Stemming the tide of deposit leakage.

A healthy deposit inflow is the foundation of financial institutions. It provides the funding that financial institutions need to make loans, invest in securities, and provide other financial services. Without it, financial institutions can face declining liquidity and an eroding capital base, not to mention reputational damage, which exacerbates the problem by making it difficult to attract new deposits.

Recent news showcasing this play out publicly, combined with a rising rate environment, has brought deposit health into the spotlight, becoming a growing concern for financial institutions and their teams. This has left many to develop new programs to stop deposit outflows and win share-of-wallet from their competitors.

A recent article by The Financial Brand points out that while paying more for deposits via higher rates and sign-up bonuses may be necessary in the short term, there is a lower-cost play that will reap longer-lasting benefits: focus on making deposits and account holder relationships stickier.

– Steve Cocheo, senior executive editor at The Financial Brand

Combat Deposit Outflows with Competitive Intelligence Marketing

Competitive intelligence is at the core of any organization’s growth plan, but financial institutions have an advantage when it comes to data. They have the unique ability to see exactly where account holders are spending their money and if they are using competing products and services.

In short, financial institutions have a complete picture of their account holders’ financial relationships right at their fingertips. This type of competitive intelligence—gleaned from transaction data—is the key ingredient for winning back share-of-wallet from competitors.

Account Holder Loyalty is up for Grabs…How to Take it Back

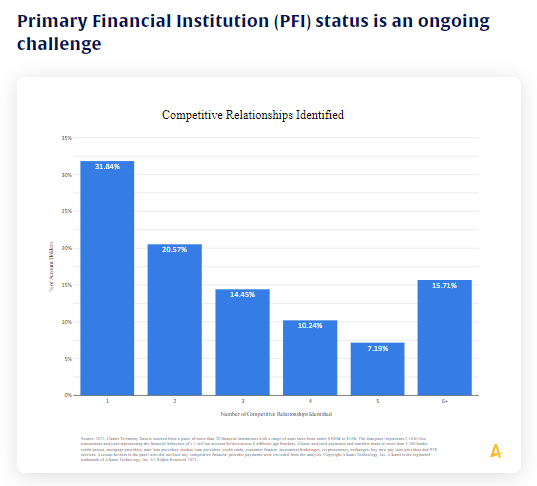

Account holders have relationships with a wide variety of financial services providers. In fact, account holders made payments to an average of 3.22 different providers in Q1 2023, and 15.72 percent of account holders had six or more relationships (according to Alkami Telemetry Data, a primary data panel consisting of over two billion de-identified transactions from within Alkami’s platform).

This financial services fragmentation makes it harder than ever for financial institutions to stake a claim to a primary financial institution (PFI) relationship.

Here are steps banks and credit unions can take to build PFI status:

- Examine account holder transaction data to determine which competitors account holders are engaging with.

- Use this intelligence to research what products and offers those competitors offer. Then, strategically target the appropriate audience with competitive win-back campaigns.

- Examine account holder data for signs of shopping for banking products or services. This will tell you what product they’re most likely to need next. When you outreach with information about those products, you can be confident you are communicating to the right audience. Relevant advertising and outreach is vital to capturing the attention and share-of-wallet of today’s savvy consumers.

- Track and learn, and adjust. Using marketing automation tools, you can automatically generate audiences, follow the success of your campaigns from launch to attribution of sale, and realize return-on-investment (ROI) that can be tied back to individual campaign elements and channels.

Deepen Relationships to Drive Growth

The bottom line is, no matter where you are in your digital transformation journey, using competitive intelligence gleaned from transaction data and digital engagement effectively will be key to driving revenue growth. Gain a deeper understanding of your customers or members with behavioral analytics, identify deposit outflow with competitor insights, find new market opportunities with AI powered marketing automation, and develop strategies suitable for your unique financial institution – all with the right modern data and marketing toolset.

Interested in learning how behavioral analytics like these can empower your financial institution to grow? Learn more.

Business Banking Solutions

Business Banking Solutions Data & Marketing Solutions

Data & Marketing Solutions Positive Pay & ACH Reporting

Positive Pay & ACH Reporting Who We Serve

Who We Serve