Banking isn’t what it used to be—account holders today expect more than just a place to store their money. They want a personalized banking experience that adapts to their needs, behaviors, and financial goals. The traditional, one-size-fits-all approach to banking has already begun feeling stale and outdated, as account holders gravitate toward personalized online banking experiences that feel more intuitive and tailored.

With the rise of fintech disruptors and digital-first banks, traditional financial institutions must rethink their strategy.

Account holders expect the same level of personalization from their financial institutions as they do from companies like Amazon, Netflix, Spotify or Apple—where every interaction feels relevant, timely, and designed for them. To stay competitive, banks and credit unions must embrace personalized banking—not as a passing trend, but as a fundamental shift in how they engage with their account holders.

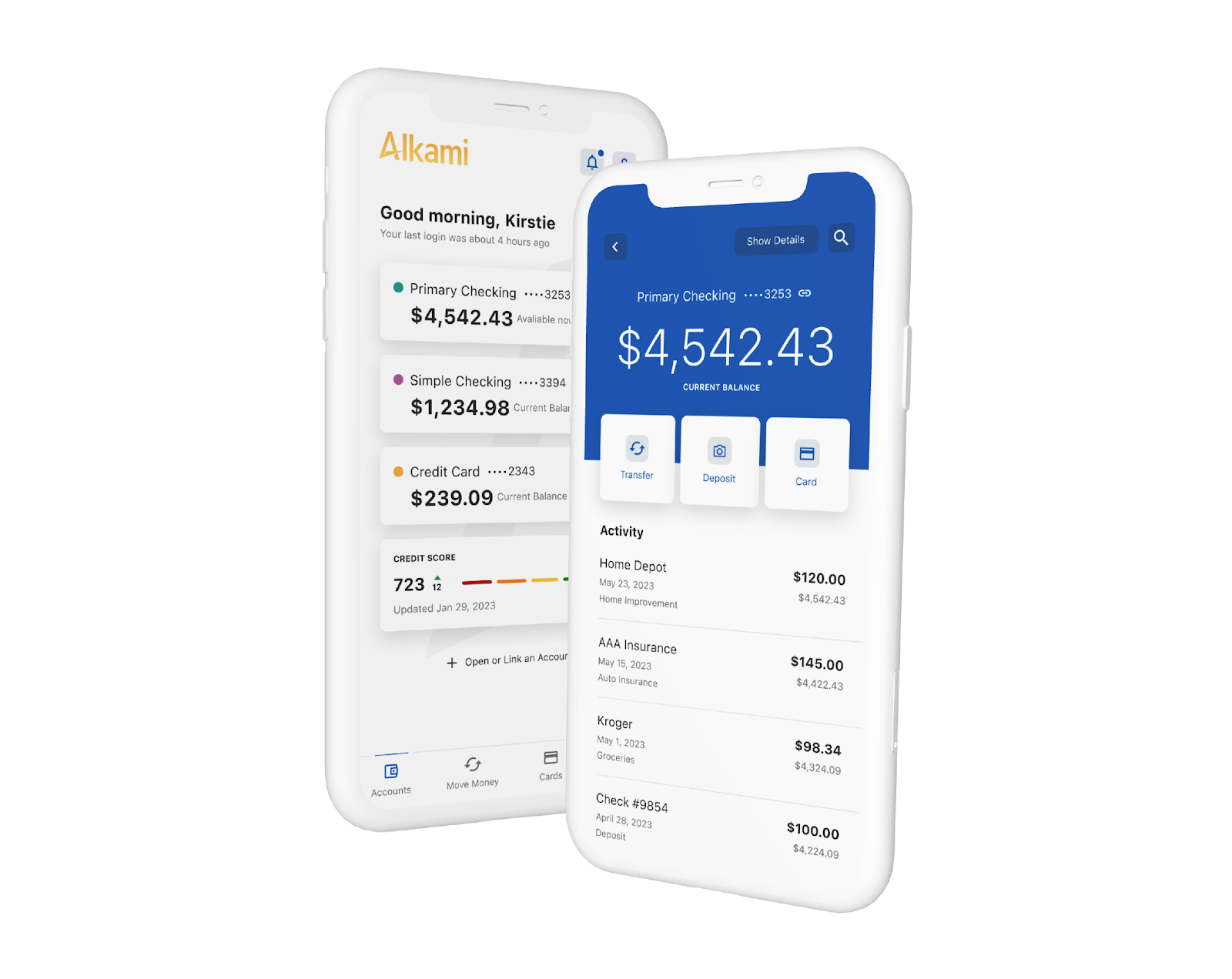

Personalized banking is about making financial services tailored and relevant to each individual. Instead of offering generic products and services, banks and credit unions leverage data, artificial intelligence in banking, and automation to understand user behaviors, anticipate future needs, and provide proactive, data-driven recommendations.

Examples of Personalized Banking in Action

✅ A consumer who frequently dines out receives tailored cashback rewards for restaurants.

✅ A customer steadily saving for a home is offered a customized mortgage option at the right time.

✅ AI-driven insights suggest personalized budgeting tips based on real-time spending behavior.

This level of personalization goes beyond convenience; it enhances financial well-being by offering smarter, more meaningful interactions. Whether it’s an AI-powered assistant providing real-time financial insights, targeted product recommendations, or even personalized financial education resources, personalization is reshaping the way people interact with their money.

Personalization isn’t just about making banking more convenient—it’s a game-changer for building trust and long-term loyalty. Consumers and businesses alike are more likely to stay with a financial institution that understands their needs, communicates proactively, and delivers relevant solutions at the right time.

Here are some key benefits of personalized banking for financial institutions:

By investing in personalization, banks and credit unions can create deeper connections while also driving business growth and operational efficiency.

