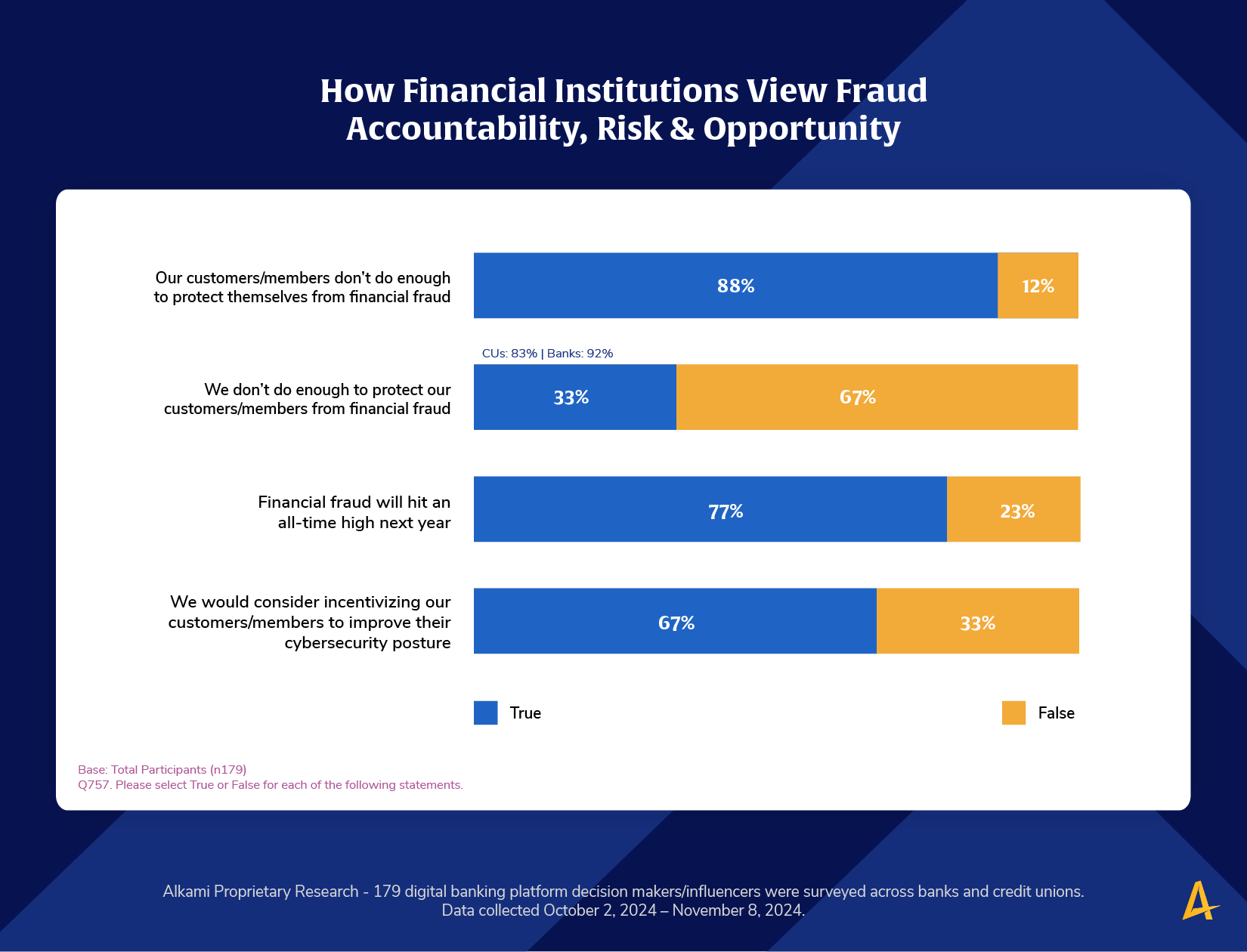

What we’re seeing:

Alkami Research conducted a study with a diverse set of financial institutions and found that banks and credit unions largely believe that their customers and members do not do enough to protect themselves from fraud (88 percent agree). However, there is a gap in self-accountability—33 percent of financial institutions acknowledge that there may be an opportunity for their institution to do more to safeguard account holders from evolving fraud tactics. Additionally, 77 percent of financial institutions expect financial fraud to hit an all-time high in the next year. To maintain institutional reputation and protect account holders, financial institutions need to determine a multi-layered approach to defend customers and members from fraud threats. A significant percentage (67 percent) of banks and credit unions are open to incentivizing account holders to improve their cybersecurity practices – informing digital banking users about emerging fraud schemes and techniques to combat attempts.

Takeaway and Call-to-Action:

In 2023, U.S. fraud and identity theft accounted for over $10 billion in losses. While financial institutions take significant steps to prevent it, there remains an opportunity to further engage customers and members in fraud prevention efforts. Financial institutions should adopt proactive measures, such as real-time fraud detection, educational initiatives, and incentives that encourage better security habits among account holders. By fostering a collaborative approach to fraud prevention, financial institutions can strengthen trust and reduce risk for both their organizations and their customers or members.

Discover how your institution can develop a multi-layered security strategy.