As business account holders’ needs evolve and become accustomed to speed and ease from their personal technology interactions, user experience (UX) is no longer a convenience—it has become a critical competitive differentiator for financial institutions. According to Alkami’s Business Banking Digital Maturity Model, digitally mature institutions grow average revenue nearly 10x faster than their less mature peers, with superior UX emerging as a core driver of success along with employee productivity and mindset. For financial institution executives leading digital transformation efforts, understanding and implementing cutting-edge UX strategies is essential for future-proofing your institution’s business banking solutions and growing your overall business portfolio.

Market research revealed four distinct cohorts of digital maturity among financial institutions that offer business banking – Cautiously Modernizing, Optimistic Believers, Emerging Pioneers, and Tech Titans. The institutions that lead the business banking digital maturity pack are those that treat user experience as a discipline, but what does a best-in-class business banking experience look like?

Alkami’s research revealed a set of capabilities that businesses considered standard for any digital banking platform to be effective:

A well-executed user experience isn’t just about aesthetics—it directly impacts customer or member satisfaction, retention, and growth. Digitally advanced financial institutions differentiate themselves by investing in the user experience and transforming typically standard capabilities to make them faster, easier, and more personalized to each account holder.

While 67% of financial institutions currently offer digital account opening for businesses, only the most mature institutions have fully automated the account creation process across their core and digital banking platforms. This streamlines the business onboarding experience by making it faster for business owners to access new accounts and begin managing their money with the institution. By digitizing back-office processes to enable seamless onboarding, leaders set themselves apart from competitors reliant on outdated manual workflows and drive successful conversion rates.

Another opportunity for financial institutions to differentiate themselves is by improving the sub user management UX. The most mature organizations enable business owners with self-service capabilities that allow them to determine users’ depth of access with role-based permissions. These granular controls empower business owners to replicate their internal processes within their business banking solutions through customizable approval workflows, transaction limits, automated alerts, and user activity reports.

The emergence of instant transactions has influenced business expectations for faster payments. Businesses increasingly require immediate access to funds to optimize cash flow, meet operational needs, and respond quickly to market opportunities. Faster payments eliminate the traditional waiting periods associated with ACH and check processing, providing a significant edge in liquidity management. As consumer expectations spill over into the business world, organizations are compelled to adopt faster payment solutions to remain competitive and foster better relationships. Complementing speed with ease, the most digitally mature organizations are offering their business account holders an all-in-one payments center where they can view all previous payments and initiate any type of transaction in a singular view.

While payments evolve, so do new fraud techniques. According to the Association for Financial Professionals (AFP), in 2023 80% of organizations were victims of payments fraud attacks or attempts, a significant increase from previous years. However, only 59% of the most digitally mature organizations enable businesses with self-serve ACH fraud remediation that they can charge for. Businesses are looking for more opportunities to protect themselves and want to be able to respond and mitigate threats faster. Financial institutions are prime candidates to capitalize on that need by offering Positive Pay & ACH Reporting solutions that safeguard businesses while unlocking new revenue channels.

Similar to trends in retail banking, personalization drives engagement and retention with business users. Among the most digitally mature financial institutions, 70% of their relationship managers leverage client activity data to recommend tailored products and services for greater product adoption. Tech Titans use AI-powered systems to anticipate business needs, delivering actionable insights that increase cross-sell and upsell success rates, aid relationship building, and reduce the risk of attrition.

