Today’s consumers choose their primary financial institution based on the strength of your digital banking experience. With Alkami, you offer more than convenience—you deliver real value, personalized engagement, and frictionless control across every touchpoint.

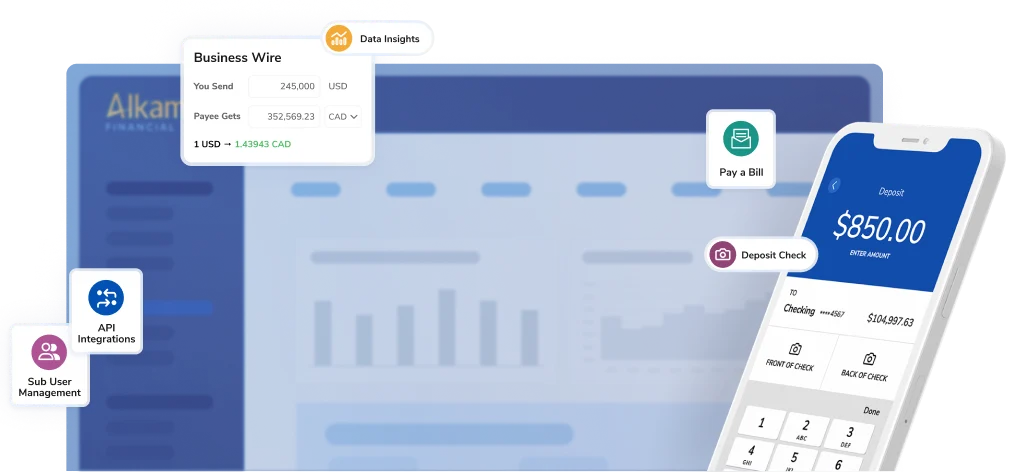

Business owners expect more than online access—they need digital banking software built for how they actually run their business.

We worked with real bankers to build tools that simplify operations, enable deeper relationships, and help your institution become their go-to partner.

Your developers deserve intuitive tools that let them move fast and build with ease. Our APIs and SDKs empower teams to integrate, customize, and future-proof their work, thanks to continuous platform upgrades that keep innovation moving forward.

We launch a new financial institution every two weeks. That means our implementation process isn’t just proven—it’s continuously refined to reduce risk, accelerate ROI, and deliver an optimized experience from day one.

higher core deposit growth

higher revenue growth

higher average revenue per FTE

higher loan growth

You consistently outperform expectations. You’re bold, resourceful, and determined to turn digital into your competitive edge.

Isn’t it time your digital banking solution lived up to that?

A digital banking conversion doesn’t have to be risky. We’ve taken the playbook from the most successful digital banking conversions in recent years to give your institution a step-by-step guide and accompanying resources and tools for getting it right—regardless if you choose Alkami as your digital banking provider.