Financial institutions have a wealth of data to help them create better products, improve account holder experiences and strengthen their competitive position in the market. But many banks and credit unions aren’t using financial services data analytics to its full potential, and account holders are taking notice. A recent study found that 58% of consumers feel companies don’t understand their needs and preferences. Luckily, financial institutions already have the data needed to better understand their account holders—their daily spending habits and financial behaviors. By tapping into data insights from these valuable sources, financial institutions can move beyond assumptions and make data-driven decisions that align with what account holders actually want. From personalized banking to deposit growth and card utilization, data analytics in banking provides a clear path for innovation. Here’s how banks and credit unions can leverage financial services data analytics to develop smarter financial products and services.

It’s easy to guess what account holders want, but data tells the true story. By analyzing transaction data trends, financial institutions can see what account holders are doing in real time—how they spend, where they bank and which services and products they use. Instead of relying on assumptions, banks and credit unions can use behavioral data tags to categorize and track spending behavior, allowing them to deliver the right products at the right time.

For example, if transaction data shows a growing demand for buy now, pay later (BNPL) services, a product manager at a community bank might consider developing its own BNPL offering within its digital banking solutions. Instead of losing those transactions to third-party providers, financial institutions can evolve to offer a built-in BNPL service, strengthening their account holder relationships and keeping payments within their ecosystem.

Rewards programs are a great way to encourage card usage, but not all rewards motivate account holders equally. A one-size-fits-all approach may miss the mark, but a data-driven strategy ensures rewards align with actual spending habits. With data tags built from financial services data analytics, financial institutions can personalize rewards based on how account holders actually spend their money. For example, some account holders may respond best to cash back on grocery purchases, while others may prefer bonus points for dining out. Tailoring rewards to match actual spending habits can drive everyday transactions, increasing card usage and interchange income.

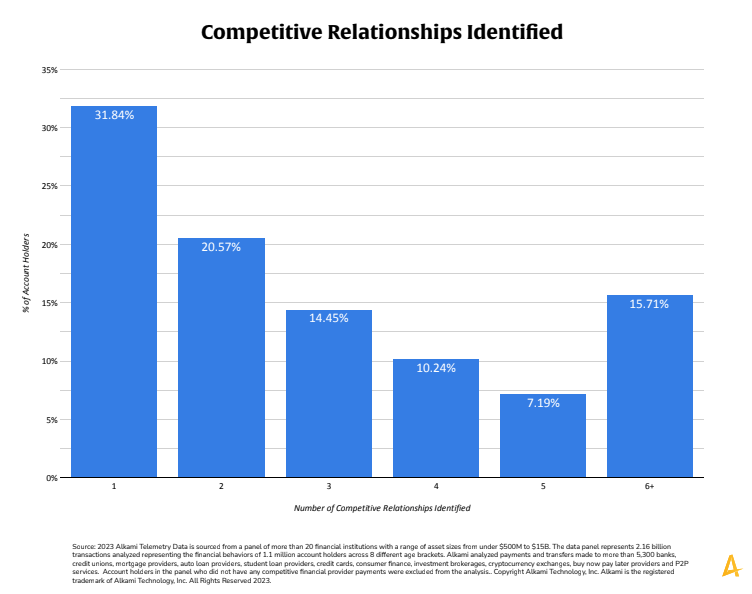

Today’s account holders aren’t loyal to a single financial institution. Alkami Telemetry Data reveals that the average account holder makes payments to three different financial providers. Additionally, 15.71% of account holders have six or more financial relationships, while the top 1% engage with 12 or more providers—some even have up to 36 relationships.

This fragmentation makes it harder for financial institutions to maintain a primary financial institution (PFI) relationship. Account holders are spreading their financial activity across multiple providers, making it essential for banks and credit unions to use transaction data to understand which competitors are top of wallet for their account holders. By analyzing these data insights, financial institutions can develop competitive products to bring more business back in-house, whether through better rewards, improved lending options or competitive win-back campaigns.

With rising home prices, 63% of Generation Z (Gen Z) and millennials still want to buy their first home but feel financially unprepared. Product managers at financial institutions can use this insight to develop first-time homebuyer incentives, such as:

By identifying these needs through financial services data analytics, banks and credit unions can position themselves as trusted partners in the homebuying journey, strengthening their relationships with younger generations.

Data is one of the most valuable tools banks and credit unions have—but only if they use it strategically. Account holder loyalty is up for grabs, and financial institutions that leverage transaction insights will be better positioned to develop products that meet account holders’ needs, reduce competitive losses and drive growth. The key to success isn’t just having data—it’s taking action on it to innovate, engage and win in a competitive market.

How can smaller banks and credit unions compete with larger competitors using financial services data analytics?

Smaller banks and credit unions have an advantage—they often have stronger relationships with their account holders. By activating their transaction data, they can offer highly personalized banking experiences and targeted marketing engagement that larger institutions struggle to provide. Understanding where account holders are spending, which competitors they use and what financial products they need allows smaller institutions to create unique rewards, lending programs, and digital solutions to keep account holders engaged.

How can institutions use data analytics in banking to increase account holder loyalty?

Loyalty comes from meeting account holders where they are and offering solutions tailored to their needs. Account holder insights built from financial services data analytics can help institutions identify opportunities to introduce relevant financial products, improve rewards programs and provide better lending options. By consistently using insights to create value for account holders, banks and credit unions can position themselves as trusted financial partners rather than just service providers.

What are some quick wins financial institutions can achieve using data insights?

After implementing a data strategy, financial institutions may struggle to quickly gain tangible benefits from their infrastructure. Multiple data sources, uncategorized data, and the lack of one source of truth all contribute to delayed outcomes for data analytics in banking. However, executive teams expect results fast, and their teams should strive to achieve some goals within the first several months of implementing a new data strategy at their institution. Here are five wins your financial institution can accomplish in the first 90 days of implementing a well-executed data strategy.