Consistent digital evolution is essential for financial institutions aiming to meet account holder expectations. A 2024 Deloitte survey indicates that over 80% of banking organizations are investing in mobile, cloud, and data analytics in banking to enhance digital engagement. Additionally, mobile banking usage among U.S. bank account holders has increased from 58% in the first half of 2019 to 63% in the third quarter of 2024, reflecting a growing demand for seamless, data-driven experiences.

This case study explores how two leading financial institutions—a regional bank and a large financial institution—leveraged Yodlee’s account aggregation, transaction enrichment, and financial wellness tools to accelerate digital adoption, improve customer and member onboarding, and foster long-term financial health.

A regional bank sought to enhance its digital experience and improve account verification processes. Since launching its mobile-first platform in August 2023, the bank has seen 72% of customer interactions occur via mobile, highlighting the demand for a seamless digital experience.

Key Successes:

This long-standing partnership, which began in 2016, has evolved into a strategic collaboration that enhances customer trust, security, and engagement.

Account aggregation lets us look into the entire customer's financial life. And with that, we're able to go and personalize offers to give them what they need versus what we think they need.

- SVP, Consumer Product Development

By combining data-driven insights with a mobile-first approach, the bank has strengthened its competitive edge, ensuring its customers receive smart and proactive digital banking solutions.

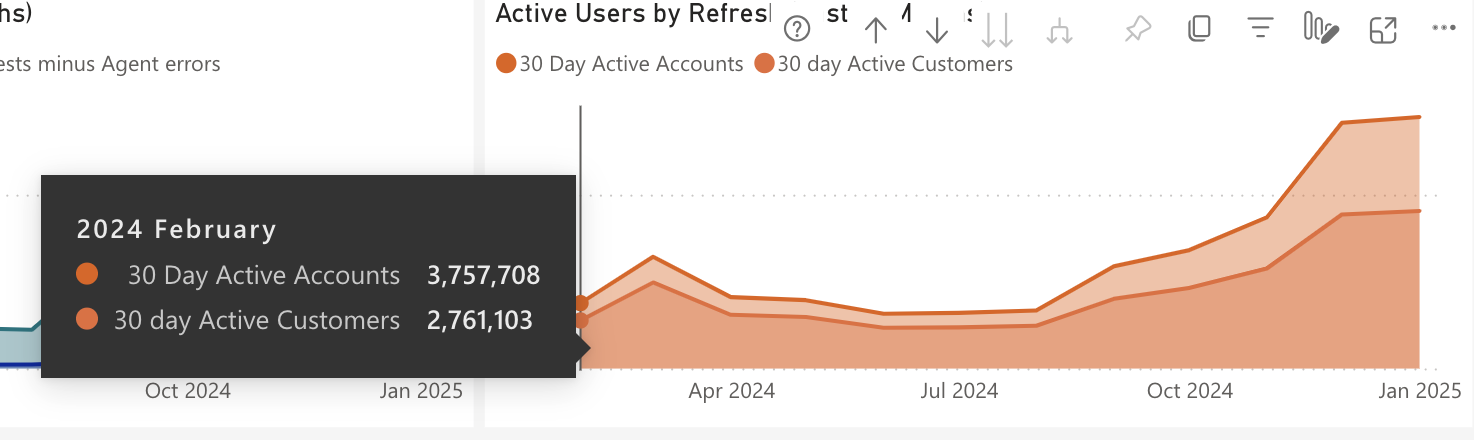

Large institution’s baseline active account and customer counts in February of 2024.

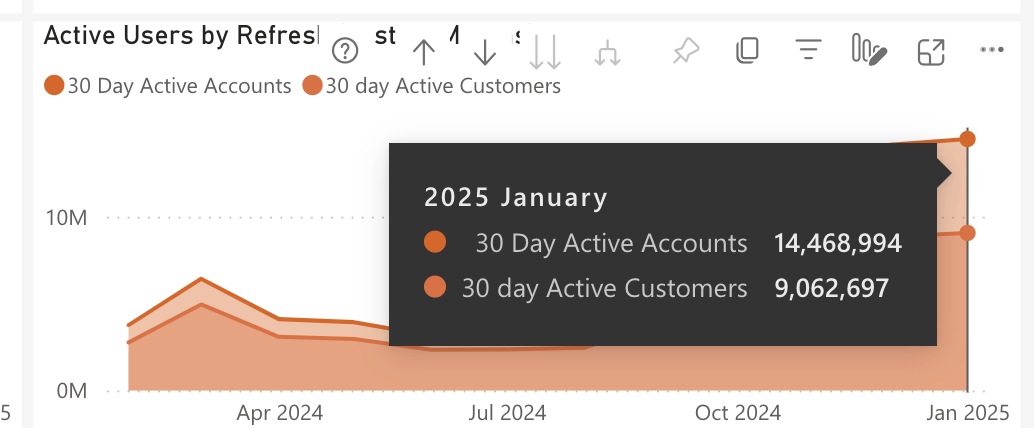

A large credit union embarked on an ambitious omnichannel transformation, including an iOS migration and a data-enriched digital banking experience. The results were exceptional, with massive user growth and expanded account linking.

Key Successes

Large credit union’s active account and member growth in just 12 months.

We’re now focused on moving from wellness to wealth building, helping our members strengthen their financial lives and plan for mid- and long-term goals.

– Digital Banking Lead

By enriching transaction data and enhancing digital banking experiences, this institution has positioned itself as a leader in financial innovation, offering members the tools they need to manage and grow their wealth.

These two case studies show just how powerful Yodlee’s data aggregation, enrichment, and financial wellness solutions can be in boosting engagement and long-term financial success. With data analytics in banking, financial institutions can better understand their account holders, create more personalized experiences, and strengthen digital relationships.

Whether it’s through mobile-first banking, smarter fraud prevention, or tools that help people build wealth, Yodlee gives banks and credit unions what they need to stay ahead of the competition.

Yodlee, in partnership with Alkami, is helping financial institutions harness the power of data analytics in banking to deliver smarter, more personalized digital experiences that drive engagement and long-term growth. Want to see it in action? Yodlee will be at Alkami Co:lab —stop by to connect with our team and learn how we can transform your digital banking strategy with cutting-edge financial data solutions!