Data and Marketing Solutions: Personalized banking starts with understanding account holders on a deeper level. Alkami’s Data & Marketing Solutions make that possible by transforming a financial institution’s data into actionable insights. Using data insights built from account holders’ real-time transaction patterns, deposit behaviors and engagement signals, financial institutions can predict account holders’ financial needs. This means when an account holder might be looking for a loan, the financial institution can proactively initiate marketing engagement to provide the best loan offer for that individual. With financial services marketing automation, banks and credit unions can deliver timely, relevant offers and communications, ensuring every interaction feels tailored.

Alkami’s Operational Data & Insights helps banks and credit unions analyze user interactions across digital banking channels.

✅ Identify account holder behavior trends through transaction data.

✅ Optimize digital banking experiences with AI-driven insights.

✅ Enhance security and fraud prevention by detecting anomalies in user engagement.

This data-driven approach makes it easier to offer personalized banking experiences, delivering the right solutions at the right time to build stronger relationships.

Now that we covered why personalized banking is so important, let’s dive into why it needs to be prioritized. Retail and business users expect seamless, tailored experiences, and fintech companies are setting new standards for convenience and customization.

People have become accustomed to the personalized experiences they receive from tech giants and they expect the same level of engagement from their financial institutions. This shift in user expectations is evident as more than a third of Gen Z consumers prefer fintech services over traditional banks for online payments, highlighting a significant trend towards personalized digital solutions.

Making personalized banking work isn’t just about having the latest technology—it’s about using data strategically and creating seamless experiences across every touchpoint. Here’s how banks and credit unions can get it right:

Personalized banking isn’t just a trend—it’s the future of financial services. Both retail and business account holders are demanding more relevant, seamless, and data-driven experiences. And to no surprise, financial institutions that deliver on these expectations will gain a significant competitive advantage.

By using data responsibly, investing in AI, and creating frictionless omnichannel experiences, banks and credit unions can strengthen relationships, drive revenue, and stay ahead of the competition. Now is the time to assess your current personalization strategy, identify areas for improvement, and explore new ways to make banking more intuitive, relevant, and rewarding for your account holders.

The future of banking is personal—are you ready to embrace it?

To learn more about adopting a personalized banking strategy, contact us for a demo or a conversation with our digital banking experts.