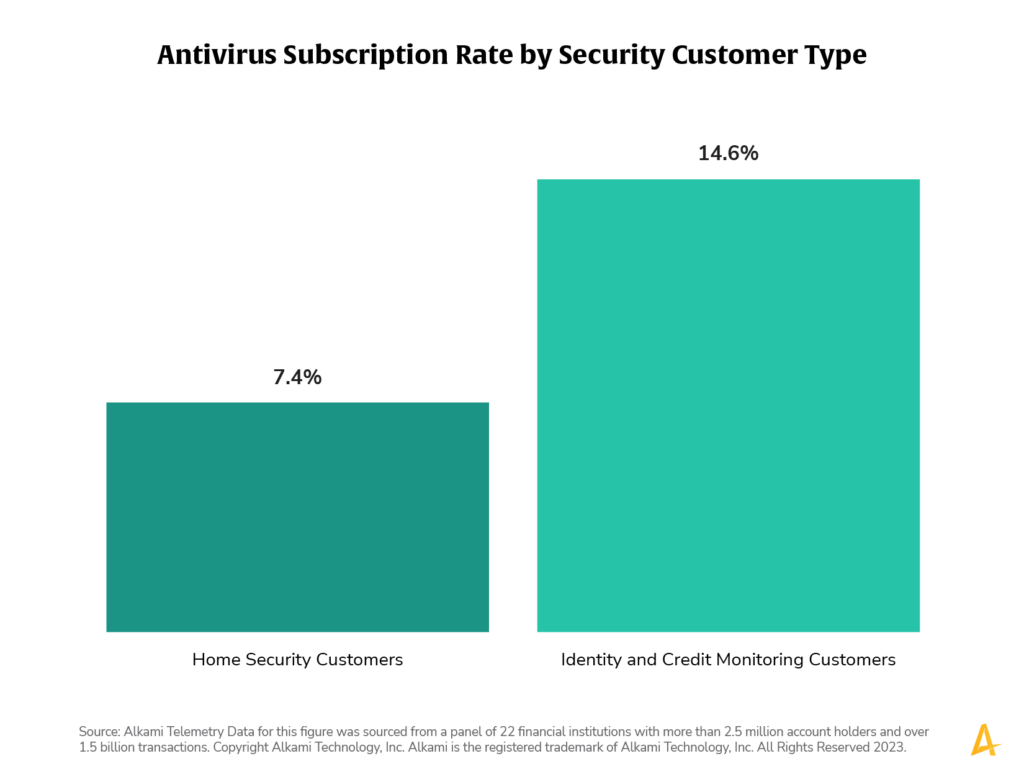

Analysis of transaction data for security products reveals two interesting cohorts.

Cohort 1: Among those who pay for Home Security systems, only 7.4 percent also pay for antivirus software.

Cohort 2: In contrast, 14.6 percent of those who have identity monitoring or credit monitoring also pay for antivirus software.

You might have thought that all security-minded account holders are the same, but digital security and physical security are different priorities and an account holder might be risk averse in one area and not as risk averse in another.

Transaction data can illuminate personas and preferences within your account holder base. Digitally Secure and Physically Secure are two separate personas to consider. Those paying for identity or credit monitoring services are twice as likely to also pay for antivirus software as compared to those paying for home security monitoring services. An account holder’s spending behavior can help you identify both.

To gain new account holders, use Customer Insights and Marketing Automation to target advertising to the generation most likely to prioritize either physical or digital security. Then, look at existing account holders and build a target audience for Digitally Secure users and educate and excite them about the institution’s credit monitoring and identity protection services. Third, examine the Physically Secure user audience closely; these users could be interested in your insurance products. Create loyalty by rewarding them additional debit or credit points for spending on their preferred home security products.

SourceAlkami Telemetry Data for this figure was sourced from a panel of 22 financial institutions with more than 2.5 million account holders and over 1.5 billion transactions.