That’s a wrap on 2024! Before we embark on the next chapter in 2025, we wanted to celebrate the many highlights from this year. We are incredibly proud and humbled to serve the fastest-growing banks and credit unions in the United States with our digital banking solutions, positive pay & ACH reporting, and data & marketing solutions. We sincerely appreciate each and every partnership. Alkami’s success can only be attributed to our remarkable customers who encourage us to be the best partner we can be, inspire forward-thinking, and are incredibly dedicated to delivering their customers and members solutions that foster meaningful connections. It is truly an honor to be a part of your story.

2024 has been filled with terrific milestones that have allowed us to empower our customers with a best-in-class user experience, confidence, improved processes and technology, industry insights, and of course, innovation. Let’s look back at some of the moments that have defined our year.

We saw incredible collaboration and growth with our clients. As of our third quarter earnings call, we achieved new heights:

To honor the impact our customers have in their local communities, we launched a video series showcasing their stories.

The success stories didn’t stop there. We also celebrated our customers’ leadership and innovation by featuring them on the FIsionaries podcast with fintech influencer, Jim Marous.

This year’s guests included:

Throughout these episodes, our customers shared their inspiring stories of digital transformation, community impact, and growth.

We were blown away this year to discover we surpassed all digital banking providers to become #1 in credit union market share. FI Navigator data revealed that credit unions on Alkami’s digital banking platform outperformed their peers in deposit, loan, and revenue growth from January 1, 2020 to June 30, 2024.

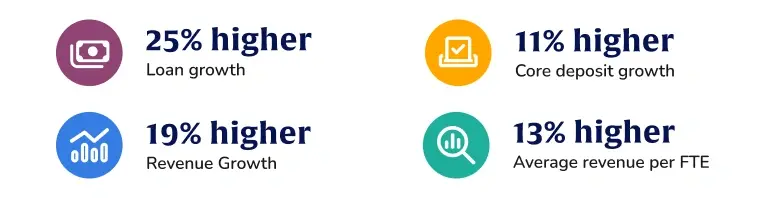

According to 2024 FI Navigator Data, Alkami clients who have been on the online banking platform for 5+ years outperform their peers on major financial metrics: 25% higher loan growth, 11% higher core deposit growth, 19% higher revenue growth, and 13% higher average revenue per full time employee.

There’s something special about our client community. Not only are these financial institutions making an incredible impact on their account holders’ lives, but they have built vibrant connections with one another both in-person and online. To commemorate their constant collaboration, we launched a community portal, the Alkami Community, where they can engage in user groups, connect with peers, find product guides and roadmap information, attend events, and more.

It was a big year for our Product team. User experience has always been treated as a discipline at Alkami, and our scientific approach and culture of continuous innovation paid off. In July, Alkami was certified by J.D. Power for providing “An Outstanding Mobile Banking Platform Experience” for clients based on successful completion of an audit and exceeding a customer experience benchmark through a survey of recent servicing interactions. That achievement set the pace for a very exciting season ahead!

We welcomed a new member to our executive leadership team, Gagan Kanjlia, Alkami’s chief product officer. His wealth of experience stems from over twenty-five years developing and commercializing products for some of the most prominent financial institutions and fintechs in the country.

“Gagan brings an entrepreneurial mindset with the proven ability to develop, commercialize, and scale market-leading products in the financial sector. His rich background in working for leading financial institutions and fintechs will benefit Alkami’s customers, as he intimately understands their opportunities and challenges having walked in their shoes.”

– Alex Shootman, chief executive officer of Alkami

As we rolled out new features and enhancements throughout the years, we focused our efforts across all lines of business.

Our digital banking investments spanned data analytics in banking, payments, business banking solutions, fraud prevention, and more. We’ve introduced instant payments for account-to-account (A2A) transfers via the RTP and FedNow payment rails to provide users with real-time transaction capabilities, as well as partnered with SWIVEL for flexible loan payments.

To further support consumers in their financial journey, we expanded our partnership with SavvyMoney to enable financial institutions to easily auto-enroll users in credit score monitoring upon digital banking login or registration, driving adoption and enabling financial institution teams to better support account holders and cross-sell products.

For business users, we enhanced the Business Analytics Widget developed via our partnership with Uptiq, formerly known as upSWOT. This widget delivers actionable insights across key business functions, like marketing and accounting, enabling clearer decision-making without data overload. We’ve also simplified access for business banking users with Login Grouping, allowing seamless, unified access to multiple accounts while maintaining security controls.

Additionally, our new Business Transaction Limit Management feature lets business users request transaction limit increases directly within the platform, streamlining high-value transfers with a secure, audit-ready approval process.

While we focus on delivering exceptional experiences to digital banking users, we also recognize the importance of strengthening back-office operations. To that end, we’ve enhanced the digital customer service experience with Glia’s third-party messaging, agent automation, and AI-driven insights to help managers understand team performance and make strategic operational decisions based on support trends.

