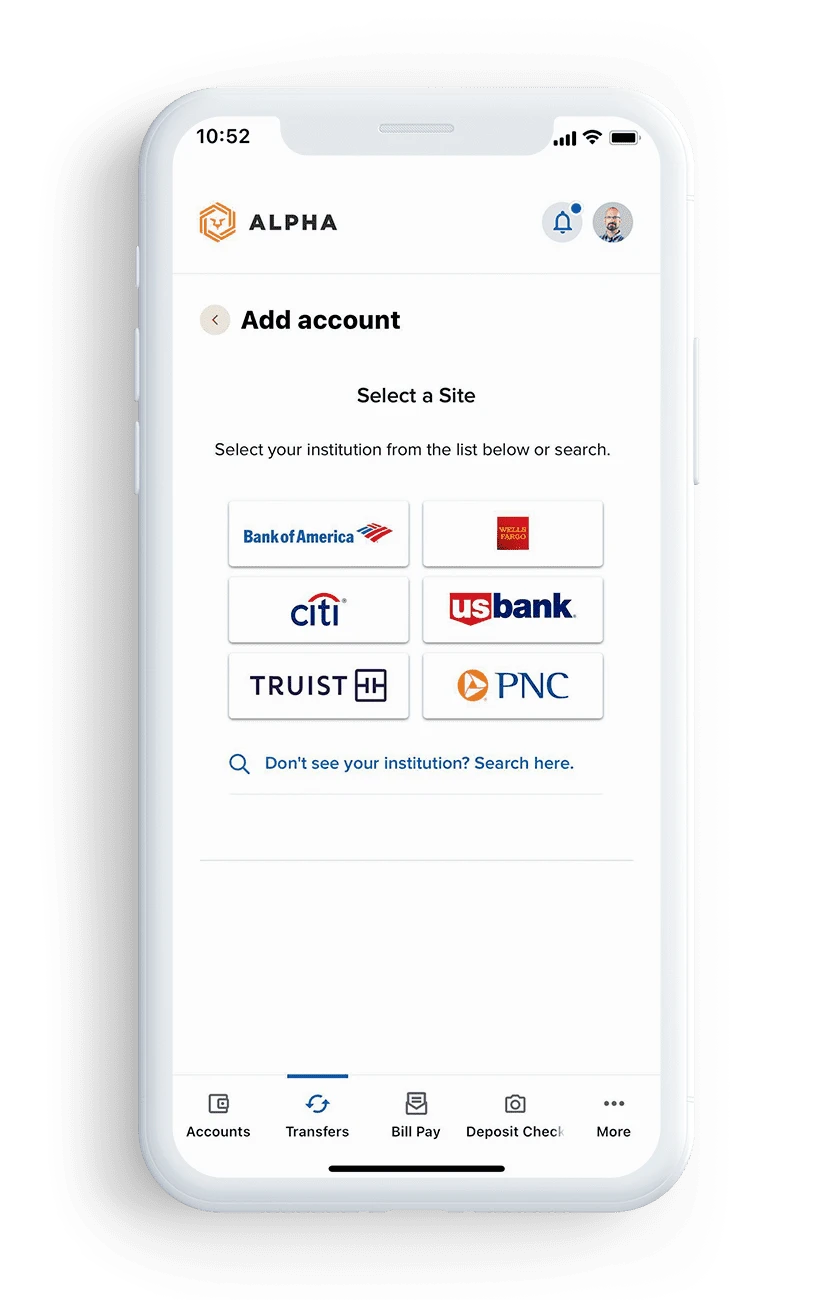

Put control into users’ hands by enabling them to send their money how they want – and when they want.

Bill Pay: Simplify the bill pay experience by offering all bill payment needs directly within your FI– eåliminating the need for users to navigate to multiple biller sites. Enable your users to view their eBills, manage payees, schedule payments, and more.

P2P: Make P2P as easy as 1-2-3. Provide your users with even more flexibility by giving them the option to make P2P transactions directly within your digital banking app.

Allow your users to make fast and seamless transfers– so their money is in the right place when they need it.

A2A: Allow your users to initiate account-to-account (A2A) transfers instantly via the RTP® network and FedNowSM Service.

Account Funding: Users can instantly deposit funds into a bank account by pulling from a linked debit card.

Loan Payments: Give your users the flexibility to make instant loan and credit card payments using a debit card.

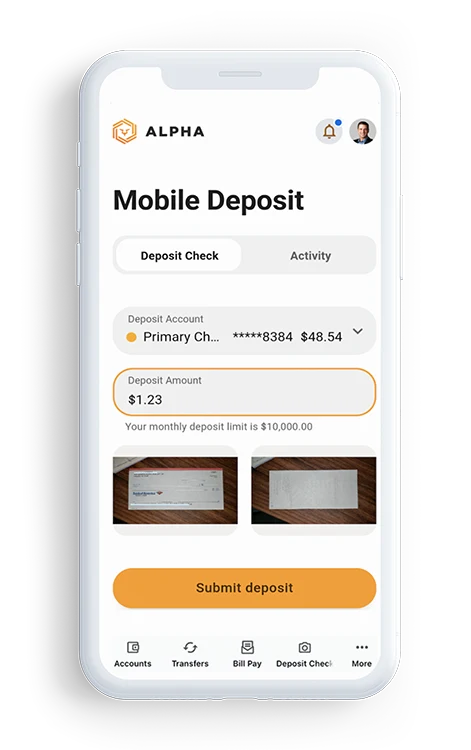

Increase engagement and reduce processing costs with remote deposit capture (RDC), giving your users the ability to easily deposit checks on their mobile devices.

With RDC, it’s as easy as Sign, Snap + Deposit.

Your users will be able to access their funds faster than traditional deposit methods, with the convenience of not having to visit a physical branch to do so.