The right digital account opening solution can make all the difference. Seamlessly convert consumers with an omnichannel account origination solution designed to remove friction and drive conversions whether applicants are on mobile, desktop, contacting the call center, or in-branch.

Sift out unnecessary, time-intensive steps and in-branch barriers while enhancing your fraud prevention capabilities. With Alkami, FIs can convert users seamlessly via our digital-first and in-branch account origination experiences.

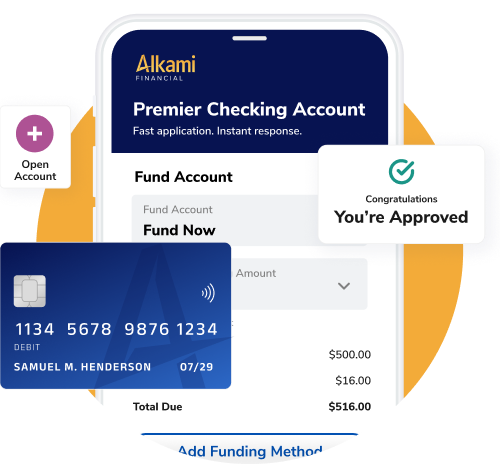

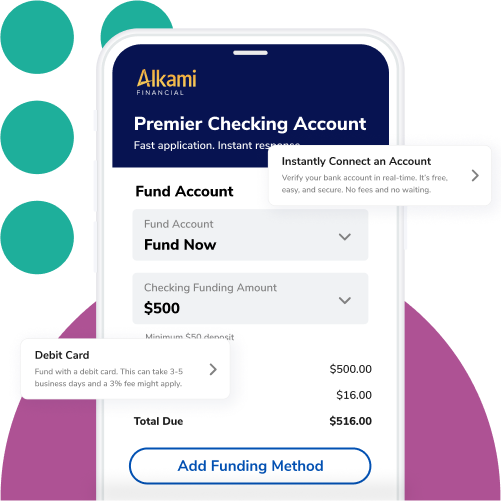

Onboard users via an intuitive application that has minimal data inputs, flexible funding methods, and electronic signatures. Reduce abandonment by delivering automated messaging on outstanding tasks and secure invitations for remote applicants.

Back-office teams have enough work on their plate. Streamline your financial institution’s operations with real-time identity verification and rules-based decisions.

Review applications in a centralized order processing system for deposits with a clear audit history built to improve compliance.

Creating operational efficiencies is easier said than done. We know your time is valuable, which is why we have developed a network of integrations that enables you to do more in less time.

With MANTL financial institutions can prevent fraud, offer flexible funding methods, and seamlessly connect with your preferred core provider for real-time account origination.