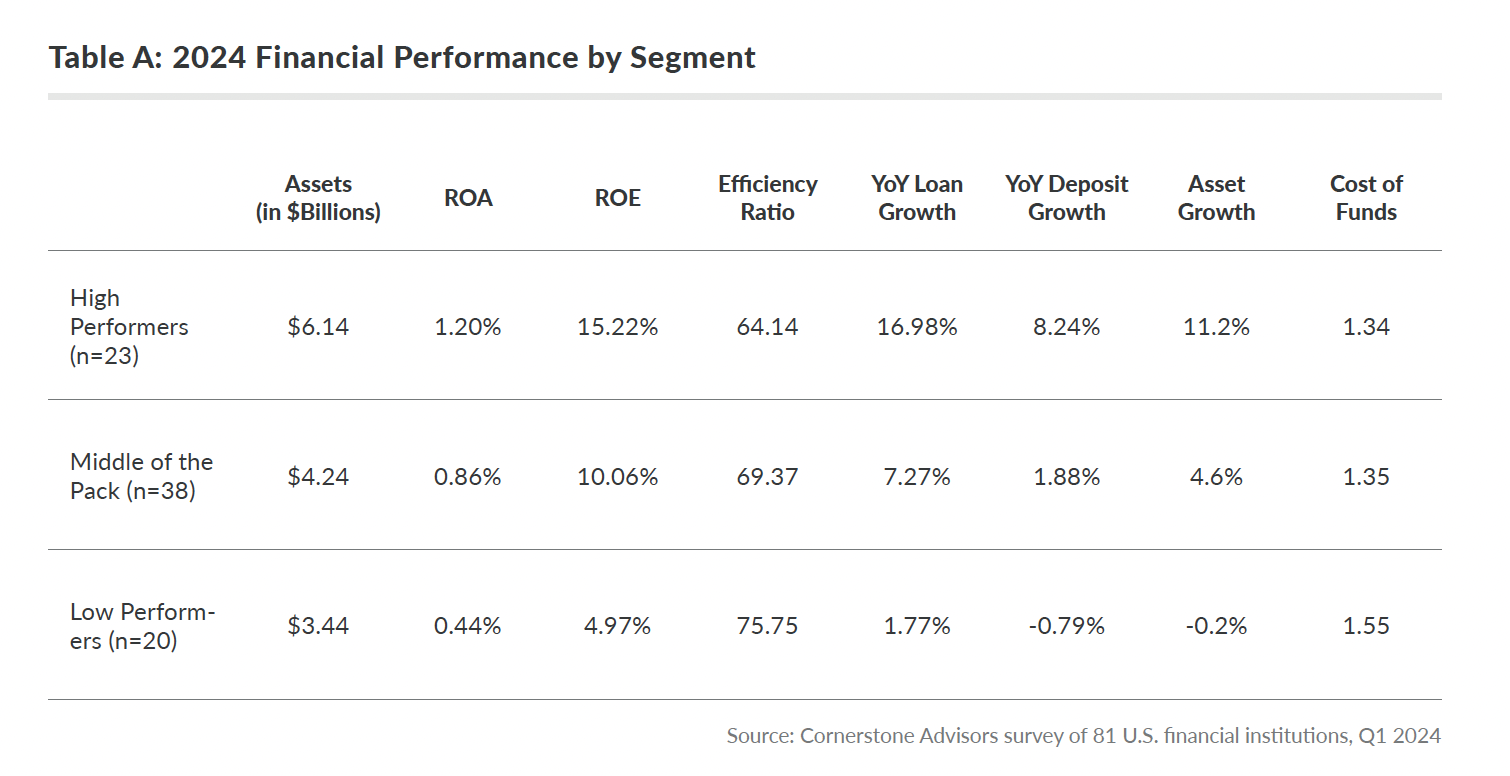

Performance by Institution Type: The report categorizes banks and credit unions into high, middle, and low performers based on various financial metrics such as return on assets (ROA) and efficiency ratios. It’s revealed that while stronger business results generally support better digital outcomes, the quality of digital initiatives is not solely dependent on financial performance.

Digital Spend Trends: There’s a notable increase in digital spending, with digital channel spending now representing 26% of total IT spend. This rise reflects the growing importance of digital strategies in overall business frameworks.

Digital Banking Solutions Utilization: Active digital banking users as a percentage of checking accounts increased year over year to 77% in 2024. However, even though the overall percentage of checking account holders who are active mobile banking users increased 1% between the 2023 and 2024 report, it’s an indication that utilization has slowed. As stated in the report, “A financial institution’s overall financial performance or investment into digital banking does not necessarily correlate with checking account holders who are also active mobile banking users.”

