Buy now pay later (BNPL) adoption has soared and shows no signs of abating. Alkami’s commissioned research* shows that 58 percent of digital banking Americans who use online-only banks say in five years, BNPL transactions will exceed credit card transactions in the U.S., the highest of any primary financial provider tested.

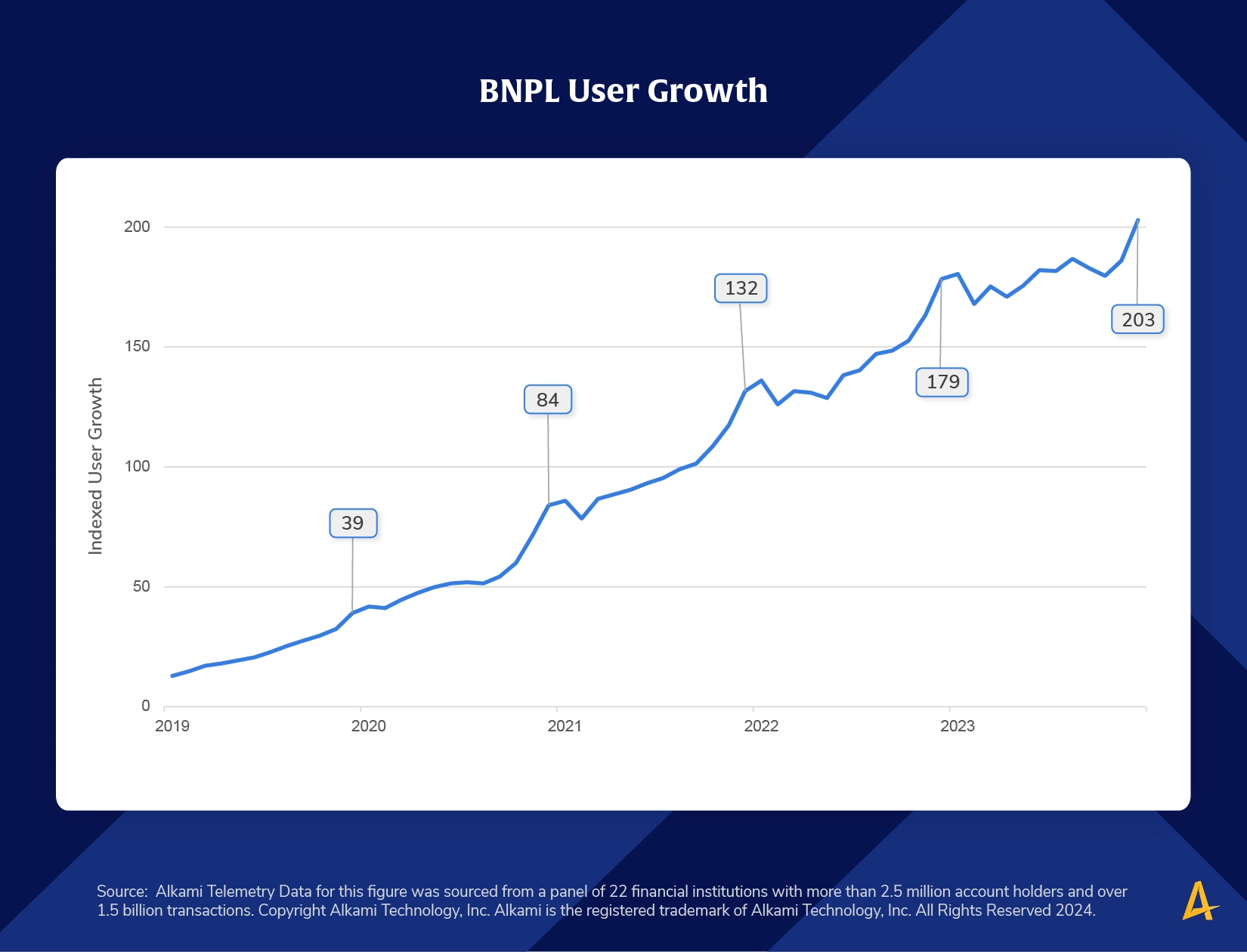

This week’s chart shows the trend of BNPL adoption, with values indexed to 100 where 100 equals the average number of users across all months analyzed. Comparing December values in each year, there are 5.17x more BNPL users in 2023 than in 2019. It’s worth noting the spike in usage during December and January each year. This shows that holiday shopping is a key time when new users try BNPL.

With the knowledge that new usage of BNPL spikes during the holiday shopping season, financial institutions can get ahead of that trend now. If your FI has a pay over time offering, make sure your account holders are aware of that starting now. Further, now is the time to share financial wellness content about budgeting for holiday spending. This will show that your FI is a trusted partner and help keep account holder’s financial journey’s on track.