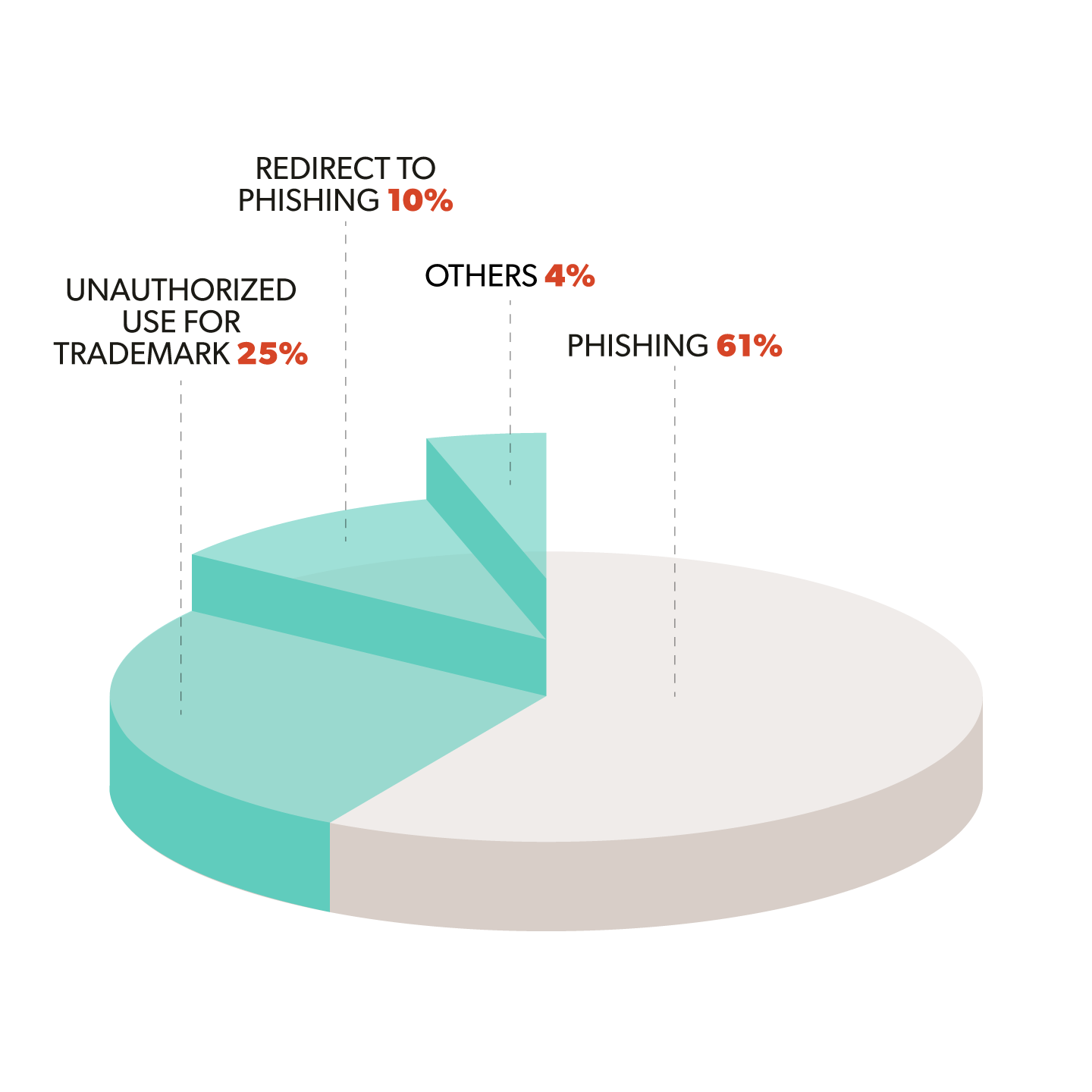

The cyberthreat environment is rapidly evolving in digital banking solutions, fueled by the increasing use of artificial intelligence (AI) by attackers. This technology enables them to expand their attack surface and create sophisticated phishing scams that mimic legitimate websites with alarming accuracy. Phishing remains a primary tool for cybercriminals seeking to harvest sensitive information for fraud and identity theft. Staying informed and proactive is critical in this escalating threat environment.

Appgate’s SOC team is on the front lines, constantly monitoring and analyzing online banking platforms for both cutting-edge and traditional cyberattacks. We rely on these key metrics to measure our performance and prioritize our efforts. In our most recent report, we uncover and explore the most common types of attacks in 2023, as well as the year-over-year attack trends. This blog will provide an overview and analysis of our attack response, proactive measures and incident deactivation times for the first half of 2024.

During the first half of 2024, we surpassed 20,000 fraud deactivations, underscoring our commitment to protecting our customers. We achieved this by implementing automated solutions that significantly enhanced our operational efficiency.