Mobile deposit adoption inched up year over year, from 52% in 2023 to 54% in 2024 – high performers were on top with 57% of active mobile deposit users as a percentage of active digital banking users.

Digital Account Opening: There are many financial institutions that are planning to deploy new digital account opening systems in 2024, and the numbers or account openings are showing the need. The troubling decline in the percentage of digital checking account openings dropped 3% to 16% of total in 2024. This could be due to delays in upgrading digital account opening applications or shifting demographic trends. The report suggests a disparity between planning and execution, particularly in digital account openings and technology upgrades, highlighting a possible need for better strategic alignment and resource allocation.

Payments Increasing: A select group of financial institutions reported mobile payments activity, and within that segment, the percentage of digital banking users making mobile payments on/or through their institution’s mobile app grew from 22% to 34%, year-over-year. P2P payments usage nearly doubled, which lends itself to the preference that consumers want the instant payment as well as convenience.

Emerging Technologies: Institutions are rapidly adopting technologies like APIs and robotic process automation, with machine learning and generative artificial intelligence (AI) also gaining traction. This trend underscores the sector’s push towards more sophisticated digital solutions. Currently, 42% of financial institutions have already deployed machine learning, and by the end of 2024, if technology plans stay on track, over half will have deployed the technology. By the end of next year, over half of financial institutions expect to have deployed generative AI in some form.

The engagement with advanced technologies like artificial intelligence in banking indicates a promising direction for enhancing customer service and operational efficiency, but also calls for careful integration into existing systems.

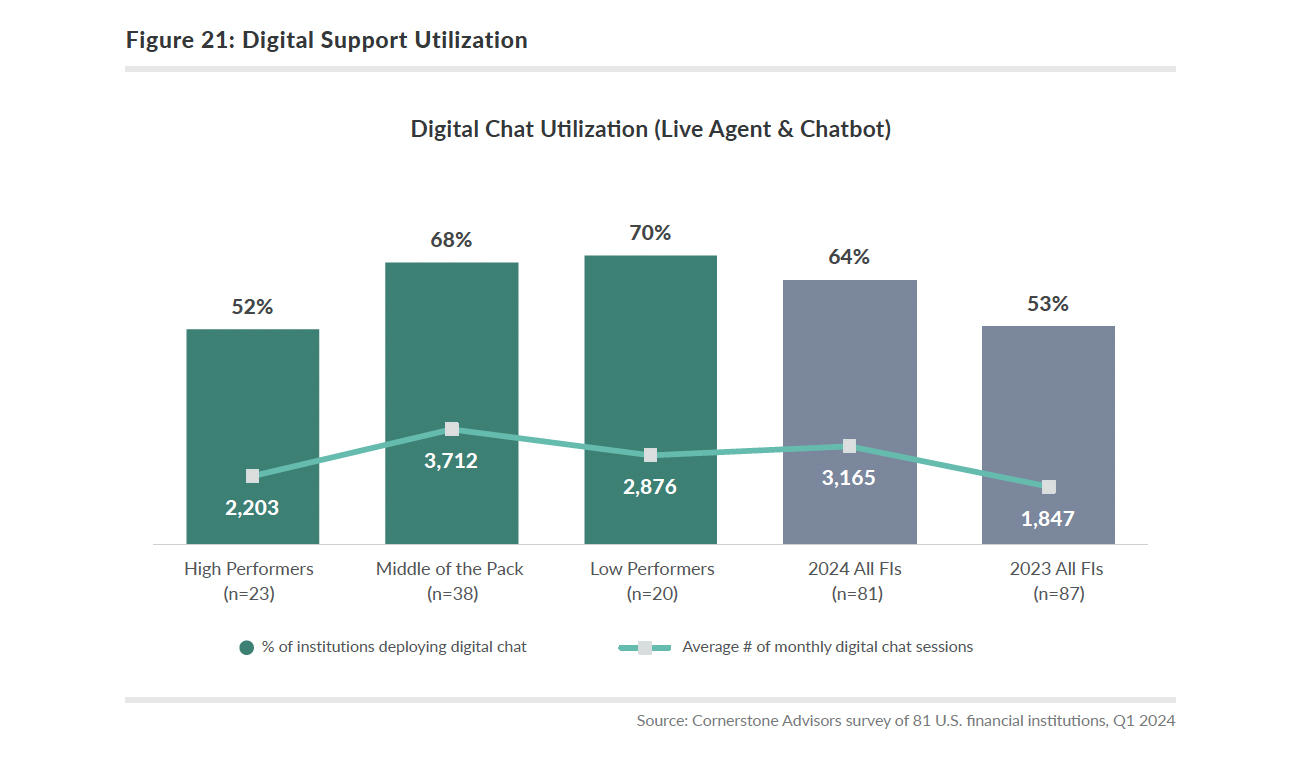

In the first iteration of this study in 2022, only 5% of participating institutions provided metrics for digital chat activity. In last year’s study, that percentage grew to a little more than half, and to 64% in this year’s report. The average number of monthly live agent and chatbot transactions also increased drastically, from 1,847 to 3,165 (Figure 21).

