In today’s environment, instant isn’t a benefit. It’s an expectation. So when cardholders face friction with a new card or receive unexpectedly declined transactions, they are left more than a little frustrated.

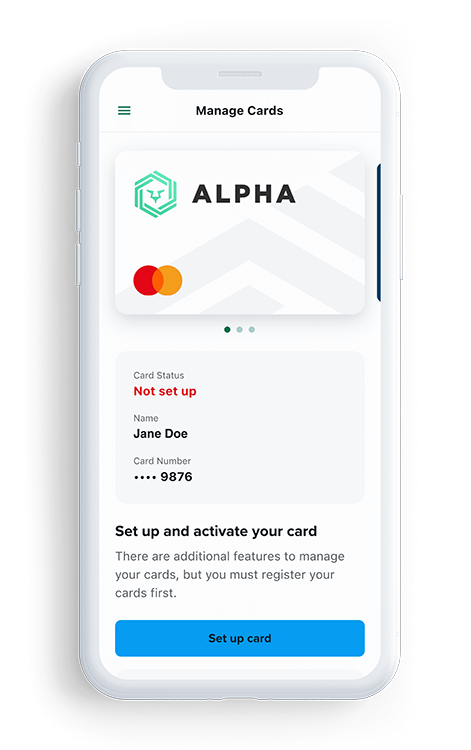

By providing a wide breadth of coverage for different cores, card processors, fintechs, and card networks, Alkami is putting “instant” back into card experience by delivering self-service within the digital banking platform.

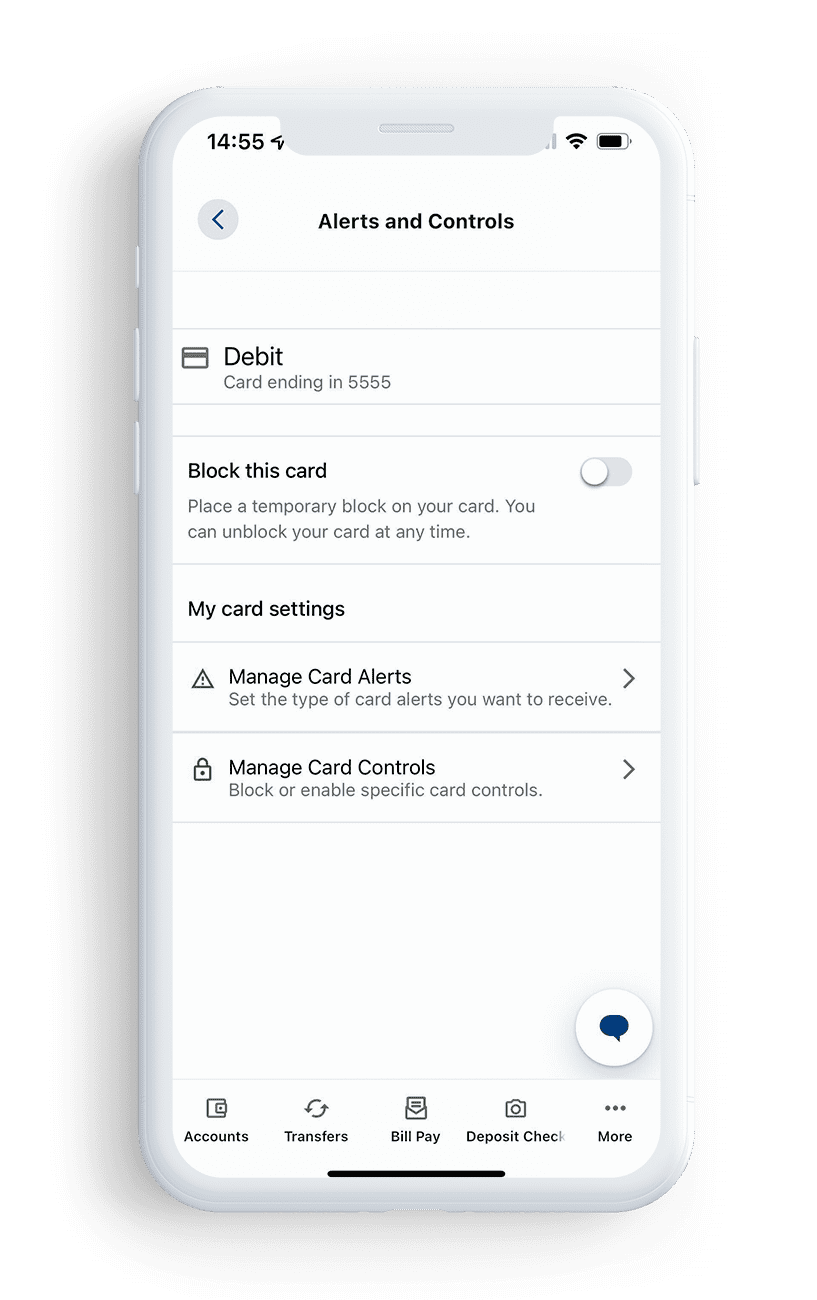

Within the digital banking platform, cardholders will have direct access to controls for card usage, block/unblock, authorizations, travel notices, as well as receive real-time alerts on transactions.

When you’re able to deliver self-service benefits like this, you shouldn’t be surprised if you see an increase in card usage and digital wallet adoption. In fact, you should expect it.