Client Success, Resources, Testimonial

June 12, 2025

Unitus Community Credit Union’s Digital Maturity Results

Creating a Culture of Innovation: How Unitus Used the Retail Digital Sales & Service Maturity Mo...

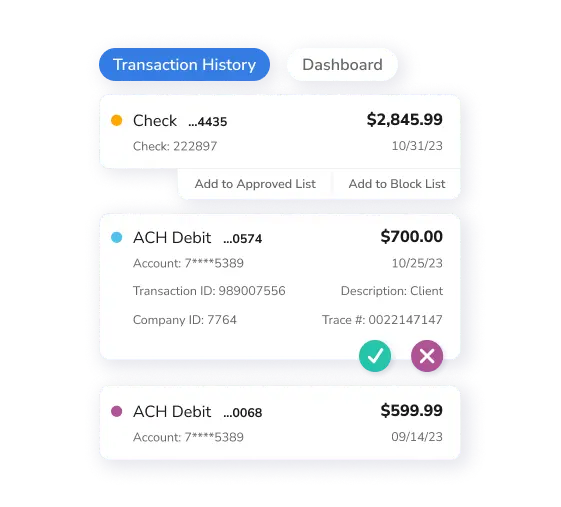

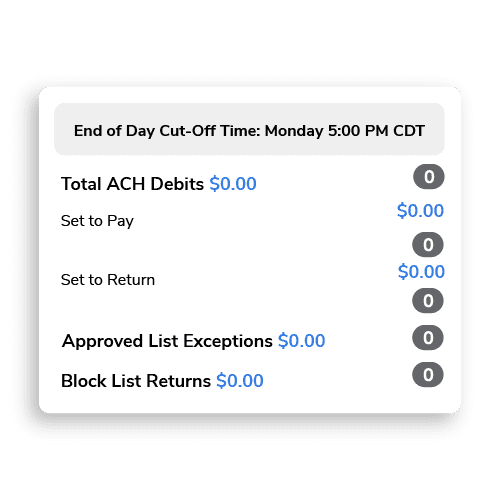

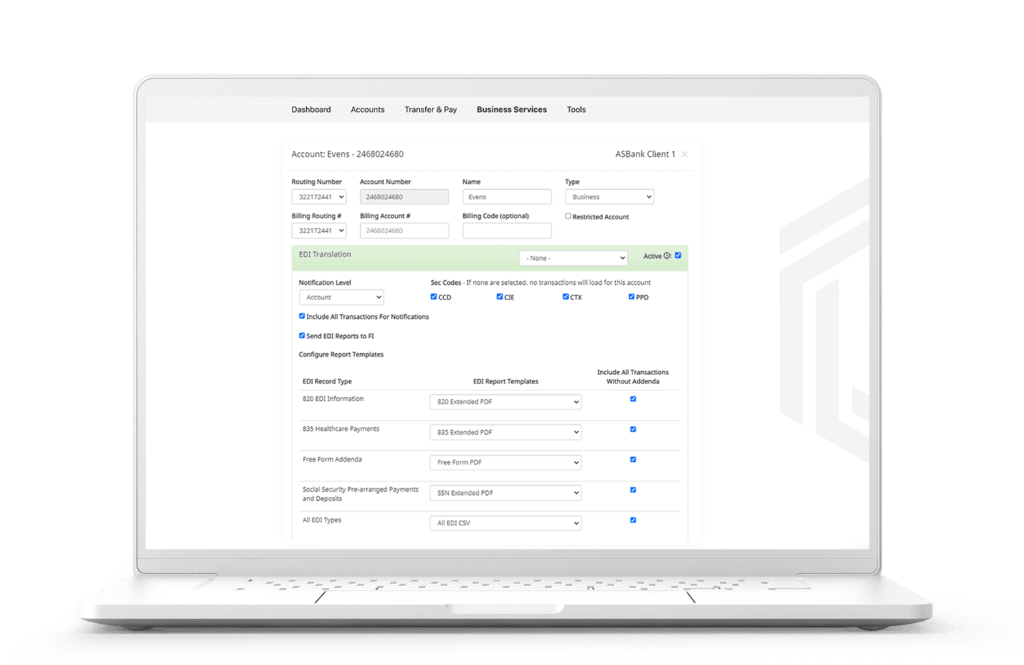

Positive Pay is a banking service that helps detect and prevent ACH and check fraud by allowing commercial accounts to monitor transactions against check issuance files and ACH criteria. Matching transactions are processed, while discrepancies are flagged for review, requiring approval or rejection.

Transactions Monitored

47% increase YoY

Transactions

Stopped/Returned

36% increase YoY