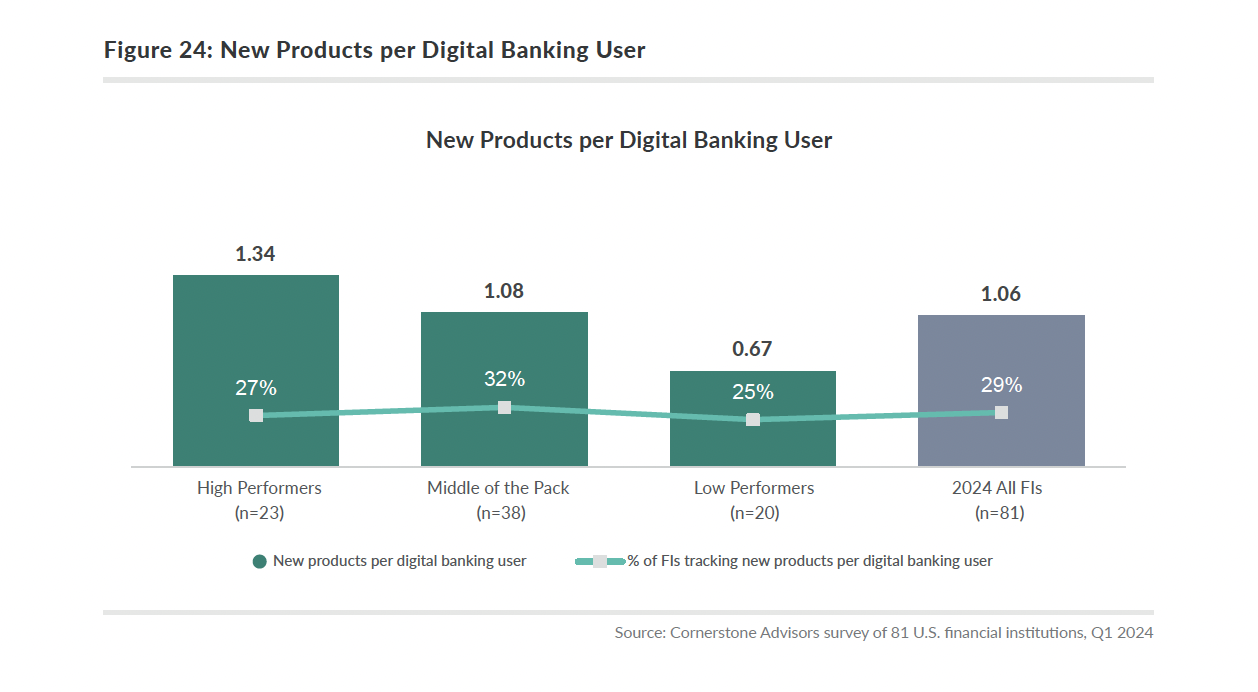

Cross Sell: High performers (of the ones that track this metric) grew their relationship with digital banking users by adding an average of 1.34 new products, 24% higher than middle-of-the-pack institutions and 100% higher than the low performers (Figure 24).

The 2024 Digital Banking Performance Metrics report offers valuable insights into the current state and trajectory of digital banking. Financial institutions must leverage these insights to refine their digital strategies, focusing on customer-centric innovations and efficient technology deployment. The ongoing shift towards more integrated and technologically advanced banking services not only responds to current consumer needs through personalized banking, but also sets the stage for future developments in the financial sector. Artificial intelligence in banking is one of those advancements that will continue to grow in popularity and require financial institutions to integrate with their digital banking platform in order to deliver the exceptional account holder experience that is expected.

With digital spending per $1 billion in assets otherwise quadrupling over the past two years per the report, and digital account openings showing low performance, the investment at these levels for digital technology can’t sustain. Financial institutions will have to strategically manage the demand for digital investment and the return based on consumer impact.

Most importantly, as referenced in this press release, “The future of banking lies with technology and understanding how it can further enhance the account holder experience and transform the organization,” said Shevlin. “Overall, the metrics in this report are intended to give financial institution executives perspective on the industry’s digital banking performance. Banks and credit unions should adopt a digital banking metric framework to ensure measurement aligns with strategy,” Shevlin continued.

Download the complete 2024 Digital Banking Performance Metrics Report