Why Offer Commercial Banking Solutions?

Financial institutions opt to offer commercial banking solutions for several compelling reasons. Primarily, commercial banking can significantly enhance the institution’s revenue through fees from ACH transactions, interest on larger account balances, and charges for additional services like treasury management solutions and foreign exchange.

Moreover, providing commercial banking solutions deepens client relationships, allowing institutions to engage with clients across multiple facets of their financial needs, which promotes loyalty and increases client retention. Commercial banking also positions a financial institution as a full-service provider, attracting a broader client base and enhancing its competitive edge in the market.

Differences Between Commercial and Retail ACH Transactions

Understanding the distinction between commercial and retail ACH transactions is critical due to the increased complexities and risks associated with higher transaction volumes and values in business contexts. Key differences include:

- Retail Uses: Primarily involves consumer-oriented transactions like person-to-person (P2P) payments and bill payments.

- Commercial Uses: Includes transactions such as payroll, business-to-business (B2B) payments, and large scale collections, often requiring more sophisticated risk management and compliance strategies.

- Benefits of Payment Origination: Offering business ACH origination provides substantial value by enhancing operational efficiency and offering scalable financial services that meet the evolving needs of business clients.

Ensuring Regulatory Compliance and Effective Risk Management

Regulatory compliance is at the heart of commercial banking operations. Key points include:

- Nacha Regulations: All entities involved in the ACH network must follow the standards set by Nacha.

- Regulation E: Regulation E protects consumers when they use electronic funds and remittance transfers.

- FFIEC Regulation: The Federal Financial Institutions Examination Council (FFIEC) issues guidance that provides financial institutions with examples of effective authentication and access risk management principles and practices for customers or members, employees, and third-parties accessing digital banking services and information systems.

- NCUA Audit Resources: The National Credit Union Administration (NCUA) provides audit resources designed to educate, stimulate ideas and provide guidance.

- Regional Payments Associations: These associations provide detailed support on compliance issues and help navigate the complexities of ACH transactions.

- Risk Management Practices: Institutions must perform risk assessments for each business client, evaluating factors such as business nature, transaction volumes, and financial history.

