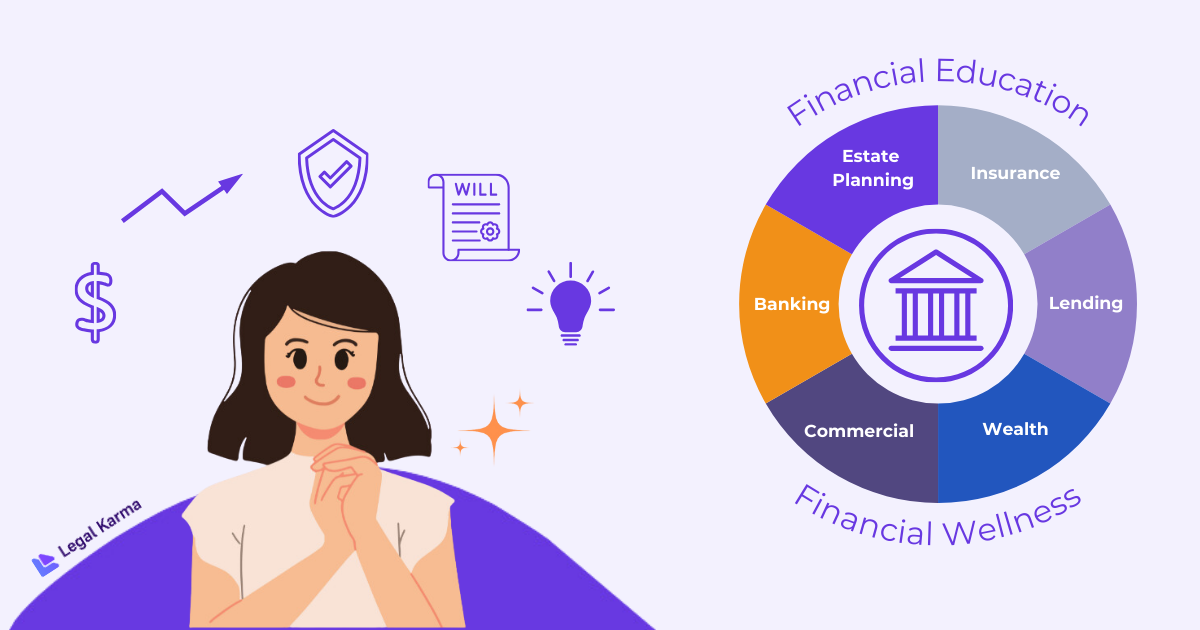

Leading credit unions and banks are enhancing financial wellness with comprehensive programs that go beyond banking. These programs focus on a holistic view of financial wellness including wealth management, estate planning, insurance, financial education and some even include investment trading platforms. As these self-directed investment platforms evolve to offer banking-like services such as bill pay, debit cards and cash withdrawals, they are becoming a growing competitive threat.

Credit unions and banks are under increasing pressure from multiple directions and continue to face competitive pressure from larger banks and fintech competitors. Regulatory mandates that require reduced banking fees make it harder for all financial institutions to maintain non-interest income.

One of the biggest challenges is the sharp decline in overdraft fees. According to the Consumer Financial Protection Bureau (CFPB), credit unions and banks with over $10 billion in assets are now capped at a maximum overdraft fee of $5. When mid-size and large financial institutions reduce their overdraft fees, the smaller banking institutions will need to follow suit to remain competitive. As a result, financial institutions of all sizes must innovate and find new ways to generate non-interest income.

Financial institutions with successful financial wellness programs often provide incentives for employees to become Certified Financial Counselors (which is different from financial advisors). This approach ensures that account holders receive personalized guidance tailored to their day-to-day financial needs and long-term goals.

Rather than just promoting products, these institutions focus on educating members and customers, helping them understand financial concepts in simple terms. The human connection and guidance are key to retention and satisfaction, which then creates potential revenue opportunities.

The most successful financial institutions aren’t just offering financial wellness programs – they’re integrating them directly into their online banking platform.

This approach creates seamless access to financial tools and services, helping institutions offset lost fee-based income while deepening connections with members and customers. By embedding financial wellness within their digital banking solutions, institutions can:

While integrating financial wellness services into digital banking solutions requires upfront investment and resources, the long-term benefits outweigh the costs. Creating exclusive in-house services like estate planning adds value by retaining and attracting new account holders. This strategy is far more effective than simply referring customers or members to external providers, which limits revenue potential and weakens account holder relationships.

A credit union thought leader recently described the industry shift in a powerful way:

By integrating Alkami’s cloud-based, digital banking platform, fintech technology providers like Legal Karma enable financial institutions to seamlessly offer estate planning automation, legal document creation and account holder support within their own banking portal.

Instead of referring members and customers out to a third-party estate planning provider, financial institutions can keep both the revenue and relationship in-house.

Here is how it works:

Legal Karma is a proud sponsor of Alkami Co:lab 2025 and will be showcasing our integrated estate planning solutions and services. Join us to explore how Alkami and Legal Karma can help your institution increase non-interest revenue, deepen member and customer relationships, and become the hub of financial wellness for your account holders.