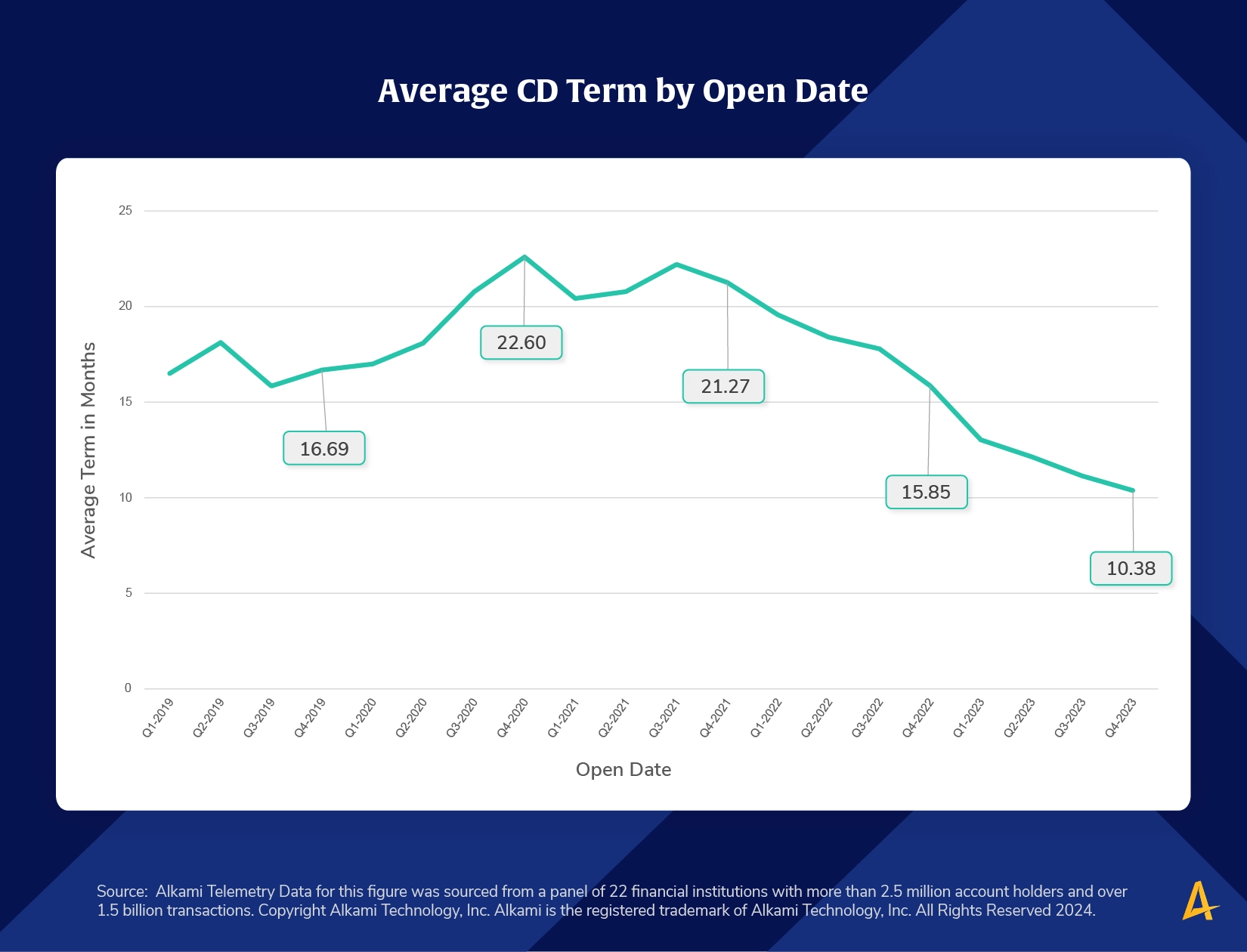

The average certificate of deposit (CD) term length in months is shown in the chart based on the opening date from 2019-2023. Revealed through consumer spending trend data, CDs became shorter in duration, on average, as interest rates increased. Financial institutions, perhaps reluctant to commit to higher cost of funds for long periods, began to offer attractive interest rates on shorter term CDs. As a result, consumers demanding competitive rates shifted to those shorter term notes and have benefitted from higher interest rates and more flexibility. The average term for a CD issued in Q4 2021 was 21.27 months. By Q4 2022, the average term was 15.85 months and in Q4 2023, the average term was only 10.38 months.

As CD term lengths have shortened, financial institutions need to have a full funnel marketing strategy to keep expiring CD funds in their institution. This is more critical in light of the interest rate decrease announced by the Fed in September, which will lead to a decrease in the yield that consumers will earn on CDs and may leave them looking elsewhere when current certificates mature.

Using transaction data to reveal expiring CD products can provide banks and credit unions with intel on their account holders to develop targeted campaigns to drive renewals and keep those funds.