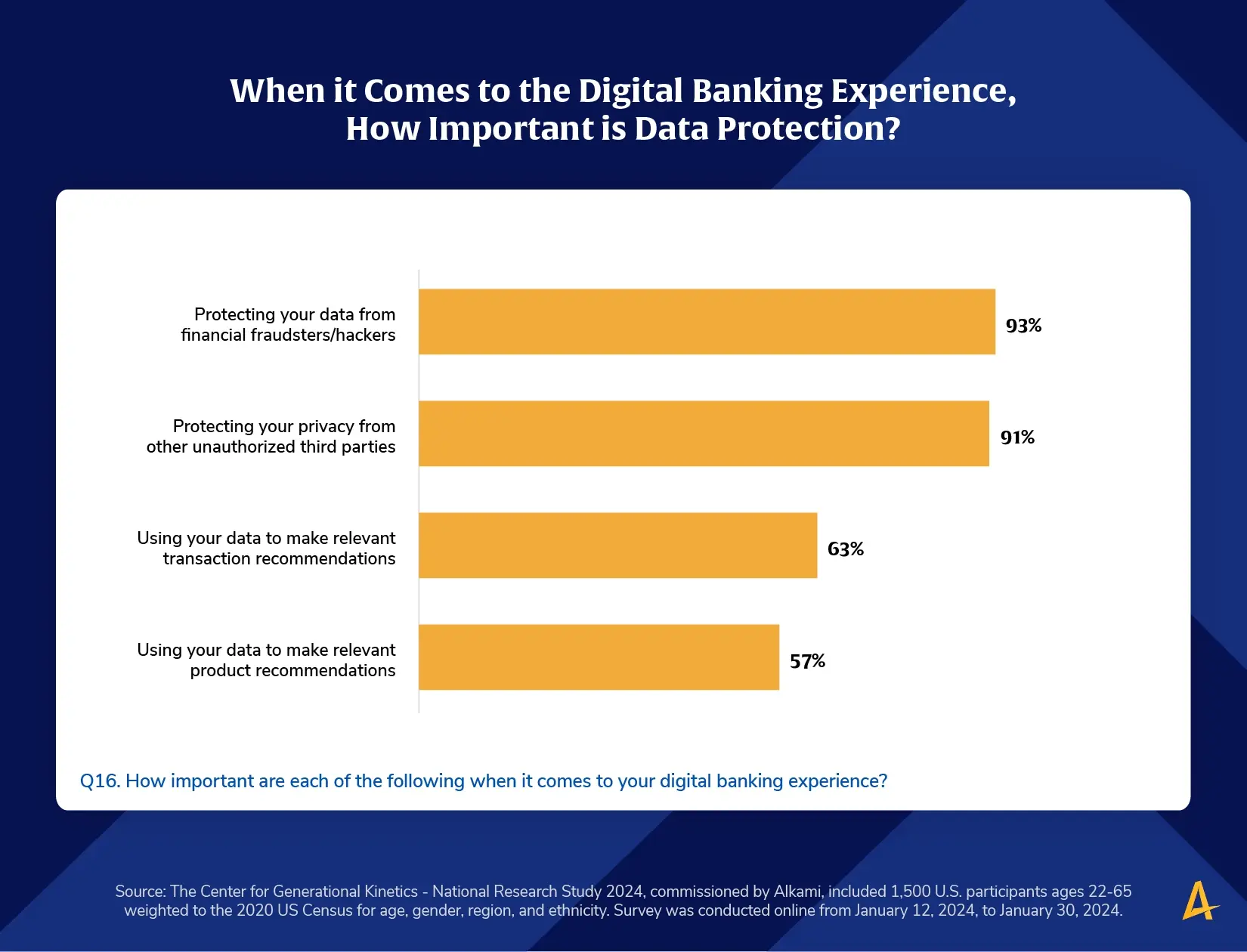

In the 2024 research study conducted by The Center for Generational Kinetics to support Alkami’s The Generational Trends in Digital Banking Study, when asked how important data protection is to the digital banking experience, 93 percent of respondents (in total across all generations) indicated that protecting data from financial fraudsters and hackers was important or very important to them. Also in the same section of the survey, 91 percent of respondents indicated that protecting data from other unauthorized third parties was important or very important to them.*

In comparison, when provided with additional questions, how important is using your data to make relevant transaction recommendations (such as such as informing you what debt payments should be prioritized to minimize interest payments) and how important is using your data to make relevant product recommendations (such as the perfect card, loan, or investment account), respondents were significantly less likely to indicate that those were very important or important to them.

Digital banking Americans are aware of the increased threat environment in which they live, and they are looking to their financial services provider to protect them. Financial institutions should take these survey responses as a directive to prioritize delivering strong, multi-layered security and fraud measures to their customers and members.

Already offering these protections to your account holders? For existing accounts, this will be a welcome reminder via your communication channels of why they do business with you. For potential accounts, this could be a reason to convince them to switch to your institution.

*These findings have not been previously published.