Discover how artificial intelligence in banking drives marketing engagement and deeper account holder relationships

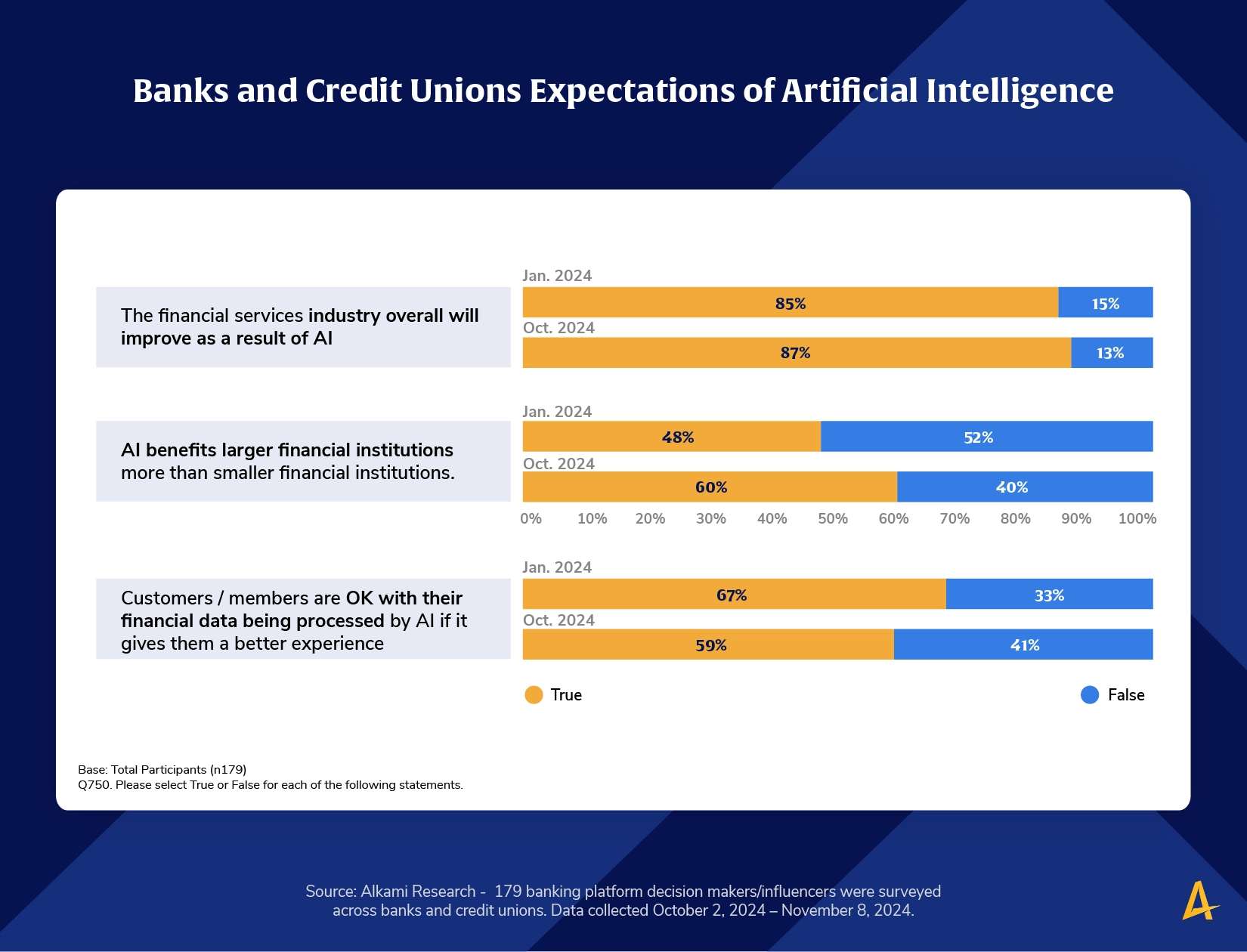

Artificial intelligence (AI) in banking is changing the financial services industry fast. Most professionals agree—87% of financial leaders believe AI will improve banking, up from 85% earlier this year. But while excitement around predictive AI is growing, many financial institutions are still struggling to implement it effectively.

While 96% of banks and credit unions plan to adopt artificial intelligence in banking within the next five years, only 18% of regional financial institutions have successfully integrated it into their operations. This gap highlights a key challenge: where should financial institutions start with AI?

