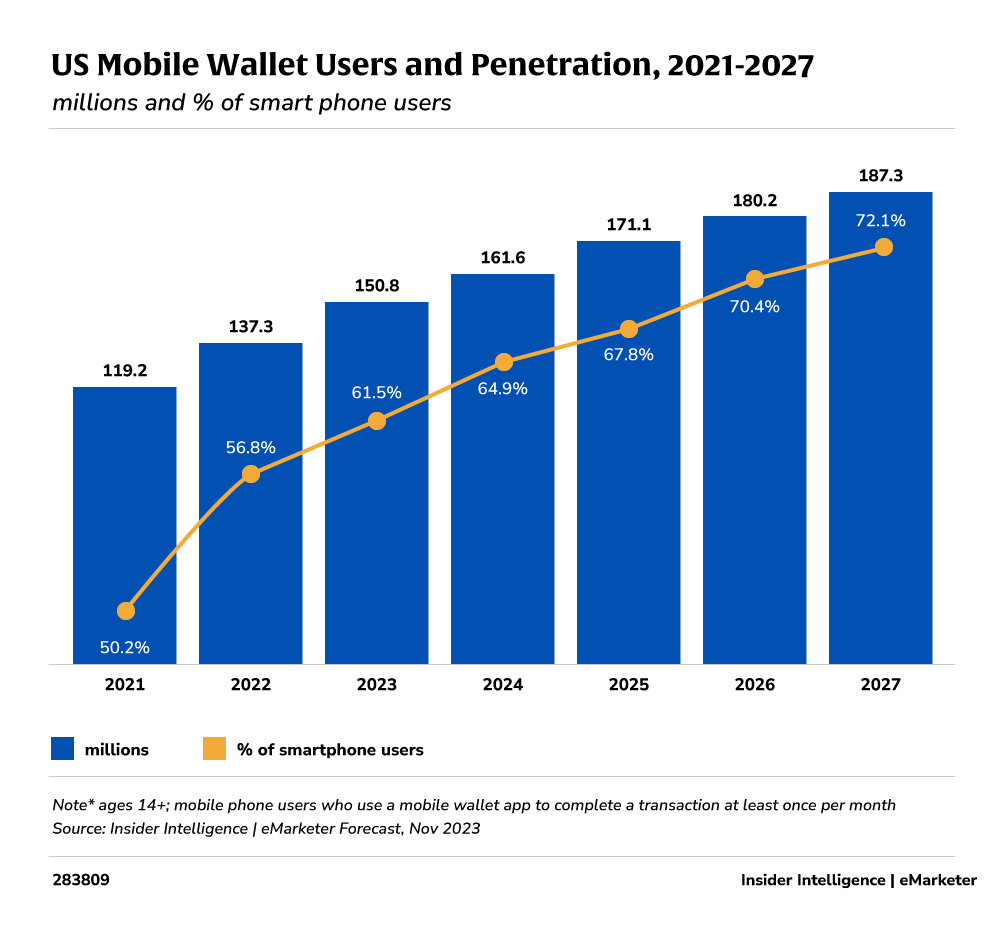

Per Insider Intelligence‘s 2024 forecast, nearly two-thirds of U.S. smartphone users will use their digital wallet to transact every month.

Payments and e-commerce shopping have undergone a permanent change. Mobile-first transactions are prominent among all consumers, no longer just a request from Millennials or Gen Z. Financial institutions need to reimagine their payment capabilities and think digital-first to stay relevant and remain top-of-wallet.

Digital wallets protect cardholders’ banking information and passwords. They safeguard consumer transactions across payment channels, including online, ATM, and tap-to-pay interactions. Digital wallets have moved beyond contactless payment methods to include many aspects of a consumer’s life from insurance cards to concert tickets.

According to a November 2023 eMarketer Forecast, by 2027, about 72.1% of U.S. smartphone users will use mobile wallets.

While some financial institutions may still feel wary about the adoption of digital wallets, there is no need to fear. Each payment method requires a card to be on file, but ultimately it is up to financial institutions to win that valuable card placement. Meanwhile, competitors are fighting hard for a piece of consumers’ wallet share. Financial institutions can compete with megabanks and neobanks by empowering cardholders with digital card capabilities powered by their digital banking platform.

