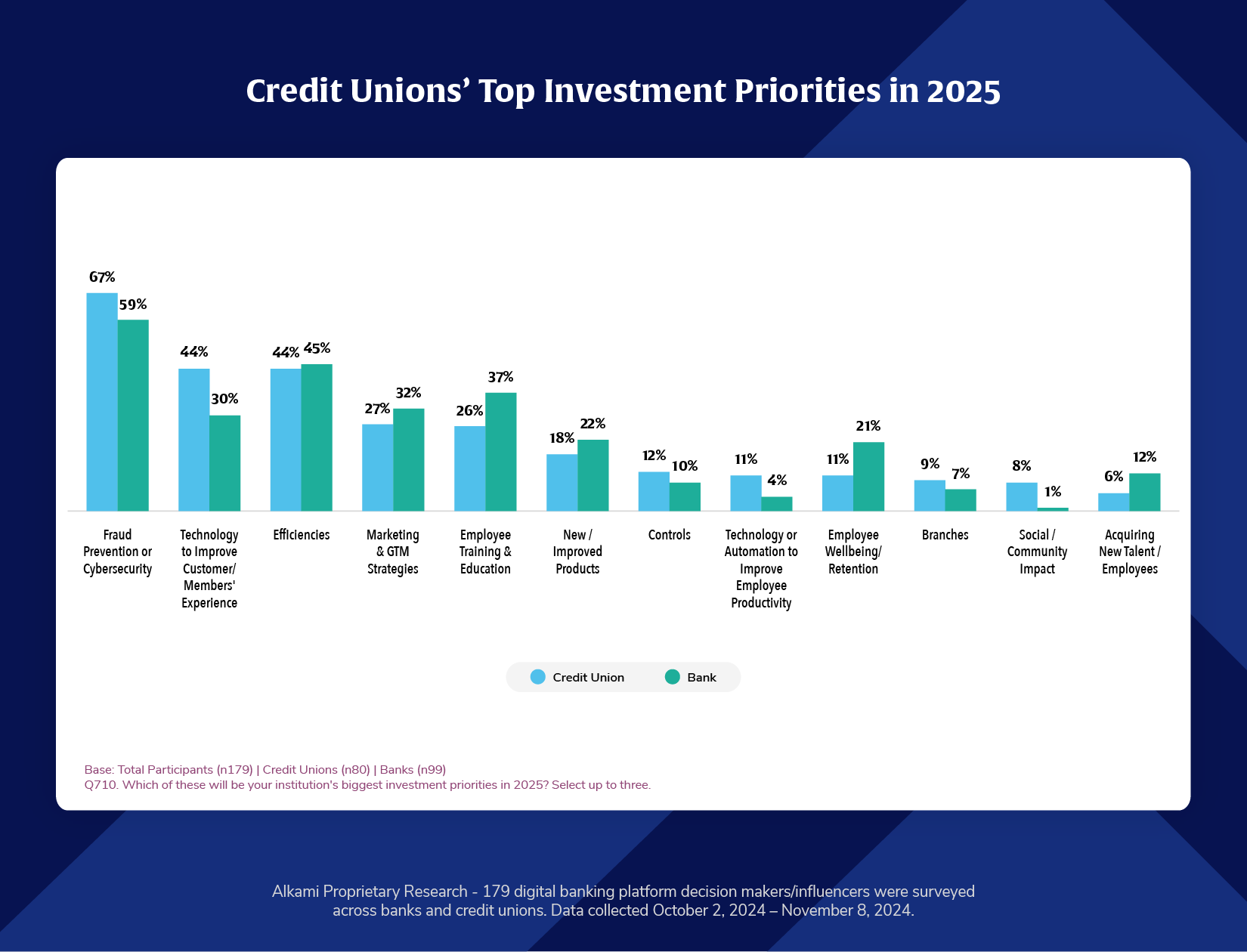

Alkami Research conducted a study and found that the priorities for technology investments in 2025 first starts with fraud prevention or cybersecurity. This is a positive trend, as it means that credit unions plan to deliver on the most sought after digital banking experience that users are looking for in 2025.

The next top priority for credit unions will be investments into ways which improve on member experience, followed by back office efficiencies. In contrast, this analysis also shows how banks are prioritizing operational efficiencies and training employees over additional investments into user experience improvements.

Both banks and credit unions seem to be aligned with fraud prevention being a top investment priority. While on the surface it may seem that credit unions and banks are not aligned in other key areas, perhaps the focus is a reflection of strategic initiatives. For example, a better trained front line staff, for example, could be part of an overall strategy to provide a higher level of user experience in an offline setting.