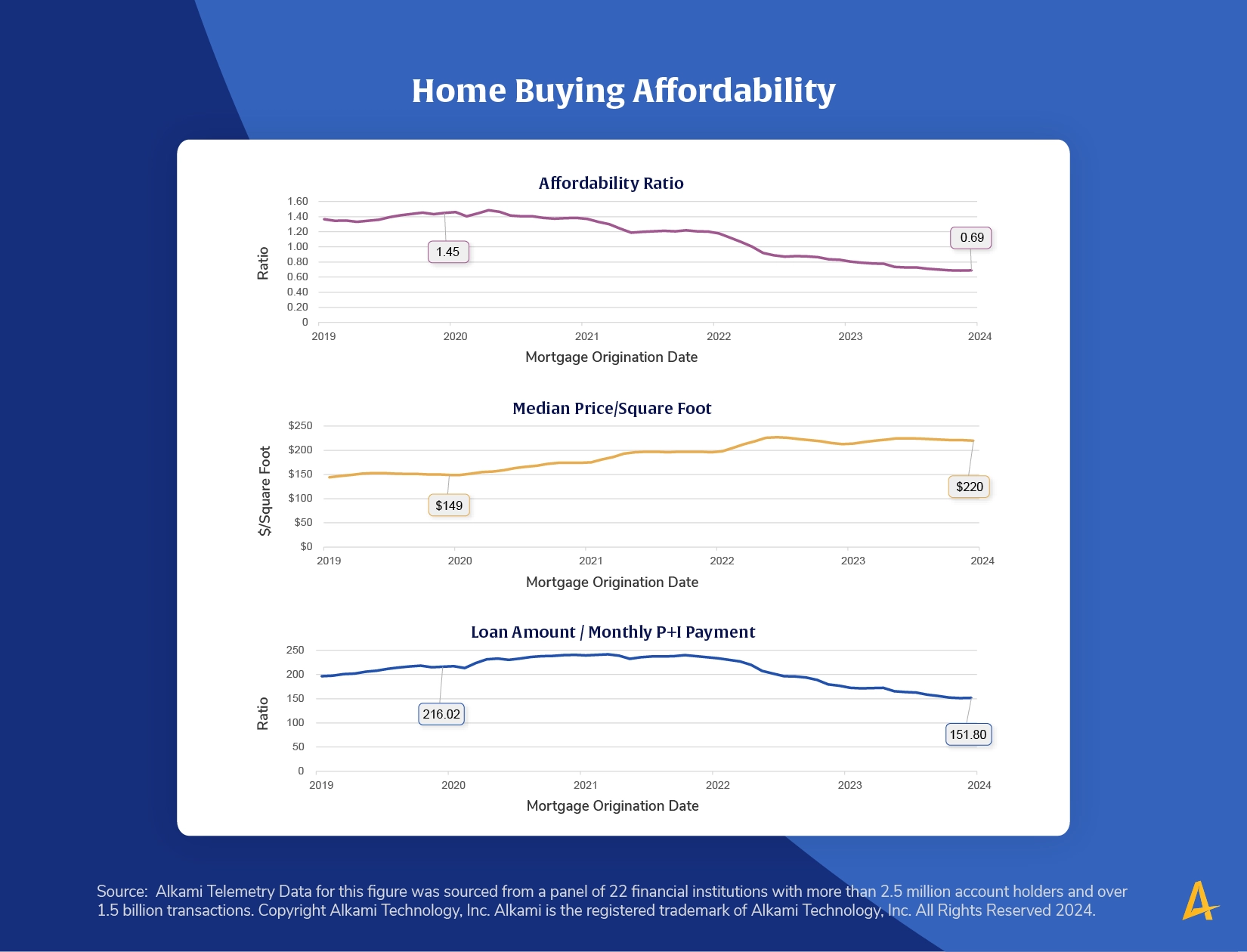

The double whammy of higher home prices combined with rising interest rates has had a large impact in consumer purchasing power. In the top panel in the above chart, Alkami Telemetry Data shows the ratio of loan amount to monthly principal and interest (P&I) payment decreasing by 29.7% from December 2019 to December 2023. This is the interest rate effect which means for the same monthly payment, a consumer can borrow less money today than they could in 2019.

The middle panel in the above chart shows the median price per square foot as reported by Realtor.com data to the St. Louis Fed. In December of 2019, a square foot cost $149. In December of 2023, this cost had increased by 47.6% to $220.

Finally, the bottom panel of the above chart shows the combined impact of both trends. The same monthly payment amount gets a home buyer 52% fewer square feet in December 2023 than it would have at the end of 2019, effectively cutting the buyer’s purchasing power in half over four years.

Download the 2024 Alkami Telemetry Report, The High Interest Rate Environment and its Impact on Consumers and Financial Institutions to read more insights about how the housing market is impacted by high interest rates.