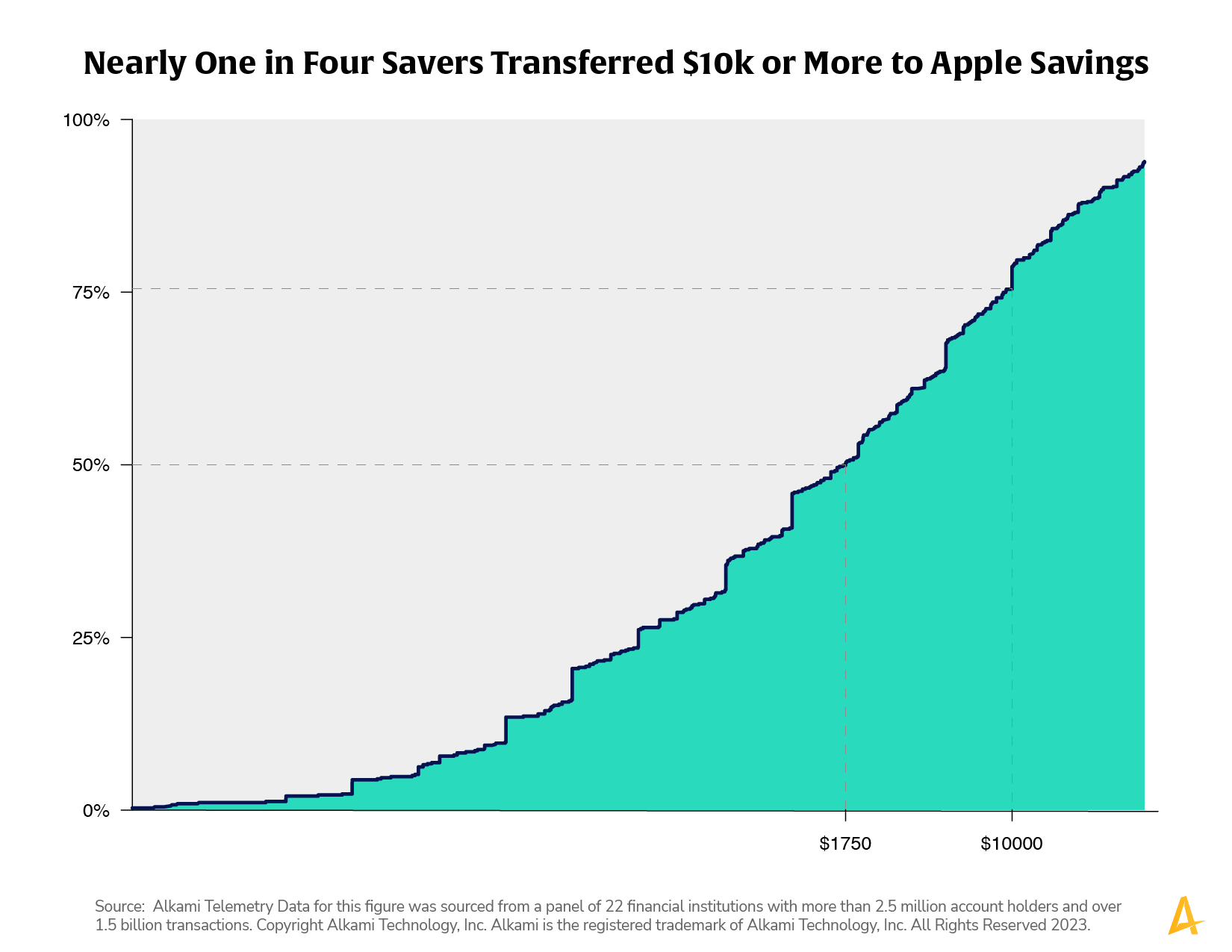

Previously, the amounts transferred to Apple Card’s high-yield savings account found a median amount transferred of $1,750 and nearly one in four savers transferred over $10,000.

The above chart further investigates Apple Savings compared to increasingly popular fintech/budgeting app Rocket Money, which allows users to squirrel away money into non-interest bearing accounts through passive measures like automated deposits or by “rounding up” day-to-day expenditures. Compared to Apple Savings, saving features in this fintech app lead to very different saving behavior in lower savings amounts, as the figure above demonstrates (yellow line). Savers in our panel who used Rocket Money had median transfer amounts of only $127, with one in four transferring more than $326.

Financial institutions are under pressure to compete with non-traditional players offering high-interest savings accounts or apps that implement easy-to-execute saving strategies. But not all new savings products are alike. Financial institutions have an opportunity to deploy campaigns such as short-term certificate of deposit (CD) that offer a higher interest rate, or other deposit account products with features and benefits that can compete and be the driver for a win-back strategy relevant to each type of saver.

Source: Alkami Telemetry Data for this figure was sourced from a panel of 22 financial institutions with more than 2.5 million account holders and over 1.5 billion transactions.