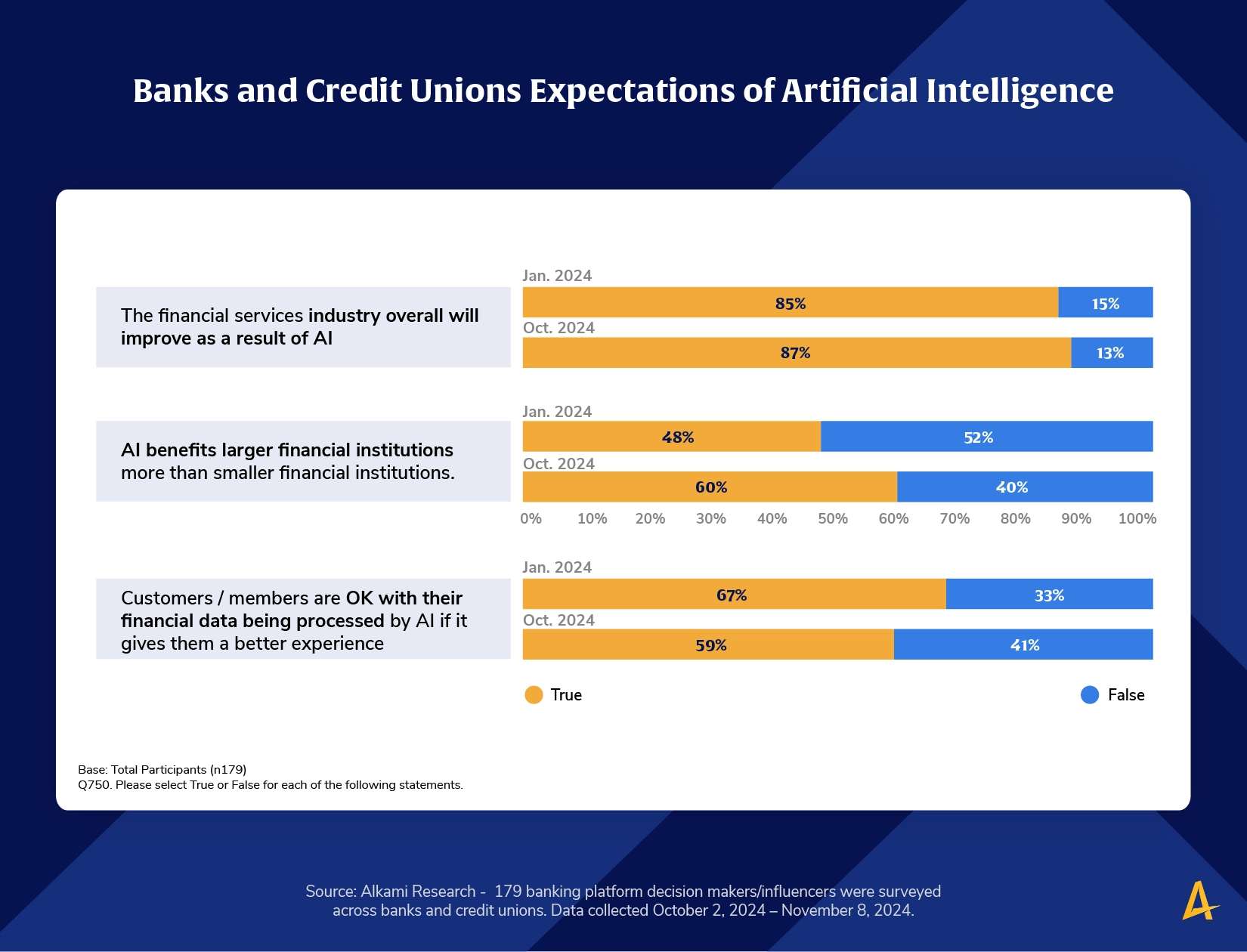

Alkami Research conducted a study that surveyed bank and credit union banking platform decision makers/influencers to explore their digital banking provider perceptions and experience. Within the survey, conducted twice in 2024 to measure changes in perceptions, respondents were asked to answer true or false questions about their expectations of artificial intelligence (AI) and the benefits it can deliver.

Comparing survey responses from January 2024 to October 2024 on the sentiment of AI, the research revealed a 12-point increase in financial institutions that believe AI benefits larger financial institutions more than smaller institutions. This perception may be tied to the sentiment that regional community financial institutions are somewhat optimistic about their AI-driven future, but they recognize a significant gap in their current capabilities when compared to larger entities.

When asked about whether they believed their members and customers were comfortable with their financial data being processed by AI for the purposes of providing them with better experiences, fewer institutions believed that to be true in October than in January.

However, when asked if it was true or false that the financial services industry would improve as a result of AI’s use, an already overwhelming majority (85% responding True in January) increased further to 87% in October.

One way to look at the results from this survey is to refer back to the Application and Consumer Perception of Artificial Intelligence in Banking study conducted in the middle of the same year as the above survey. In this research, Alkami conducted surveys of financial institutions as well as digital banking users to learn more about the perceptions of this technology. What we found was that while 96% of financial institutions foresee AI playing a critical role in the next five years, only 61% of consumers expect AI to significantly influence their banking interactions.

“There is a disparity that underscores a broader dialogue within digital banking about AI, which involves managing expectations and fostering trust as much as it pertains to technological advancement,” the study states in its introduction.

Learn more about the perceptions and common use cases for artificial intelligence in banking, here.