It wasn’t so long ago that artificial intelligence (AI) in banking seemed futuristic. Now, AI in banking is officially mainstream as use cases mature from nice-to-have, cutting-edge options into day-to-day capabilities that offer concrete benefits and extraordinary savings. It’s about efficiency, speed, data, and insights that just weren’t possible before.

The trend toward AI is continuing to gather steam for megabanks, fintechs, and traditional financial institutions (FIs) alike. According to Business Insider:

Regardless of the FI’s asset size, it’s abundantly clear that AI is the future of digital banking. By 2023, FIs are projected to save $447 billion by using the power of AI, the majority of that being derived from user-facing apps, like chatbots, and back-office efficiencies, like fraud prevention and risk mitigation applications. These projected cost savings solidify the importance of artificial intelligence in banking.

Digital banking solutions with artificial intelligence tools.

Today’s consumers and businesses expect convenience and seamless, digital experiences. In our everyday lives, we can easily order groceries, schedule appointments, and stream media all with a click of a button. To retain and attract account holders, it’s crucial for FIs to deliver an intuitive digital banking solution, putting the power at their fingertips. Rather than just meeting their expectations, FIs should look to elevate the user experience (UX) to compete with megabanks and neobank challengers. So, how can FIs leverage AI in digital banking today?

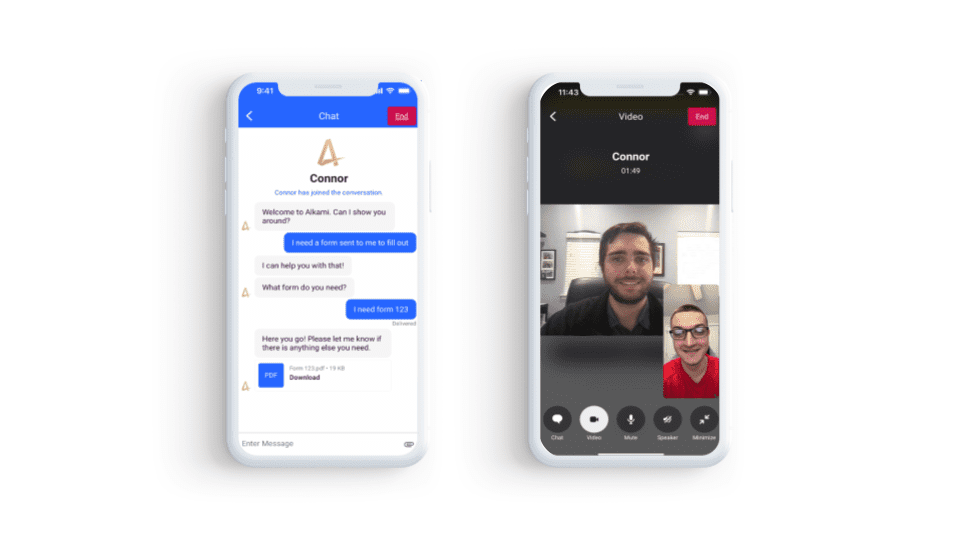

The idea of chatbots is not brand new. They’ve been around since users began adopting online banking. However, chatbots have evolved far beyond a simple application that answers banking questions 24 hours a day to a well-trained virtual financial assistant used to enhance the UX. Now, FIs can reduce call center volume and costs with an intuitive solution that seamlessly transitions between self-service customer service tools to live agent interactions. With a variety of omnichannel engagements, users can find the best tool for their needs, whether that be AI-powered chatbots, voice-activated transactions, or video interactions.

Virtual financial assistant tools powered by artificial intelligence within Alkami’s mobile banking app.

When was the last time you paid for, well, anything with cash or a check? Increasingly, we’re moving away from using a physical credit card to simply tapping our phones to buy just about everything. With all of these digital transactions, the need for cybersecurity and fraud detection has ramped up exponentially. But this isn’t just to protect account holders who fall victim to credit card theft and suddenly find two first-class tickets to Vegas on their monthly bill. It’s for FIs themselves, too. Fraud loss spans more than monetary loss, it can brutally damage the reputation and brand of the FI.

In 2021, consumers alone lost $5.8 billion as a result of fraudulent activities, a 70% increase over the previous year (CNBC, 2022). An alarming jump, causing the industry to ramp up AI protections. It’s no question that consumers and businesses alike, want their FI to protect them from suspicious activity, but they don’t want security measures that will create additional user friction. Fight fraudsters without compromising your UX with security & fraud protection tools safeguarding account holders from account takeover powered by biometrics, monitoring fraud attempts, and seamlessly authenticating users with push notifications in-app.

With AI, FIs can analyze account holders’ everyday transactions and their utilization of banking products. What FIs can derive from this data is a set of insights that paints a holistic picture of an individual’s financial life. By analyzing data about their purchases, FIs can get a clear view of an account holder’s financial priorities, spend patterns, and held-away activity. Those everyday purchases are extremely predictive of a user’s future spending behavior, allowing an FI to offer relevant products at just the right time. Predictive audiences can also be created for many different business cases, like personal loans or attrition modeling. Alkami’s AI modeling technology takes into consideration which users left the institution and users who may go delinquent on a loan to predict those likely to follow a similar pattern in the future.

By leveraging all of this data paired with AI, FIs can be more productive and deepen the account holder experience in an age when few people visit the branch. This enables FIs to provide intelligent, curated guidance to support account holders on their journey to financial freedom.

While FIs understand the urgent need to incorporate AI and ML technology into their day-to-day business operations to implement a successful growth strategy, FIs should ensure their automation capabilities are balanced with compliance requirements. Otherwise, it opens the FI up to greater risk for their account holders, brand, and reputation in the industry. Consulting with Legal, IT, and other departments across the organization creates alignment and allows for the group to agree upon a strategic approach to who their technology provider should be and how the FI can implement the technology into their digital banking platform. Furthermore, this cross-functional collaboration will enable FIs to maximize their AI capabilities using their most valuable asset: data.

Being competitive in the marketplace is about more than just implementing the hottest banking technology trend. It’s about creating less friction for users, alleviating manual processes for back-office operations, and improving data accuracy. With AI-powered virtual financial assistants providing around-the-clock customer service, users will feel their needs are being met, in turn growing institutional loyalty and overall account holder satisfaction. Pairing this 24/7 service with automation allows FIs to reduce human error and improve their marketing approach by targeting their account holders with relevant, timely offers leading to more personalized engagements and successful cross-sells. Predicting users’ needs will increase product adoption, enabling you to stay top of mind and achieve primary FI status.