The latest report by Association of Financial Professionals (AFP) highlights a distressing trend: 80% of organizations were victims of payment fraud attacks or attempts in 2023, marking a 15-percentage point increase from the previous year. Checks continue to be the most vulnerable payment method, with 65% of respondents reporting fraud attacks. Furthermore, fraud involving the United States Postal Service (USPS) has risen by 10 percentage points over the past year.

Remarkably, for the first time, Automated Clearing House (ACH) credits have surpassed wires as the most targeted payment type for Business Email Compromise (BEC) fraud, underscoring the evolving sophistication of fraudsters.

So how can you protect your business or financial institution from these types of fraud? We believe the top answer to that question is to implement Positive Pay, a vital tool that offers strong protection which businesses and financial institutions can rely on to secure their operations.

View the full video series with Wespay here.

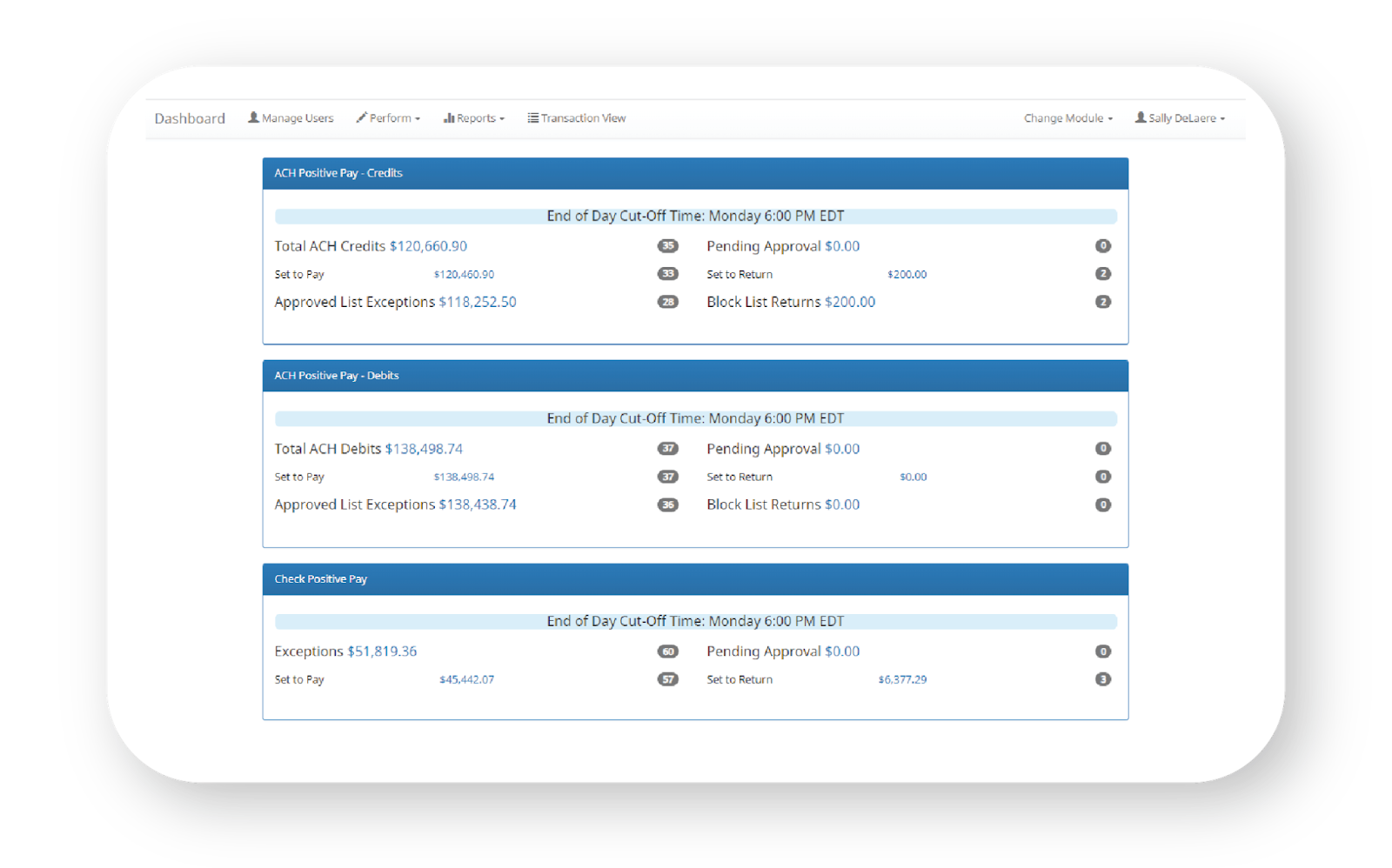

Positive Pay is a treasury management solution employed by financial institutions to detect and prevent fraud across check and ACH transactions, pivotal for chief financial officers, accountants, treasury professionals, and business owners striving to protect their funds. For checks, it requires businesses to provide a file of issued checks to their financial institution for verification of incoming checks against this file, flagging discrepancies for resolution. This process ensures that only authorized checks are processed, blocking altered or counterfeit checks. Your Check Positive Pay solution should validate check number, dollar amount, stale dating and payee for the best level of protection.

For ACH transactions, ACH Positive Pay functions similarly by allowing businesses to set filters and parameters—like amount limits and frequency of transactions—and maintain lists of authorized trading partners trying to debit or credit accounts. Unauthorized transactions are quickly identified, and alerts are sent to the account holders for immediate action. This proactive approach not only strengthens the financial integrity of businesses but also fosters deeper trust between financial institutions and their commercial accounts.

Financial institutions that implement a Positive Pay Service can offer their commercial accounts advanced fraud mitigation, thereby enhancing their value proposition. This service not only helps protect the assets of their business clients but also reduces the operational risk associated with payment processing. By replacing legacy, labor-intensive systems prone to human error with automated solutions, financial institutions can offer more efficient and reliable services, thus attracting more commercial accounts and increasing profitability.

Due to increased mail theft, check washing, and fraud attempts on commercial accounts, one super-regional bank decided to offer Check Positive Pay with payee verification and discontinue its legacy product offering. Payee verification compares the payee name submitted by the commercial client to the presented item’s payee name. If the names do not match, the items are flagged as exceptions, so the commercial account can review these items.

