Buy now pay later (BNPL) providers offer consumers the ability to finance a purchase, typically at the point of sale at many online retailers, while making interest-free payments over a short period of time. BNPL is attractive to consumers and is a convenient source of short-term financing. However, as the Office of the Comptroller of the Currency points out in a recent bulletin about BNPL risks, BNPL “borrowers could overextend themselves or may not fully understand BNPL loan repayment obligations.” With some consumers stressed by higher prices, this risk makes BNPL an emerging financial services product to watch.

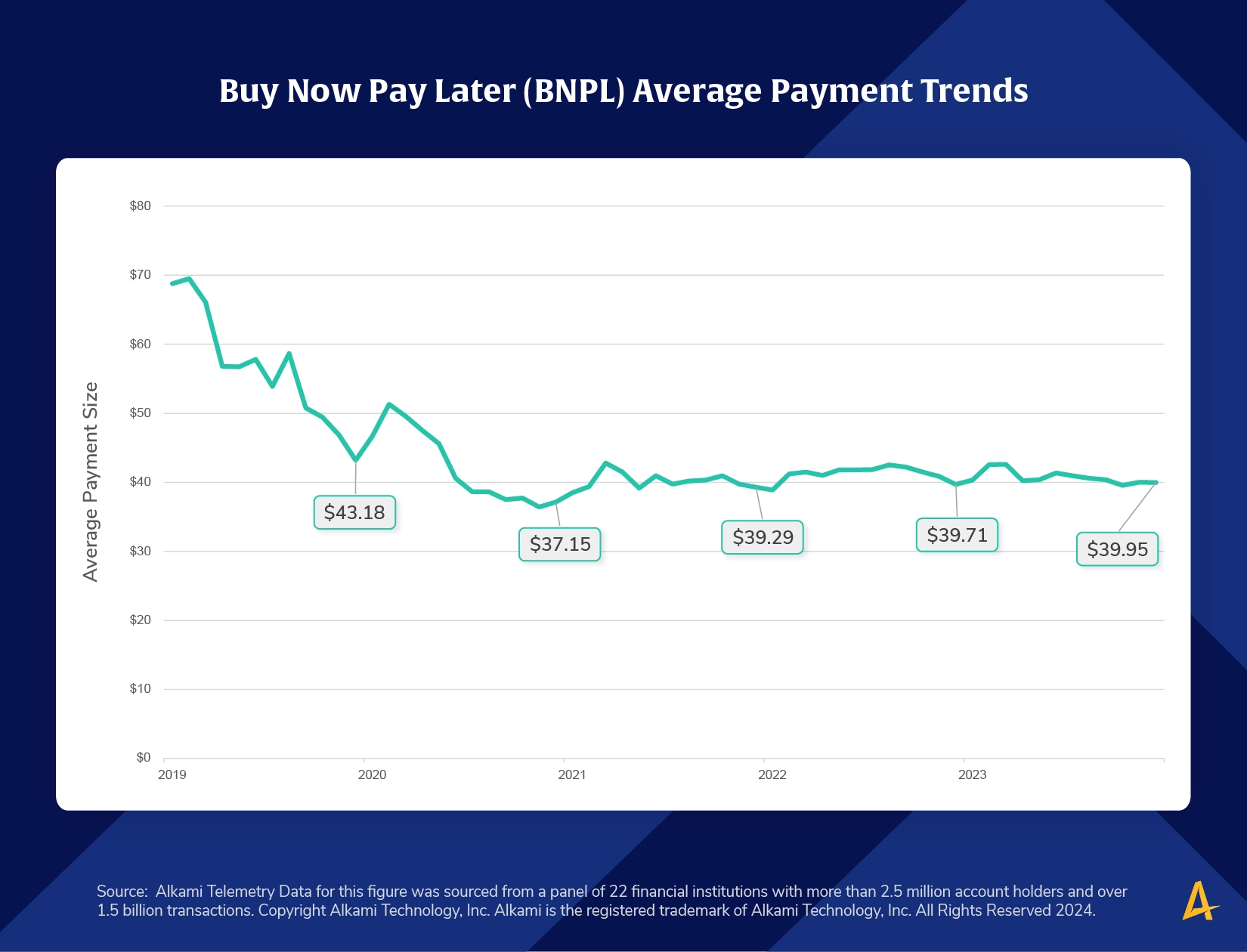

The way consumers use BNPL continues to evolve. This week our chart shows the monthly trend of average transaction size to BNPL providers. The average BNPL payment has decreased by 46 percent, from $68.78 in January 2019 to $37.15 in December 2020, a level that has remained fairly consistent since. The data suggests that consumers have become more comfortable with using BNPL for lower-value purchases.

BNPL is a new version of traditional retail finance. An average payment of around $40 suggests that some account holders are using BNPL to finance smaller everyday purchases, which may lead to financial stress. Financial institutions can position themselves as a trusted partner for financial advice; Educating account holders about budgeting and spending best practices can help foster financial wellness.