Additionally, we’ve enabled financial institution teams with a User Recent Activity Widget located within the Admin console to provide a central view of all activity data in near real time for call centers, fraud researchers, and other use cases.

To support financial institutions in finding the right data and marketing solutions for their needs, we launched a 4-question tool that evaluates an institution’s current operations and their goals to recommend a plan aligned to their objectives. For current customers, we’ve expanded our behavioral data tags to provide deeper insights into account holders’ behaviors and digital banking activity – credit score, aggregated accounts, anniversaries, and outbound transfers – empowering banks and credit unions to deliver targeted offers.

These advancements fueled increased adoption of Alkami’s Data & Marketing Solutions as demand for personalization surged, enabling financial institutions to enhance acquisition, retention, and engagement while positioning themselves as data-informed digital bankers. According to our third quarter earnings call, over 70% of financial institutions implementing Alkami have added Data & Marketing Solutions to their digital banking technology portfolio.

While fraud tactics continue to evolve, some things just don’t change. A 2024 AFP report found that 65% of organizations have reported check fraud; making it the payment method most prone to attacks. To combat this alarming trend, Alkami’s Positive Pay & ACH Reporting enables financial institutions to detect and prevent unauthorized ACH and check payments by sending alerts for quick authorization of transactions.

Alkami continues to innovate with purpose, ensuring our customers can drive adoption of Check and ACH Positive Pay to deliver secure, personalized, and intuitive digital experiences to their account holders. This year, we introduced the Positive Pay Marketing Toolkit, designed to help financial institutions boost adoption rates by equipping them with ready-to-use marketing resources and training materials.

This toolkit empowers internal teams to effectively promote Positive Pay to both new and existing business accounts, simplifying the process of securing check and ACH payments. By combining these efforts with our advanced security features, Alkami enables institutions to build stronger relationships with their business accounts while protecting against fraud.

Another first-to-market milestone, Alkami and Plaid joined forces to provide financial institutions direct access to Plaid’s platform through the Financial Data Exchange (FDX)-aligned API Core Exchange. This partnership empowers banks and credit unions with seamless and secure data-sharing capabilities, improving the digital banking experience for account holders.

By leveraging the FDX API standard, the integration ensures enhanced data privacy and streamlined connectivity for users accessing third-party financial tools as the industry moves toward open banking adoption.

Following Alkami’s Chief Technology Officer Deep Varma’s developer-first mindset, we launched our SDK Wizard to empower financial institutions to download and install our software development kit to create custom digital banking functionality on the platform that suits their specific business and account holder needs.

Leading with our TechFin mentality, we hosted two hackathons this year – one for our customers at Alkami Co:lab, our annual conference, and another for our Alkamists at Alkami HQ.

You may have noticed, we have an affinity for research reports. We are passionate about understanding what’s happening in the industry, at financial institutions, about emerging technology, and trends among consumers and businesses.

Retail Digital Sales & Service Maturity Model

Interesting Finding: Organization size does not solely determine digital maturity. 25% of digitally mature FIs have less than $500 million in assets.

Business Banking Digital Maturity Model

Interesting Finding: The most digitally mature organizations generate 10x more average annual revenue growth than their peers.

The 2024 Digital Banking Performance Metrics Report

Interesting Finding: Digital spending per $1 billion in financial institution assets has quadrupled over the past two years.

Artificial Intelligence in Banking: Top Use Cases Revealed

Interesting Finding: 51% of millennials are comfortable with AI enhancing their banking experience.

Generational Trends in Digital Banking Study

Interesting Finding: Millennials are 56% more likely to grow their relationship with their primary financial institution over the next twelve months than Gen Xers and baby boomers.

The High Interest Rate Environment and its Impact on Consumers and Financial Institutions

Interesting Finding: 67% of digital banking Americans say the rising interest rate environment has had a significant impact on their standard of living and 59% are living paycheck to paycheck.

By conducting market research, we are able to uncover actionable insights and partner with our customers to develop strategies that enable them to grow at scale, keep them relevant with account holders of different generations, and sharpen their competitive advantage as new innovations hit the scene and impact consumers and businesses’ expectations.

At Alkami, our company culture is at the heart of our operations and permeates across every team.

Championing Culture Along the Way

We pride ourselves by leading with these values and want to show up authentically in every interaction with our customers, prospects, partners, consultants, and industry connections.

It’s been an incredible journey this past year as we eclipsed new experiences at Alkami Co:lab, gave back to our local communities through the Alkami Cares Together (ACT) program, and grew our Women in Banking program with a newly launched user group and our first virtual event.

“Our Alkamists are passionate about giving back, and this year’s initiatives showcase the power of collective action. Together, we’re making a tangible difference in the lives of others. Partnering with these community organizations align with our mission to empower and uplift communities.”

– Julie Hoagland, chief human resources officer for Alkami

Alkami has made an impact on the following causes:

Thank you for being a part of our 2024 story.

We could not have done it without the support of our customers and the dedication of our Alkamists.

To another great year in 2025!