Bitcoin, the first digital asset, originated in 2008 during the Great Financial Crisis. Since then, it’s grown into an almost trillion dollar asset while the broader asset class has attracted nearly $2 trillion.

But at first, a single bitcoin was worth just fractions of a penny.

“It would take more than a year for the first economic transaction to take place, when a Florida man negotiated to have two Papa John’s pizzas, valued at $25, delivered for 10,000 BTC on May 22, 2010. That transaction essentially established the initial real-world price or value of bitcoin at 4 bitcoins per penny,” (The History of Bitcoin, 2022).

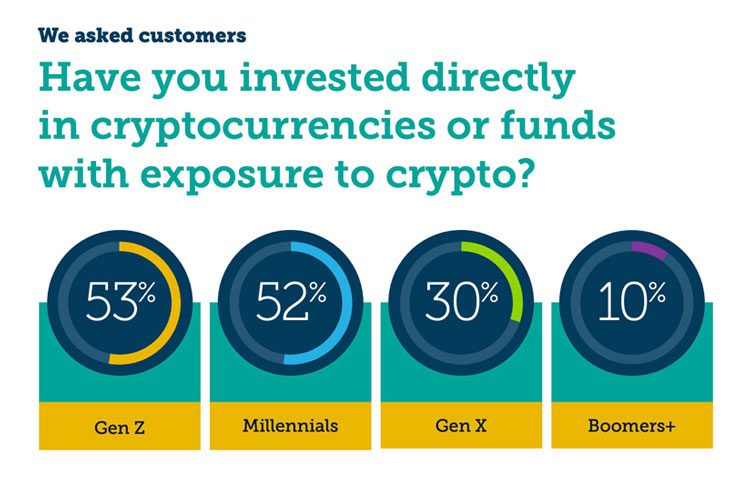

Over the years, digital currencies quickly entered mainstream consciousness. Today, NYDIG’s research shows that over 20% of American adults hold bitcoin and even more are interested in adding bitcoin to their portfolios.

According to a Morning Consult global survey, “nearly one in four people” own some form of cryptocurrency. 24% of U.S. consumers reported owning crypto. But what was especially significant was how this compared to a key deposit product — 23% of the U.S. sample own CDs. The glaring reality is that as the world goes digital, investments will too. It’s no surprise that consumers are interested in bitcoin, as they’ve seen its market value surge from just pennies to $41,132.90 USD (effective 3/17/2022).

In research conducted by BAI, financial institutions (FIs) were largely reluctant when it came to offering crypto, with 76% reporting that they did not plan to offer digital assets in 2022. If FIs are not offering access to cryptocurrency, they run the risk of losing customer or member funds to third-party vendors. What if there was a way for FIs to address the market demand for bitcoin while elevating their position as the primary FI?

Offering digital assets is unfamiliar territory for FIs. Banks and credit unions are held to strict security, regulatory, and compliance standards, and, as such, remain weary of extending their business lines into digital currencies.

NYDIG, a leading bitcoin company, supports FIs through their bitcoin journey by providing consumers an easy way to buy, sell, and hold bitcoin from within their online banking experience.

With NYDIG’s proprietary platform, FIs can now make an institutional grade bitcoin solution available to their users. Besides enabling FIs to address the market demand for digital assets, NYDIG supports FIs’ efforts to retain and grow their user bases. NYDIG’s platform also creates non-interest income opportunities, attracts savvy users, and empowers FIs to be leaders in innovation.

Bitcoin holders want their banks or credit unions to offer bitcoin. In fact, “81% of bitcoin holders would choose to store it with their bank if offered” (NYDIG, 2021). If FIs offer users a way to purchase bitcoin, it could increase funds and transaction volume, in addition to strengthening user relationships, confidence, and brand loyalty.

NYDIG gives FIs a competitive edge. Now, FIs can empower their users to conveniently buy, sell, and hold bitcoin from within their digital banking experience, stay updated on bitcoin’s market value, and gain access to educational materials.

FIs should begin to learn about bitcoin before they fall behind their competition. The world is becoming increasingly digital day by day. As stakeholders of the financial services industry, FIs should consider how they’ll adapt.

By integrating with strategic partners like NYDIG, FIs can empower themselves with the emerging, innovative technologies their users demand.