Financial institutions are under constant pressure to innovate as account holders demand more seamless, intuitive, and personalized digital experiences. Today’s users expect digital banking solutions that go beyond basic financial management—offering tools that align with their lifestyles, goals, and values.

One of the most impactful ways institutions can achieve this is by integrating investment platforms, such as Alkami’s integration partner Eko, directly into their online banking platform. This seamless fusion of traditional financial services with modern investment technology enhances the user experience while unlocking new revenue opportunities and fostering deeper user engagement.

For years, banking and investing operated as separate worlds. Users looking to manage their wealth often had to juggle multiple platforms or rely on third-party advisors. This disjointed experience presented obstacles like limited accessibility, confusing processes, and a lack of personalization—discouraging many, especially first-time and younger investors, from participating.

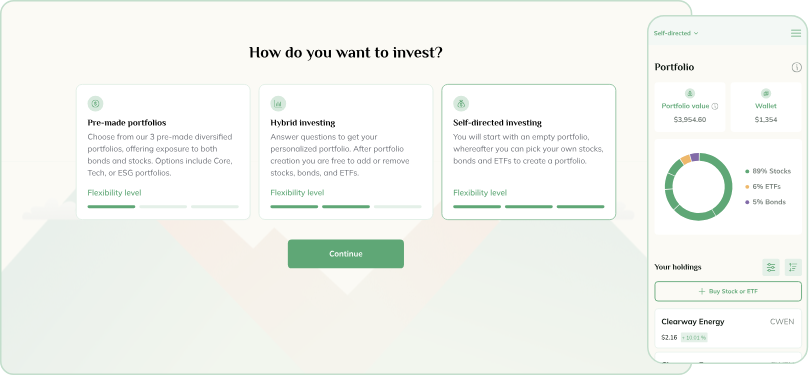

Integrated investment platforms eliminate these barriers by embedding investment tools directly into online banking platforms. This seamless integration provides users with a unified, all-in-one financial management solution.

Convenience Drives Engagement: With a single login, users can check their bank balances, manage budgets, and start investing—all in one place. This easy access encourages broader participation, particularly for Millennials and Generation Z (Gen Z), who prefer digital-first solutions.

Personalized Experiences Build Confidence: Integrated platforms often include tailored portfolio recommendations, educational tools, and access to financial advisors, empowering users to make informed decisions aligned with their goals.

Beyond enhancing the user experience, integrated investment platforms deliver tangible benefits for financial institutions themselves. These solutions foster customer or member loyalty, open new revenue streams, and position institutions to compete against agile fintech disruptors.

One of the most compelling benefits of integrated investment platforms is their ability to democratize wealth-building opportunities. Historically, investing has been perceived as exclusive—an option only for those with significant financial knowledge or resources. Platforms like Eko change this narrative by offering affordable and user-friendly solutions.

With entry points as low as $10, Eko makes investing accessible to individuals at every income level. Simplified interfaces and guided tools empower first-time investors to start their wealth-building journey with confidence. This aligns with the missions of many credit unions and community banks, which prioritize equitable financial services.

For financial institutions, embracing financial inclusion isn’t just about ethical responsibility—it’s a strategic move that fosters trust and builds lasting relationships with a broader customer or member base.

As a proud integration partner of Alkami’s digital banking solutions, Eko is excited to participate in Alkami Co:lab. Attendees will have the opportunity to see Eko’s innovative solutions in action and discover how our platform can drive deeper user engagement, unlock new revenue opportunities, and provide a competitive edge. Whether your goal is to attract younger, digitally savvy account holders, solidify your role as a trusted financial partner, or promote financial inclusion, Eko’s solutions are designed to help your financial institution succeed.