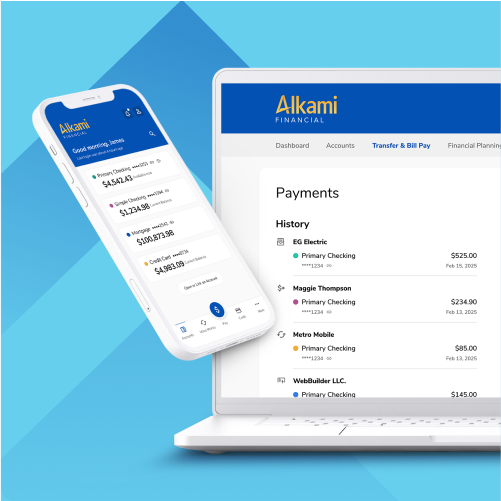

Data & Marketing

Drive ROI with personalized marketing

You already know your account holders. We help you anticipate what’s next—combining data insights, predictive intelligence, and built-in tools to deliver smarter, faster, more relevant engagement.