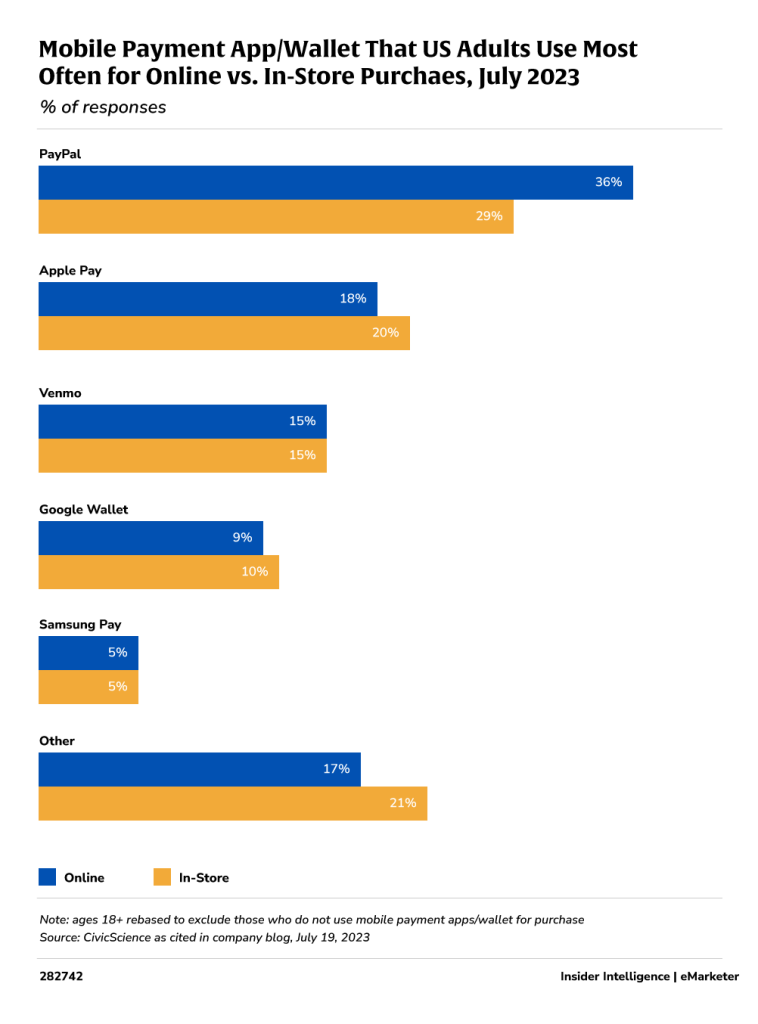

Leading fintechs, like Apple Pay, maintain brand recognition at point of sale systems. If a shopper has Apple Pay set up, it’s easy for them to use it as a payment method during checkout. Financial institutions should learn from this simplistic model to win customer or member trust and compete. If financial institutions are not offering modern consumer banking solutions, users will look elsewhere.

How can financial institutions retain cardholder relationships and grow share of wallet? By leveraging technology that places the financial institution’s card directly into the mobile wallet without manual data entry or friction.

The growing consumer need for mobile wallets will encourage financial institutions to evaluate how they are offering digital cards to retain cardholder relationships.

At Alkami, digital cards are a collection of product features available within Alkami’s card experience portfolio which allow card credentials to be used in conjunction with or without physical cards.

Digital wallets can even be safer than physical wallets. They encrypt the consumers’ banking information, protecting them from fraudulent attempts. Digital wallets use encryption to ensure consumers’ data is not transmitted from the device. On top of that, users can implement preventive security measures to protect their accounts from fraud by using card alerts and controls that send real-time notifications to their device.

Push provisioning eliminates the need to enter card credentials when setting up an Apple Pay or Google Pay mobile wallet. Instead, it prompts the user to add their card from within the banking experience with a tap of a button. This enables users to begin transacting as soon as they are digitally issued a new card; prior to the physical plastic arriving in the mail.

This strategic product enhancement positions financial institutions as an innovative leader in their account holders’ minds. Cardholders will instinctively choose the card that is the easiest to use – making a card in the digital wallet the go-to payment method for contactless and online purchases.

The way cards are displayed within the digital banking experience helps financial institutions drive engagement and capitalize on cardholders’ everyday transactions. Besides provisioning a card directly into the mobile wallet, Alkami offers the ability for cardholders to view their card credentials within the digital banking platform – making it easier for them to transact online without leaving the comfort of their couch. That’s the level of convenience modern consumers are looking for.

Fintechs’ presence in consumers’ everyday lives elevates their expectations for seamless experiences and convenience. As the world becomes increasingly digital, consumers will lean on their financial institution to support them with the latest technology or look elsewhere for the best alternative.

Financial institutions have an advantage that fintechs do not – established relationships with their customers and members. Besides intuitive technology, consumers want personalized experiences and service. By nurturing existing banking relationships, financial institutions can build loyalty and stickiness with users.

Gone are the days of losing users because of outdated technology. With modern consumer banking solutions, financial institutions can strengthen cardholder relationships while future-proofing their card strategy.