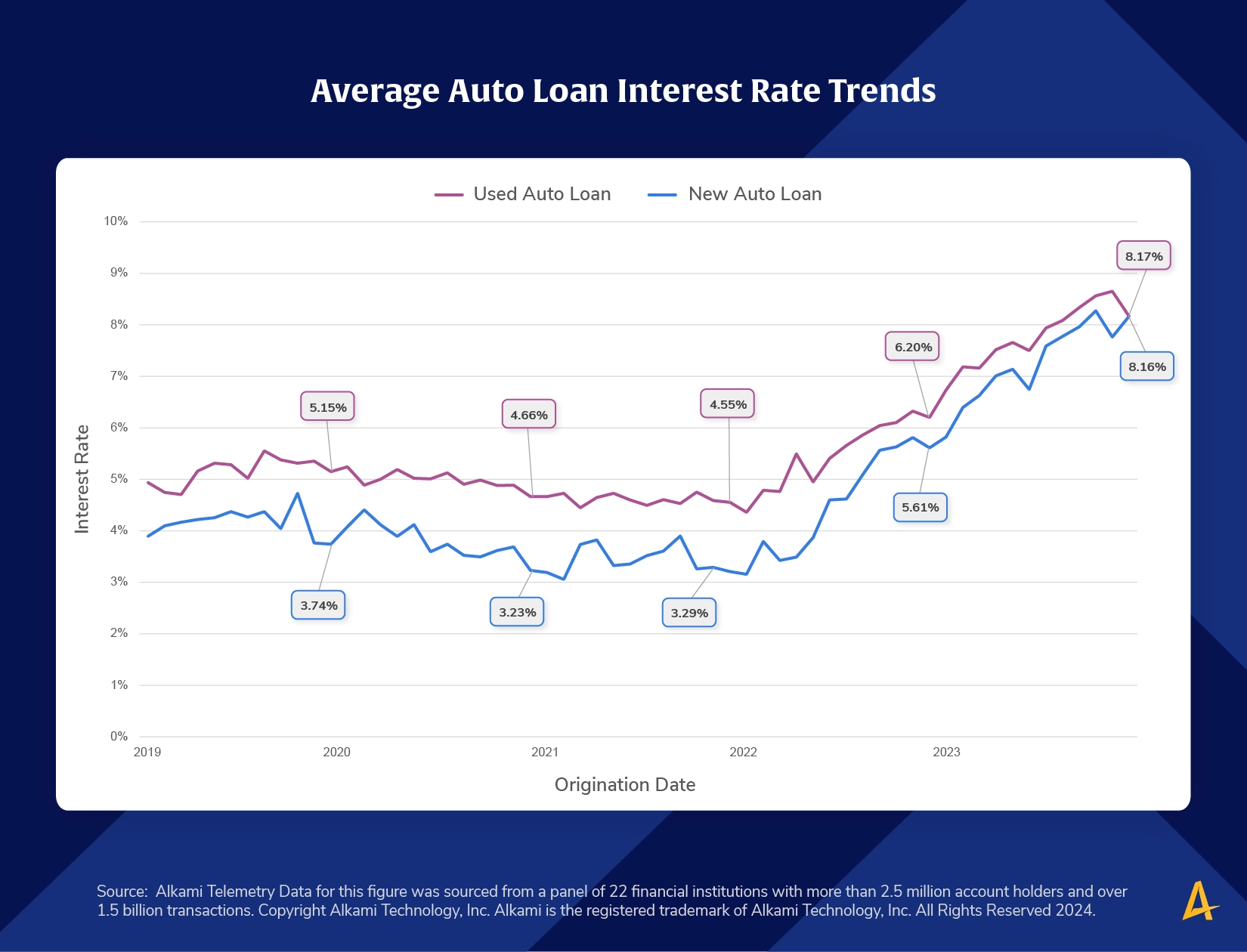

Interest rates have trended upwards in the automobile loan market since early 2022, following a three-year period where average interest rates had declined. Those who purchased a vehicle with financing at the end of 2023 are paying an average interest rate of 8 percent. Interestingly, the gap between the interest rate for new vehicle financing versus used vehicle financing converged at the end of 2023. Typically, used auto financing has a higher interest rate. Note, this data shows the average interest rate for auto loans that originated, not the interest rates that are advertised. This may mean that lower credit-worthy individuals are buying more new cars, thus driving up the average interest rate for new car buyers or that more higher credit-worthy individuals are buying used cars, thus driving down the average interest rate for used car loans (or both!). Regardless, the average cost to finance a vehicle has increased for American consumers.

Higher auto loan interest rates are putting pressure on consumer budgets. If interest rates decline, financial institutions should be prepared to offer lower rate refinances to provide consumers with some relief. This can be a particularly effective strategy to convert indirect relationships. Consider offering an additional auto loan rate discount if an indirect opens a checking account and adds a direct deposit.