The most immediate impact areas for AI in banking are data insights, customer service, security and fraud protection, and marketing. Consumers are especially eager to see improvements in fraud detection and customer service, but many are still hesitant about incorporating predictive AI into marketing campaigns. However, younger generations—especially millennials—expect personalized banking experiences. This is exactly where predictive AI can help.

What is predictive AI?

Predictive AI is built on two components: data and models. Think of data as the fuel—without clean, well-maintained, and structured data, an AI model can’t make accurate predictions. The model is the engine: a structured system that processes and analyzes data to generate insights.

In banking, predictive AI analyzes past behaviors to forecast future events. For example, it can predict which account holders might open a new certificate of deposit (CD) or which ones may be at risk of leaving. By applying predictive AI to data insights, financial institutions can improve the digital banking experience and accelerate growth.

How financial institutions are using predictive AI

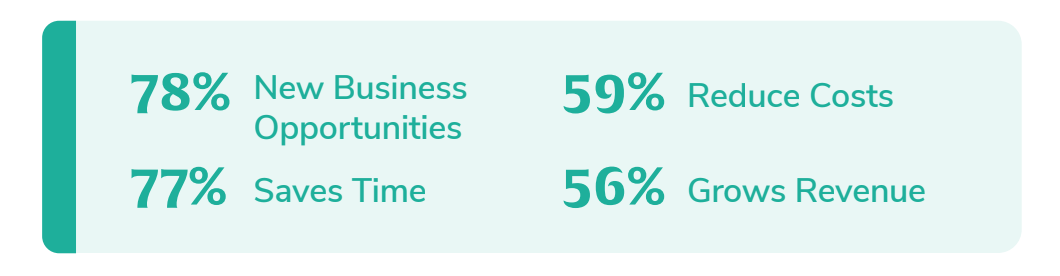

Financial institutions can use predictive AI to personalize the account holder experience, optimize cross-selling and increase revenue. One of the most impactful ways AI is making a difference is through data insights, which help banks and credit unions understand their account holders better than ever before.

A top use case for predictive AI in banking is uncovering insights from account holder behavior to offer more relevant products and services. The rise of the data-informed digital banker means financial professionals now have access to predictive AI models on demand that deliver personalization at scale.

Real-life applications of predictive AI in banking

Smarter cross-selling with personalized financial services marketing automation

Predictive AI can identify account holders who are likely to open a CD based on past behaviors. By analyzing data from six months before a CD was last opened, predictive AI models can find similar account holders who may be ready to open another CD. This increases marketing engagement by targeting the right people at the right time.

Customer results: Capital Credit Union captures 52 additional home equity loans worth $2.6 million

While student loans were gearing up to resume after the payment pause, Capital Credit Union created a home equity loan campaign focused on individuals with student loans and mortgages.

When we had the opportunity to test this and take the human element and go up against AI – we made it a game and saw it as a competition – can we beat the AI? Where does AI fit to help us capture what we missed and how do we leverage both and get as much out of it as possible?

-Steve Zich, Chief Marketing Officer, Capital Credit Union

The predictive AI cross-sell models generated 52 prospects totaling $2.6 million, demonstrating a performance 4X better than the human-curated list. These prospects would have been missed without the support from artificial intelligence in banking.

Read more about Capital Credit Union’s predictive AI journey here.

Improving marketing engagement and account holder retention

Predictive AI models don’t just predict what products account holders might buy next—they can also detect early signs of disengagement. For example, if an account holder suddenly stops making recurring payments, such as auto insurance withdrawals, it could indicate they’re considering switching financial institutions. With AI-powered insights, banks and credit unions can take proactive steps to retain account holders before they leave.

Customer results: NET Federal Credit Union personalizes member outreach for cross-sell success

NET Federal Credit Union scaled their cross-sell capabilities using Alkami’s financial services marketing solutions. By harnessing data insights and predictive AI, they launched personalized marketing campaigns that resulted in increased product adoption and engagement. The AI-powered models allowed them to identify new growth opportunities and optimize member engagement strategies.

Read more about NET Federal Credit Union’s personalized member outreach here.

Key takeaways for how predictive AI helps banks and credit unions

Predictive AI is a critical tool for financial institutions looking to compete with fintechs and megabanks. By integrating predictive AI now, financial institutions can:

- Use data-driven insights to enhance marketing engagement

- Improve account holder retention by identifying early signs of attrition

- Optimize cross-sell opportunities by predicting account holders’ needs