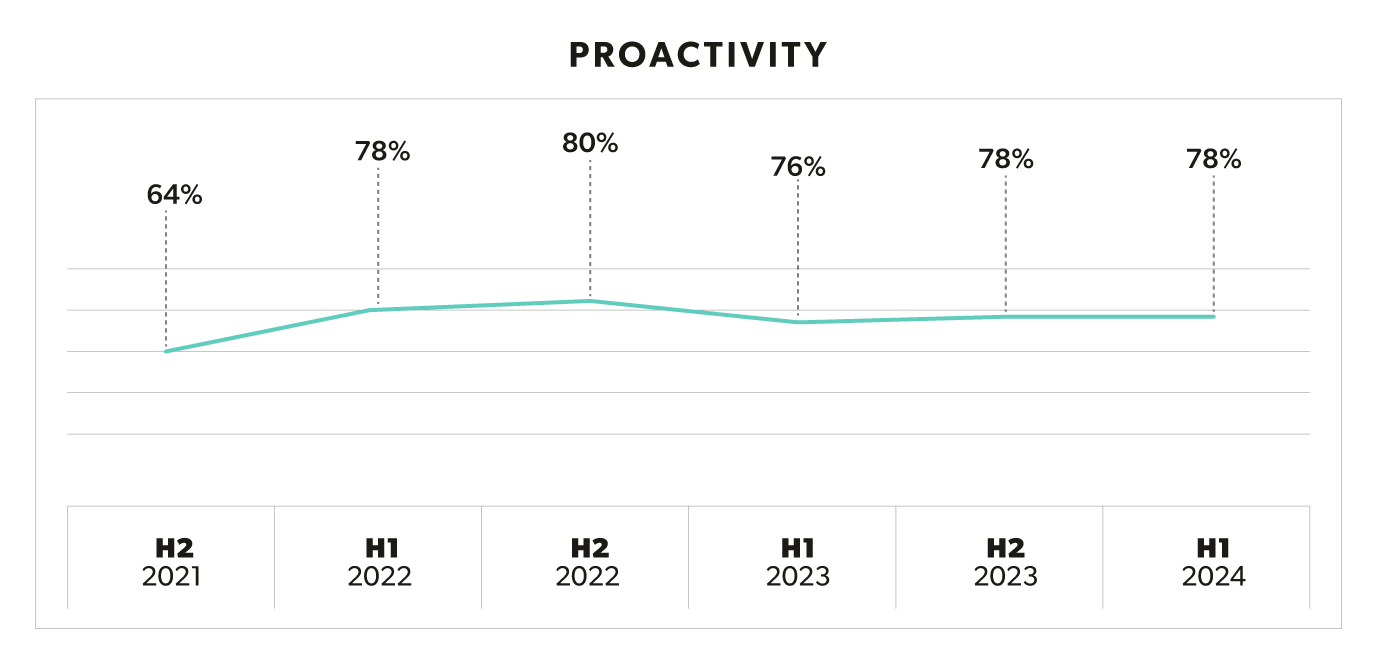

The Appgate SOC has significantly enhanced its proactive detection capabilities for phishing and fake profiles, achieving an average proactivity rate exceeding 78% in recent years. These improvements have resulted in greater efficiency and accuracy in identifying and mitigating threats.

Key enhancements include:

These ongoing efforts demonstrate our commitment to proactively safeguarding our environment from the evolving threat of phishing attacks. Let’s examine the growth of our proactive detection capabilities over time:

In the first half of 2024, we achieved a remarkable 70% success rate in disabling phishing attempts within 0 to 5 days. This rapid response time significantly mitigates the potential damage of these attacks, safeguarding sensitive data and operational integrity. This advance not only demonstrates our technical capacity but is also a testament to the dedication of our cybersecurity experts and the effectiveness of our collaborative approach.

The first half of 2024 reaffirmed the importance of maintaining proactive and efficient cyber threat detection. Through automation enhancements and strong vendor partnerships, we have achieved a significant reduction in response times, enabling our SOC team to identify and neutralize attacks with greater accuracy.

As threats continue to evolve, we remain committed to strengthening our defenses, focusing on the most vulnerable regions and attack techniques. We will continue to refine our strategies to exceed customer expectations, ensuring their data is protected and their confidence in our cyber risk management capabilities remains strong.

The dynamic nature of fraud demands a proactive and strategic approach. By identifying vulnerabilities, embracing cutting-edge technologies, and adapting to the shifting threat landscape, businesses can fortify their defenses and stay ahead of malicious threat actors.

Alkami and Appgate remain steadfast in our commitment to innovation and security, and we encourage organizations to join us in the fight against fraud to ensure a secure future for all.

Arkansas Federal Credit Union (AFCU) successfully tackled a significant phishing-related fraud challenge by integrating Appgate’s Detect TA solution through Alkami’s online banking platform. Fraudsters exploited phishing techniques by impersonating AFCU customer service to deceive members into revealing their account information, which was then used to execute fraudulent member-to-member transfers.

In response, AFCU implemented targeted security rules, including restrictions on transfers during weekends and holidays, which proved highly effective in counteracting these attacks. This proactive strategy not only thwarted phishing-driven fraud attempts, saving nearly $200,000 in potential losses, but also reinforced AFCU’s commitment to safeguarding its members with advanced, real-time fraud detection technology.

To learn more about Appgate’s threat advisory, secure access and anti-fraud solutions, request a demo today.