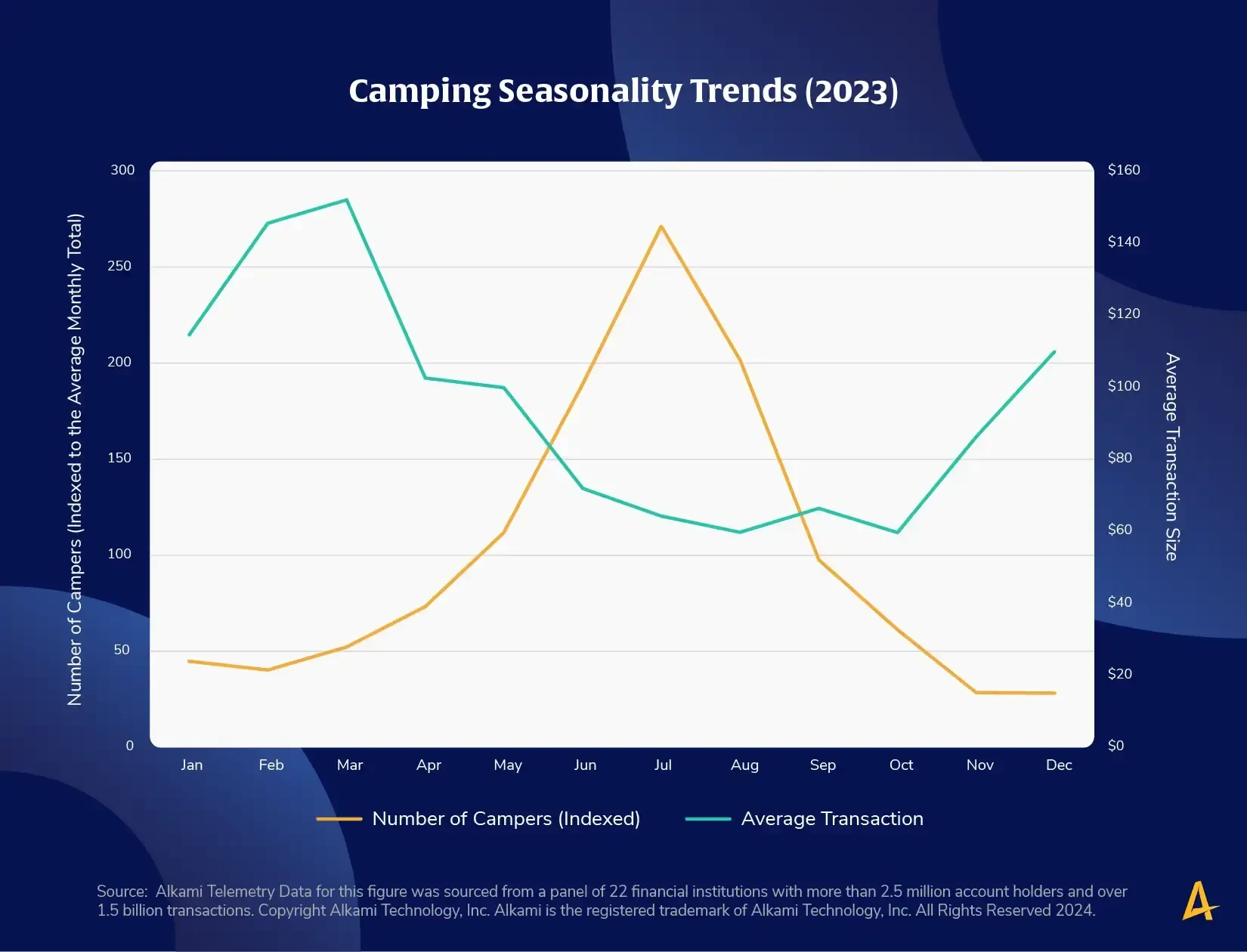

Camping is a classic summer activity for those who love the outdoors. Our research looked at seasonal trends in transactions at campsites using 2023 data to see a recent complete year. The chart shows both the number of accounts with campsite transactions and the average dollar amount of those transactions. The number of accounts with transactions is indexed to 100, where 100 equals the average monthly accounts across the year.

Not surprisingly, Alkami Research’s analysis of transactions at campsites shows peak activity in June, July, and August. Interestingly, the average transaction amount peaks in the winter months. Why? There are two types of campers. Tent campers and recreational vehicle (RV) campers. Tent campers peak in the summer when the weather is more accommodating – likely reserving outdoor campsites for shorter trips. These site reservations are less expensive and there is more availability in the summer months, bringing the average transaction amount down. Tent campers are also more likely to be families.

RV campers have made an investment in an expensive vehicle that allows them to travel the country. RV campers are more likely to be retirees, or individuals who have time to vacation or travel even in the winter months, hence the higher average transactions.

Financial institutions should consider tailoring their marketing campaigns to personas. A message in digital banking with relevant imagery will resonate with account holders and feel personal – summer months are a great time to target campers with a certificate of deposit (CD) product inviting them to “Earn S’more Interest” – include a picture of marshmallows and a campfire to hit the point home.

Also, keep an eye on the winter months’ campers. These are likely to be RV owners who may have unique vehicle financing and insurance needs.