Data is more than just numbers—it’s the key to unlocking personalized, relevant account holder experiences. Financial institutions have been increasingly turning to data insights and full funnel marketing to surface trends, create custom audiences, and deliver meaningful outreach to their account holders. We sat down with the team of experts behind Alkami’s Data & Marketing Solutions to discuss how financial institutions can leverage data tags to drive engagement and revenue growth.

Mark Leher: A data tag is derived from the transaction or account data we see in the core banking system. Our job is to surface and normalize that data so financial institutions can use it to create personalized marketing audiences. For example, we could identify a transaction where someone visited an apple farm or a corn maze, or maybe they’re regularly visiting Tesla supercharger stations. How you use those data insights in your marketing is up to your creativity, but the level of detail we provide is what makes it truly powerful. We’ve built a comprehensive library of more than 50,000 data tags. These tags allow financial institutions to design highly personalized experiences for their account holders, and the possibilities are virtually limitless.

Joan Clark: One of my favorites is the recurring spend insights. Recurring transactions, like utility payments or subscriptions to Netflix, are a goldmine for financial institutions. Many account holders aren’t using the institution’s credit or debit card for these transactions, which is a missed opportunity for interchange revenue. We have data tags that track these payments, and whether there’s been a drop or if the institution isn’t capturing them at all. Identifying these gaps can help financial institutions tailor outreach to encourage more recurring payments on their cards.

John Redmond: I really like the home improver data tag. It identifies account holders making transactions at home improvement stores—places like Home Depot or Lowe’s. It’s a great opportunity for financial institutions to reach out about a home equity line of credit (HELOC). Maybe that person is looking to do a big home project, like adding a new pool or building an addition. By identifying those trends early, institutions can offer solutions like a HELOC to help finance those dream projects.

Mark Leher: One of my favorite recent use cases centers around HELOC utilization. You hear a lot of stories in the news about electric vehicle (EV) drivers struggling to find working chargers, or they have to wait 30 minutes while their car charges. If we see transactions at places like Tesla supercharger stations, ChargePoint, or EVgo, we can suggest to those account holders that they use a HELOC to install a home charging station. It’s a timely, relevant recommendation that provides real value to the account holder while also driving HELOC utilization.

John Redmond: Yes, there are so many reasons to engage people with a HELOC. You can also reach out to parents with kids going to college, or even younger families with children who may have unexpected expenses. People who love to travel or those planning for outdoor adventures could also benefit from a HELOC. It’s about being creative and finding the right moments to make that connection.

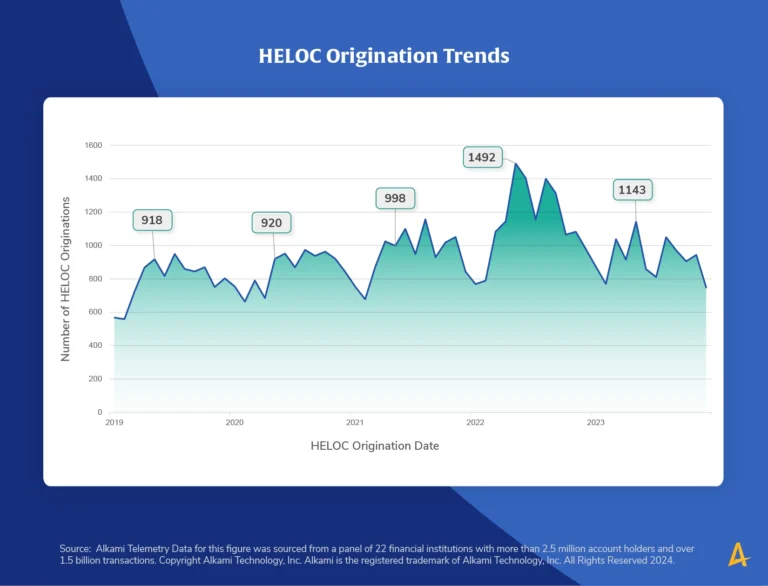

Mark Leher: Absolutely. HELOCs are actually more relevant than ever, especially given the current interest rate environment. We released a telemetry report earlier this year where we looked into some interesting trends. People have a lot of equity in their homes right now, but with higher interest rates, doing a cash-out refinance doesn’t make sense anymore—it would raise their mortgage rate. HELOCs offer an alternative way to tap into that equity without refinancing the entire mortgage.

When we started the research, I assumed that because interest rates were up, people wouldn’t be using their HELOCs, or they’d be paying them off. It turns out I was wrong. The data showed the opposite—people are using HELOCs more, and financial institutions need to tap into that trend.

Joan Clark: That’s exactly why we always rely on the data. It’s easy to make assumptions, but the data tells the real story. When you look at transaction trends, you can see what people are doing in real-time and make data-driven decisions. That’s where data tags really shine—giving financial institutions the insights they need to engage account holders in the right ways, at the right times.

John Redmond: The future of financial services marketing is personalization, and data insights are the key to making it happen. Financial institutions have access to so much data, but it’s how they use it that will set them apart. By leveraging data insights and full funnel marketing, institutions can meet their account holders where they are, offering solutions that make their lives easier and drive growth for the institution.

Unlock the power of data analytics in banking across all account holders and activities. Access 50K+ data tags ready for your financial institution. See the top 100 data tags used by our customers.