What does your onboarding experience look like before your account holder reaches your digital banking solution?

If the ideal onboarding of new account holders and originating new accounts could be summed up in one word for 2024, that word would be “speed.” While many banks and credit unions offer a digital channel for digital account opening and loan origination, two in five banks still run their core banking processes on legacy systems, according to 2023 research by the ABA Banking Journal.

The biggest roadblocks to success will be the inability to embrace change.

- Jim Marous

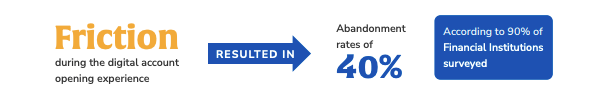

Recent research by ABBYY, reported by OneSpan in June 2023, looked into trends in account origination, and found for 90 percent of financial institutions, “friction during the digital account opening process” caused abandonment rates of 40 percent, and that’s on the low end. Respondents cited too many manual steps, the process being too long and identity verification snags.

Yet, a recent report, “The State of Digital Sales and Engagement in Banking” by Jim Marous, reveals as few as 30 percent of digital banking apps allow customers to open a new checking account, apply for a consumer loan, or manage finances with speed.

Where are traditional financial institutions going wrong with digital account opening? And how can banks and credit unions make it right?

Consumers are looking for a simple and quick experience to open and begin using their accounts. There’s only one opportunity to make a great first impression and for many prospective account holders the financial institution’s website is that first interaction. As neobanks and megabanks continue to eat away at regional and community financial institution’s account opening market share, banks and credit unions must reimagine their digital account opening solution to attract, educate, and convert prospective customers or members. By embracing the digital-age, financial institutions will be more inviting to the next generation of account holders. Not only will this shift benefit applicants, but it will also support operational staff’s efforts by creating efficiencies through automation, improved audit tracking, and a layered approach to identity verification – significantly reducing fraudulent attempts.

How can financial institutions elevate the in-branch account opening experience?

While account opening in the digital channel is crucial to a financial institution’s acquisition strategy, so is the in-branch experience. According to a 2022 study by Aite-Novarica, they found that 43% of U.S. survey respondents opened their recent checking account at a branch. When upgrading the deposit account opening solution, it’s essential that the in-branch process mirrors the digital channel. By offering an omnichannel experience, a financial institution can accelerate acquisition and eliminate manual processes.

First stop, throw out the paper applications. Welcome prospective and existing account holders into your branch and dazzle them with the trusted service they desire when choosing a regional or community financial institution. Grab them a cup of coffee and sit down as you walk them through the application process on a tablet or desktop. Ask for a few simple inputs, capture their preferred funding method, and collect an e-signature. That’s it! Once submitted, process the application within the same cloud-based dashboard as online applications – creating consistency for your back office and improving audit tracking and data reporting.

What happens after a new applicant opens an account? How can financial institutions activate those relationships to create stickiness and work towards achieving primary financial institution status?

Onboarding is so much more than simply opening an account. It’s every touch point that a financial institution has with their account holders after that initial application that creates stickiness, keeps the user engaged, and ultimately can lead to primary financial institution status. Having a continuous onboarding strategy will create momentum to keep current account holders and attract new ones..

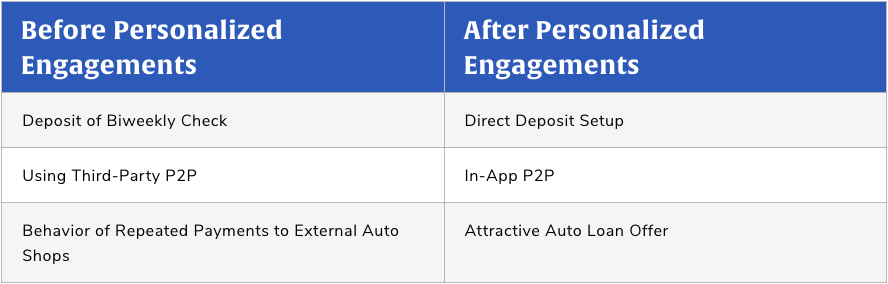

Consider this engagement. A consumer has just opened a new checking account with your institution through your mobile app. Once in digital banking, the user is encouraged to add their new debit card to their digital wallet, Apple or Google Pay, via push provisioning. The user is excited by the convenience of Apple Pay and quickly begins using it as their primary payment method at e-commerce sites and tap-to-pay points of sale. After the user begins generating some activity with their new debit card, transaction data cleansing feeds customer insights tools and identifies interesting behaviors for the financial institution to use to further tailor offers and experiences for that individual account holder. For instance, find out:

From these three observed behaviors, it would make sense to then position the following personalized engagements as the next best products for that user:

By curating what is shown to them, the account holder will feel seen and will be more likely to adopt additional banking products and services. Activities that take place on a recurring basis, like direct deposit or person-to-person (P2P) payments, keep these active digital banking users primed for product adoption and loyalty; win them over by anticipating their needs and delivering the right message at the right time.

Traditionally, the direct deposit setup and particularly switching to another financial institution is cumbersome and filled with friction. After the consumer submits the payroll change to their employer or payroll provider, it then takes a couple pay cycles to implement the change. For financial institutions, acquiring deposit streams is table stakes.

Financial institutions can streamline the direct deposit process with strategic technology partners. Now, banks and credit unions can provide access to payroll systems within their digital banking platform so consumers can manage their payroll data, switch their direct deposits, and control the money flow from their paychecks – increasing deposits and reducing the cost of acquisition.

Once financial institutions have activated direct deposit, the next step is to focus on staying top of wallet with your new account holder. Run campaigns to accelerate debit card usage and cross-sell additional financial products, like credit cards.

Across the industry, the biggest threat to regional and community financial institutions is emerging fintechs, Big Tech, and megabanks who are competing on intuitive experiences, taking card holder market share, and devaluing the primary banking relationship as attrition rates and dormancy rises among account holders. While new players offer competitive rates and instant gratification with digital card features, banks and credit unions are left wondering how to achieve a similar experience while maintaining top of wallet.

Cardholders now expect contactless payments, digital cards, simple payments, and intuitive card management tools. Financial institutions can offer digital, self-service tools that empower users to easily manage card limits, alerts, controls, and travel notices within digital banking, as well as leverage digital card display and push provisioning for major credit cards.

With Alkami’s digital banking platform, banks and credit unions can accelerate digital sales and services through personalized engagements and market-leading onboarding solutions.