OnDeck Capital is a digital first business lender offering quick access to funds to help a business grow. This organization offers term loans and lines of credit. Repayments are automatically deducted on a daily, weekly, or monthly basis. OnDeck offers a quick loan application and fast access to funds, up to $250k.

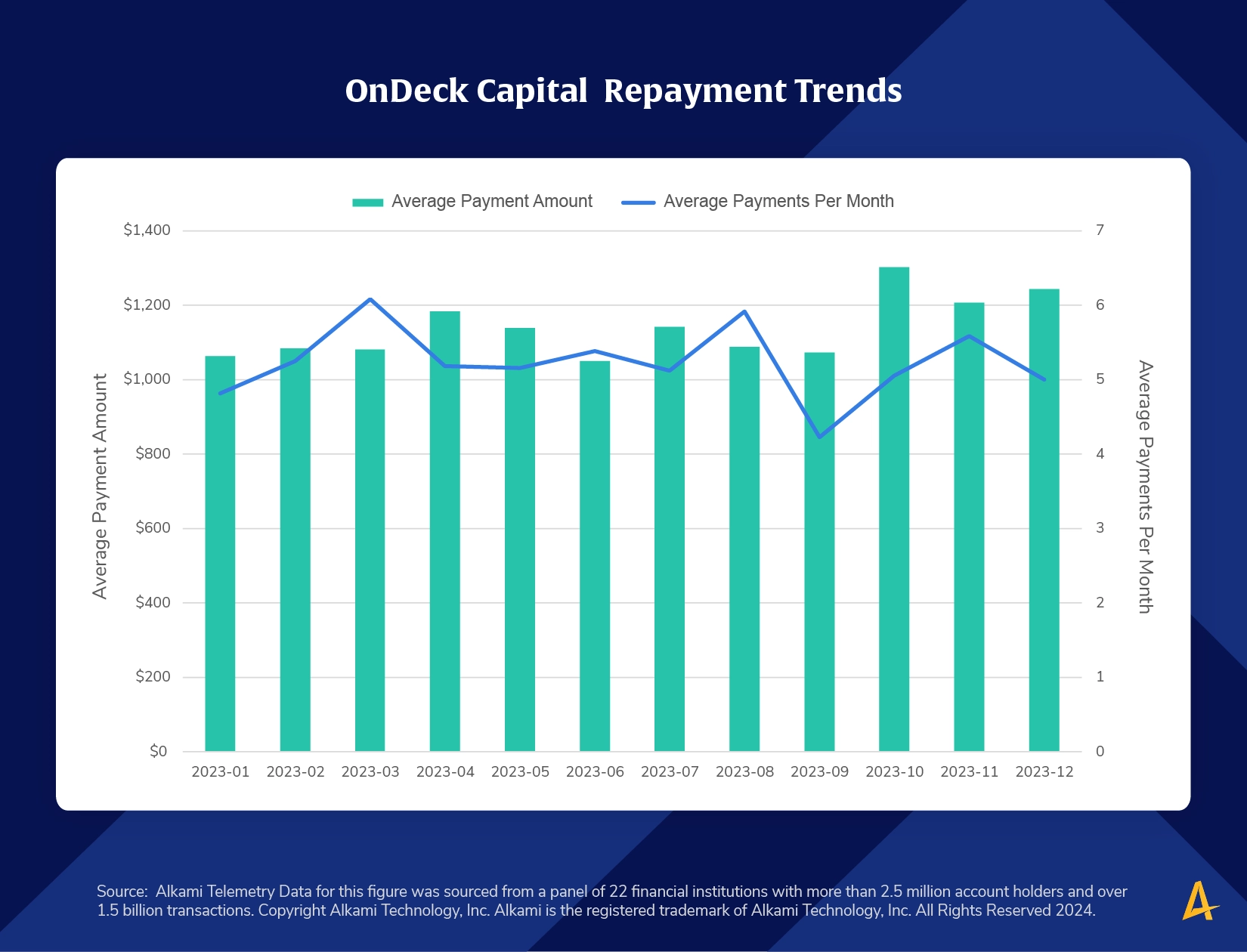

In 2023, the average payment to Ondeck Capital was $1,134 and the average Ondeck Capital Borrower made 5.23 of these payments each month.

Banks and credit unions that mine their core data for OnDeck Capital payments can create an engagement plan to serve these business accounts with products from their own financial institution. Some of these businesses may benefit from a traditional monthly repayment plan instead of the more frequent OnDeck Capital payment deductions. Financial institutions may be able to save business account holders money by refinancing the loan to a more attractive rate.