Ideal Credit Union (Ideal CU) is a $1 billion asset credit union based in Minnesota that serves more than 50,000 members with six branches throughout the Twin Cities Metro Area. In a changing interest rate environment, the team at Ideal CU knew they had to pivot their strategy to remain profitable. After years of loan growth, rising rates in 2022 required a shift to deposit growth for their marketing engagement strategy.

In 2020 and 2021, money flowed in, but by 2022, rate hikes changed the game. Members were moving their deposits elsewhere, and the Ideal CU team needed a targeted, data-driven approach to bring in new money. Simply marketing deposit products broadly wouldn’t be enough—they needed precision marketing engagement to the right members at the right time.

To reverse the trend, Ideal CU launched five targeted campaigns focused on six deposit products, including business accounts, money markets, multiple certificates of deposit (CDs) and health savings accounts (HSAs). By leveraging data analytics in banking, Ideal CU identified members who had funds elsewhere and empowered their frontline staff with personalized cross-selling opportunities.

Success wasn’t just about marketing engagement—it was about equipping frontline staff with data to have meaningful, high-value conversations. Instead of generic offers, Ideal CU’s frontline teams were able to provide personalized products and services, ensuring the right members heard the right message.

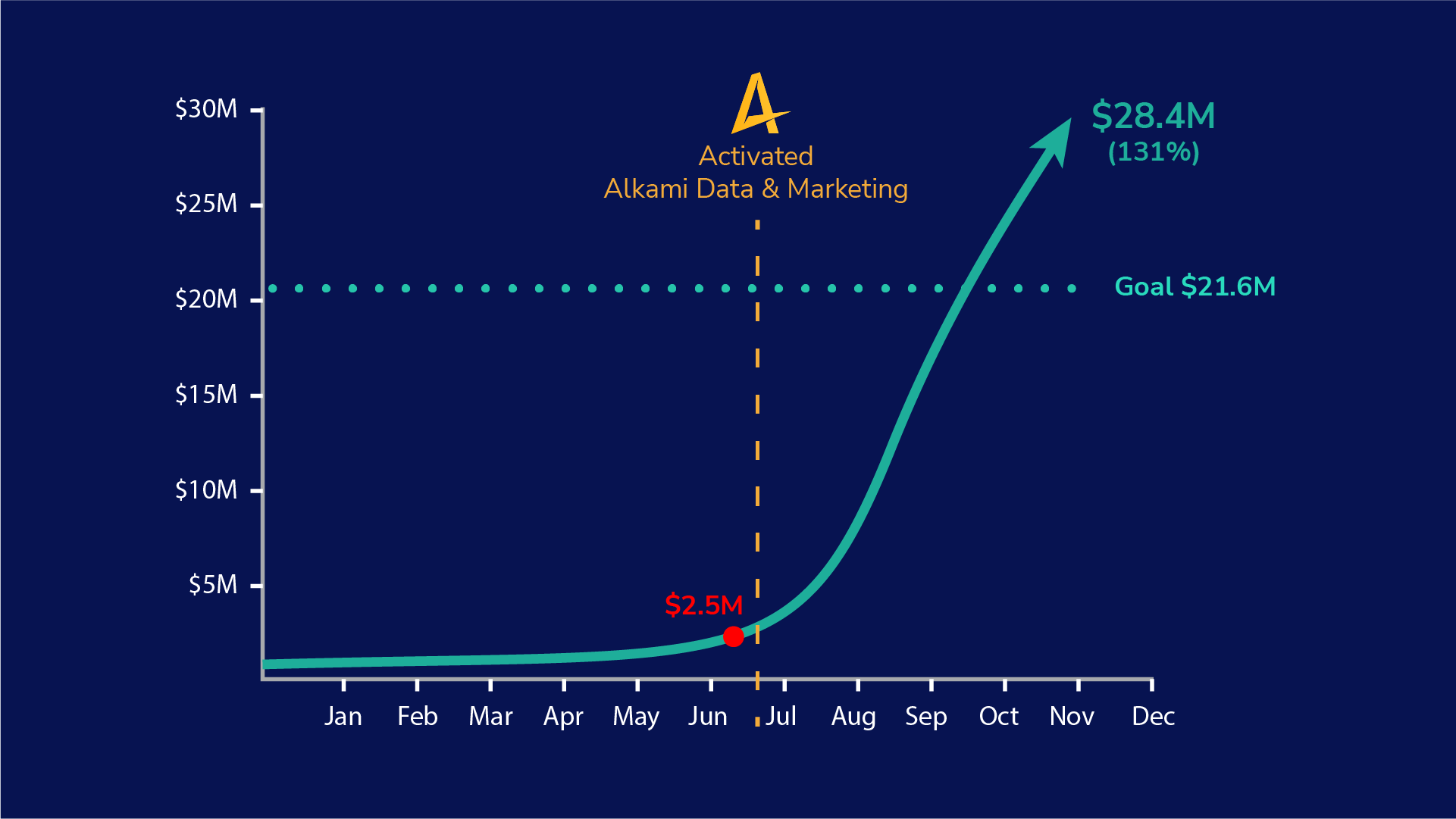

"We set a goal for our new money growth, and at the midyear point, we were at 11% of that goal. So, we put five campaigns in motion. They set off on July 1st. In June, we did $330,000 in new money. We did $5.2 million in July. And we did that using Alkami." Alisha Johnson, Chief Growth Officer, Ideal Credit Union

As a result:

By combining financial services marketing automation, frontline engagement, and data-driven targeting, Ideal CU dramatically increased deposits to exceed their new money goal.