Account holders who use saving features associated with fintech budgeting apps tend to move smaller amounts of money into savings, in contrast with the high-interest rate Apple Savings, where account holders moved larger amounts. While fintech budgeting apps savings accounts may be non-interest bearing, they can be attractive to account holders who wish to contribute money at regular intervals to build a small nest egg.

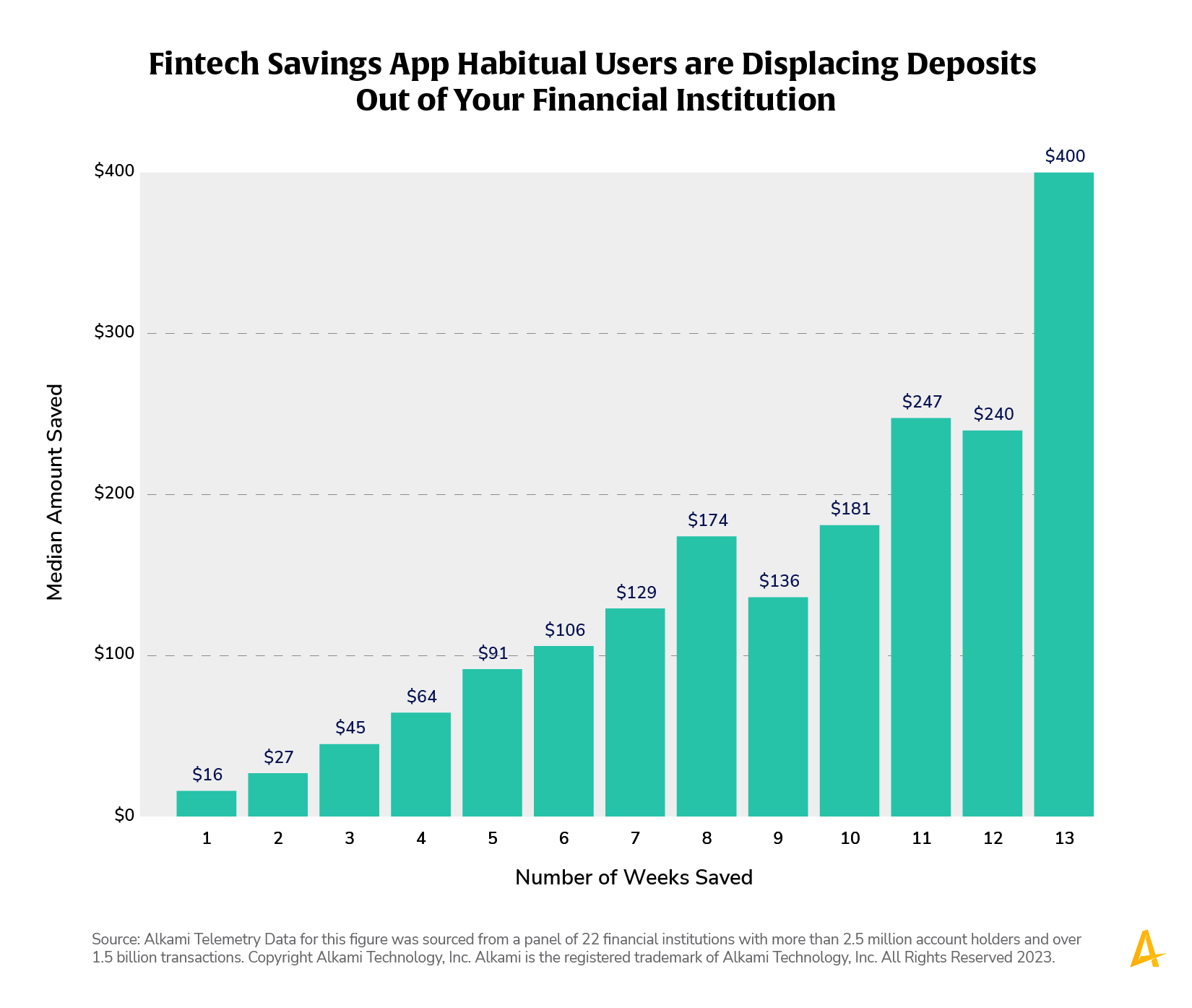

Fintech/budgeting app savings behavior over 13 weeks examines the relationship between consistency of saving behavior and overall savings. Consistent savers saved much larger amounts over time. For example, among those who transferred to savings in only 1 out of 13 weeks, the median amount was only $16. By contrast, among those who transferred to savings in 13 out of 13 weeks, the median amount saved was $400. While we might expect consistent savers to save more, note that the $400 implies that consistent savers saved $31 per week on average, nearly twice the $16.

The standard recommendation is that a consumer has three to six months worth of basic expenses covered in a savings account. While that may be steep for some, encouraging account holders to save every week, even if a small amount, and a little more when they can, may help them build financial wellness and a tenured relationship. Financial institution’s can engage with account holders providing financial education, savings advice and wealth building options. Analytics derived from transaction data can give a financial institution a targeted audience of both savers and non-savers, and provide the intel to message them with the right products and services.

Source: Alkami Telemetry Data for this figure was sourced from a panel of 22 financial institutions with more than 2.5 million account holders and over 1.5 billion transactions.