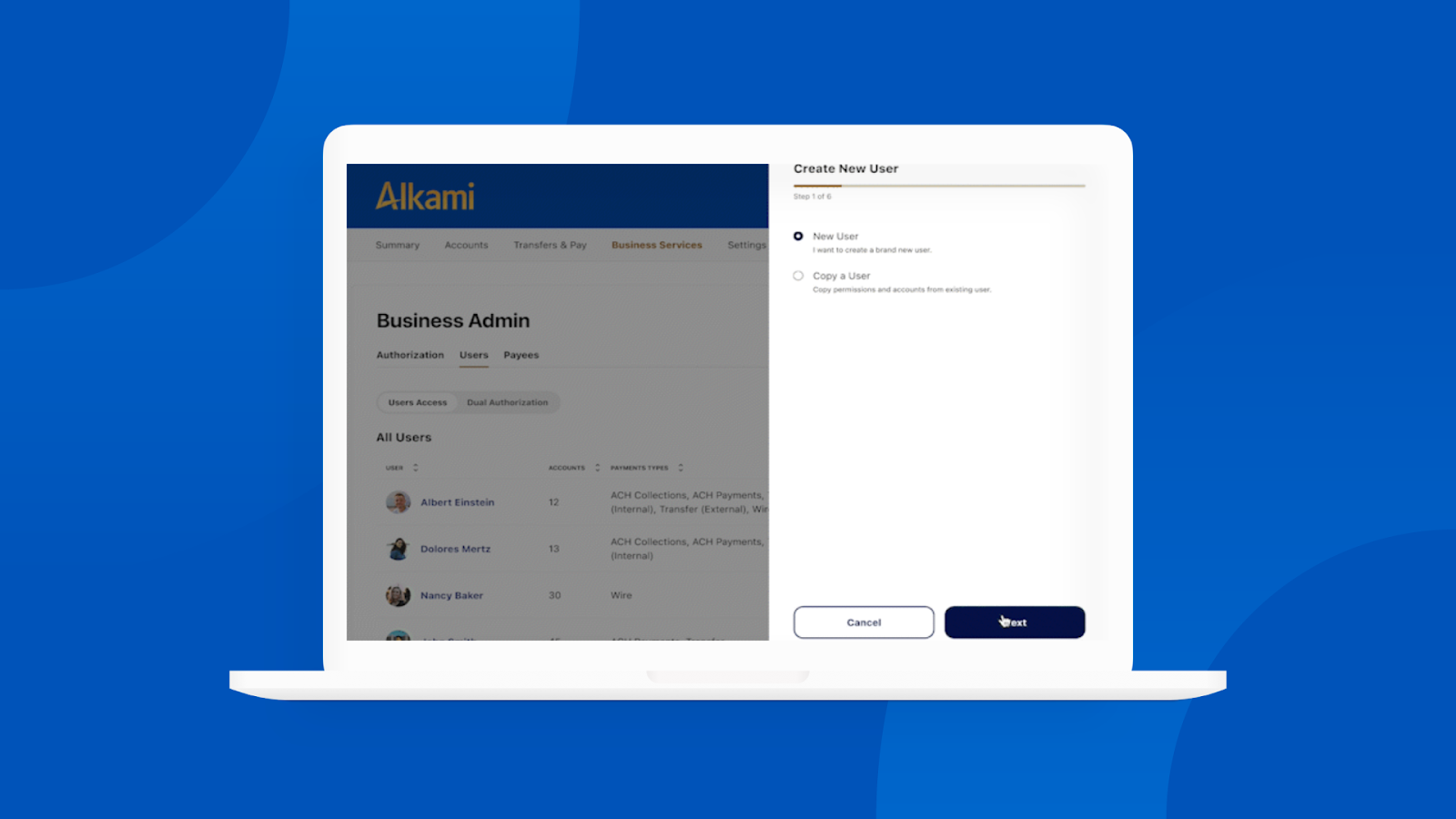

Technological Infrastructure for Commercial Banking Solutions

A powerful technological infrastructure is essential for supporting treasury management solutions. This includes an advanced commercial online banking platform that facilitates the efficient execution of large-volume ACH transactions, risk management and compliance with regulations. The technology should allow for setting transaction limits, monitoring activities and providing security measures to safeguard transaction processes.

Staffing and Expertise in Commercial Banking Solutions

Hiring knowledgeable professionals experienced in commercial banking solutions is crucial. Ongoing training and certification, such as obtaining Accredited ACH Professional (AAP) and Certified Treasury Professional (CTP) status, ensure that staff remain competent and updated on the latest banking standards and practices. Staff should have a deep understanding of both the sales and operational aspects of commercial banking and treasury management solutions to effectively manage and grow the program.

Implementation Considerations

Implementing a commercial banking solution is not merely about technology and regulations; it also involves setting up effective back-office workflows that align with the institution’s risk management framework. Operational considerations include conducting detailed risk assessments for each business engaging in ACH transactions. These assessments should evaluate factors such as the nature of the business, expected transaction volumes, and past financial behavior. Decisions regarding prefunding transactions can significantly mitigate credit risks, and institutions must carefully manage and adjust transaction limits based on actual usage and ongoing risk assessments.

Strategic Insights for Long-Term Success in Commercial Banking

The successful implementation of a commercial banking solution requires not just setup but also a strategy for long-term management and growth, including:

- Selling the Service: Understanding and targeting business needs, focusing on niche market segments initially and avoiding high-risk businesses like money transmitters or debt collectors.

- Maintaining and Growing the Service: Scaling the originator base, expanding features, and continuous reporting to leadership are crucial for dynamic growth and sustainability.

- Revenue Generation: Positioning ACH origination as a value-adding, revenue-generating service rather than a cost center, recognizing that businesses are willing to pay for enhanced services that offer significant operational benefits.

Measuring Success and Expanding Commercial Banking Solutions

Evaluating the success of a commercial banking program involves analyzing operational efficiency, client satisfaction and financial performance. Supplemental features might include enhanced fraud protection, integration with accounting software, or customized reporting tools. Approaches for pricing ACH origination services should reflect the value provided to businesses, ensuring profitability while maintaining competitive pricing.

This comprehensive approach ensures that financial institutions not only launch but also successfully manage and grow their commercial banking solution, meeting the complex needs of today’s business environment.

Interested in learning more about how to launch a commercial banking payments program? Check out our virtual hub featuring an on-demand webinar with Community Choice Credit Union and lots of valuable resources including templates for ACH operations.