Requiring it with payee verification increased the number of fraudulent checks detected, further protecting their commercial accounts, and also saved the bank from fraud losses and increased administrative costs. The bank indicated their offering has been their most sought after product.

View the full video series with Wespay here.

Businesses that leverage Positive Pay Services can significantly mitigate the risk of financial loss due to fraud. The platform provides commercial accounts with control over both check and ACH transactions, ensuring that only authorized payments are processed. The quick identification and resolution of discrepancies help maintain the integrity of business transactions and reduce the time spent on reconciliation. Furthermore, with features like Payee Positive Pay, businesses can enhance their defenses against fraud involving altered or washed payee names, adding an additional layer of security.

An especially crucial aspect of it is its swift response mechanism. Given the very short window—often less than twenty-four hours—to respond to potentially fraudulent or unauthorized transactions, this solution is invaluable. It emphasizes the need for businesses to vigilantly monitor their account activities daily. Without taking timely action within this brief period, the responsibility for losses shifts from the financial institution to the business, placing a significant burden on business owners. With this solution, businesses are quickly alerted to review their transaction activity, enabling them to easily accept or reject transactions and to build their approved or blocked lists effectively. This rapid response capability ensures that businesses can act swiftly to prevent financial loss and maintain control over their accounts.

For instance, a mid-sized enterprise using a Positive Pay Service experienced a dramatic reduction in fraudulent transactions. By setting stringent criteria for ACH transactions and maintaining a rigorous check verification process, the company not only safeguarded its financial transactions but also enhanced its operational efficiency. Such success stories underscore the practical benefits and operational improvements that it delivers.

In light of the alarming statistics from the 2024 AFP® Payments Fraud and Control Survey Report, Positive Pay proves itself not just as a protective measure but as a necessary investment in financial security for businesses handling substantial transactions. By adopting it, businesses and financial institutions not only secure their operations against fraud but also boost their operational efficiency and reduce financial losses both from a monetary and resource standpoint.

Positive Pay stands out as a testament to how modern treasury management solutions can be effectively harnessed to safeguard businesses against the ever-evolving threats of the digital age.

Learn more about Alkami’s Solutions here.