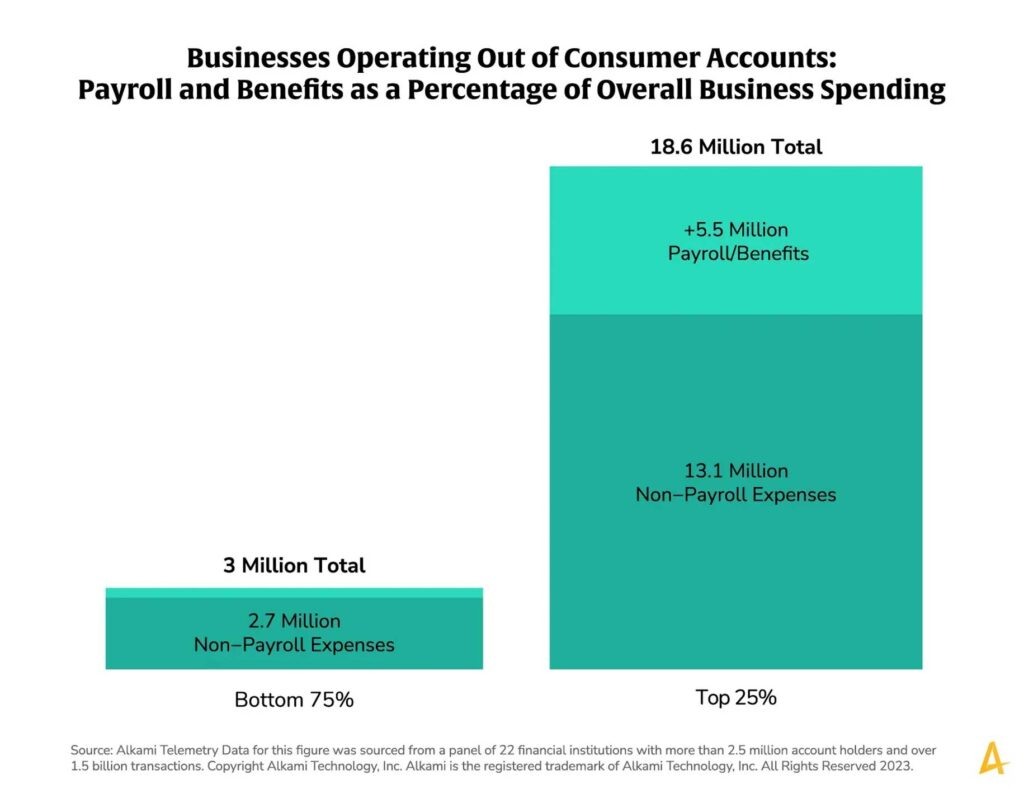

As new account holders launch their business ventures, financial institutions need to be on the lookout for customers and members that are operating businesses out of retail accounts and target those account holders with relevant offers that help them grow. According to Alkami’s 2023 Telemetry Data, businesses operating out of consumer accounts had a median monthly business expenditure of $114K, equating to $1.36M per year. Financial institutions need to deploy automated monitoring to stay ahead of business needs so they are not surprised to find a retail account with more than $15M in monthly business expenditures (a real statistic from the largest identified retail accounts).

The reality is only 43% of the most mature organizations are automatically monitoring retail accounts for business-related activities. By analyzing account holders’ transactions, financial institutions can identify recurring behaviors that align with business operations rather than consumers’ regular banking activities.

Advanced UX doesn’t stop at the surface; it’s about creating a seamless backend to foster greater efficiencies for businesses. While 80% of institutions offer accounting and ERP system connectivity, only the most mature segments leverage bi-directional Application Programming Interfaces (APIs) for data synchronization. In contrast, less mature organizations may enable businesses to export CSV or XML files, but cannot seamlessly communicate between systems. Comprehensive API functionality eliminates manual intervention, enabling faster decision-making for business clients, and deepening trust in the institution.

Financial institutions who invest heavily in elevating the business user experience are on the right track towards business banking digital maturity, however, investments alone will not determine overall success. To innovate at scale and drive organizational growth, banks and credit unions need to ensure they are also enabling their employees with greater self-service capabilities and automation – eliminating manual tasks and creating back-office efficiencies. Leadership is critical to the success of these investments. Financial institution leaders who act with a growth-oriented mindset and share that culture across their organization can ensure there is top-down alignment that empowers employees to do their jobs effectively and better serve customers and members.