Financial institutions opt to offer commercial banking solutions for several compelling reasons. Primarily, commercial banking can significantly enhance the institution’s revenue through fees from ACH transactions, interest on larger account balances, and charges for additional services like treasury management solutions and foreign exchange.

Moreover, providing commercial banking solutions deepens client relationships, allowing institutions to engage with clients across multiple facets of their financial needs, which promotes loyalty and increases client retention. Commercial banking also positions a financial institution as a full-service provider, attracting a broader client base and enhancing its competitive edge in the market.

Understanding the distinction between commercial and retail ACH transactions is critical due to the increased complexities and risks associated with higher transaction volumes and values in business contexts. Key differences include:

Regulatory compliance is at the heart of commercial banking operations. Key points include:

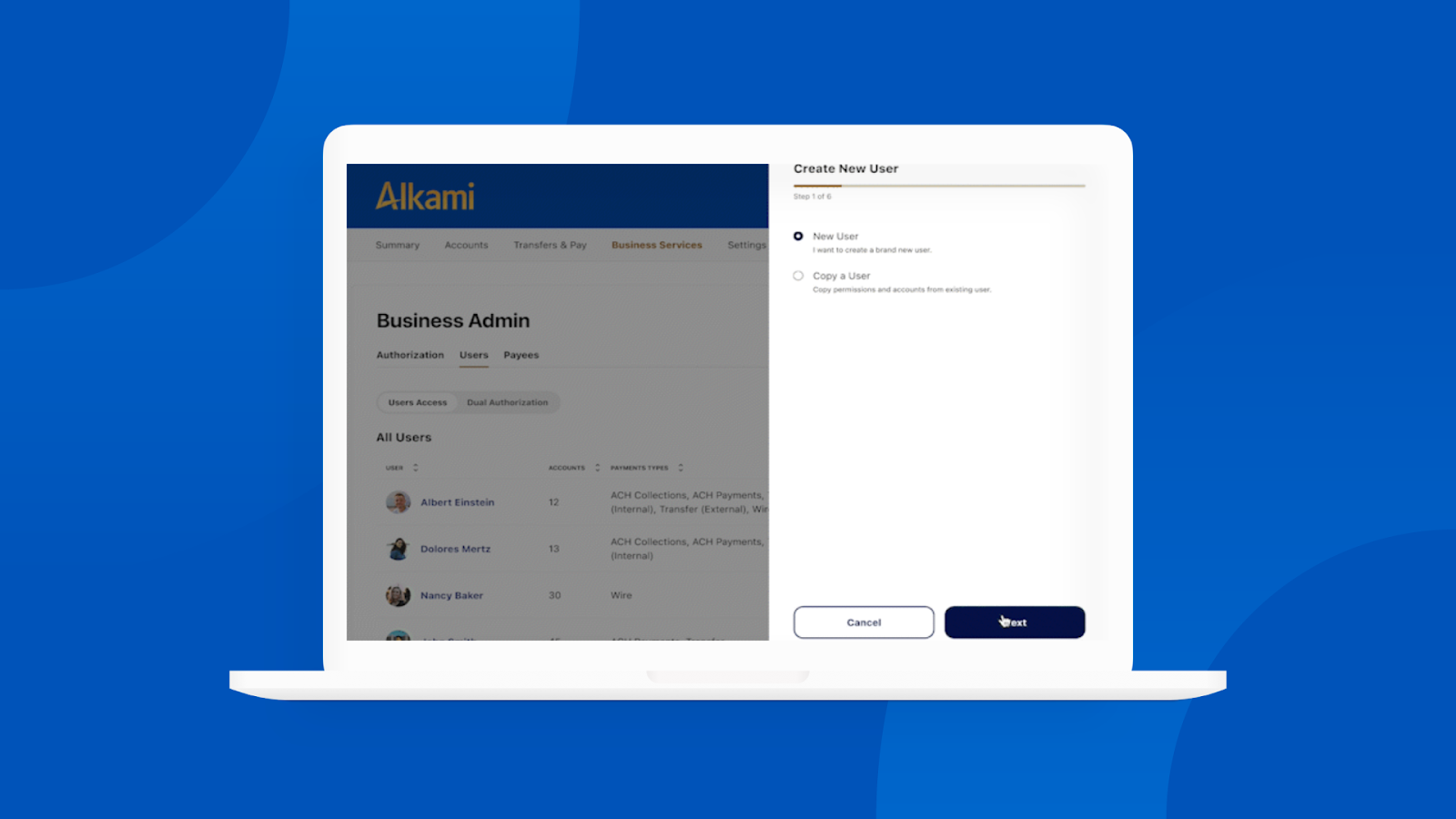

A powerful technological infrastructure is essential for supporting treasury management solutions. This includes an advanced commercial online banking platform that facilitates the efficient execution of large-volume ACH transactions, risk management and compliance with regulations. The technology should allow for setting transaction limits, monitoring activities and providing security measures to safeguard transaction processes.

Hiring knowledgeable professionals experienced in commercial banking solutions is crucial. Ongoing training and certification, such as obtaining Accredited ACH Professional (AAP) and Certified Treasury Professional (CTP) status, ensure that staff remain competent and updated on the latest banking standards and practices. Staff should have a deep understanding of both the sales and operational aspects of commercial banking and treasury management solutions to effectively manage and grow the program.

Implementing a commercial banking solution is not merely about technology and regulations; it also involves setting up effective back-office workflows that align with the institution’s risk management framework. Operational considerations include conducting detailed risk assessments for each business engaging in ACH transactions. These assessments should evaluate factors such as the nature of the business, expected transaction volumes, and past financial behavior. Decisions regarding prefunding transactions can significantly mitigate credit risks, and institutions must carefully manage and adjust transaction limits based on actual usage and ongoing risk assessments.

The successful implementation of a commercial banking solution requires not just setup but also a strategy for long-term management and growth, including:

Evaluating the success of a commercial banking program involves analyzing operational efficiency, client satisfaction and financial performance. Supplemental features might include enhanced fraud protection, integration with accounting software, or customized reporting tools. Approaches for pricing ACH origination services should reflect the value provided to businesses, ensuring profitability while maintaining competitive pricing.

This comprehensive approach ensures that financial institutions not only launch but also successfully manage and grow their commercial banking solution, meeting the complex needs of today’s business environment.

Interested in learning more about how to launch a commercial banking payments program? Check out our virtual hub featuring an on-demand webinar with Community Choice Credit Union and lots of valuable resources including templates for ACH operations.