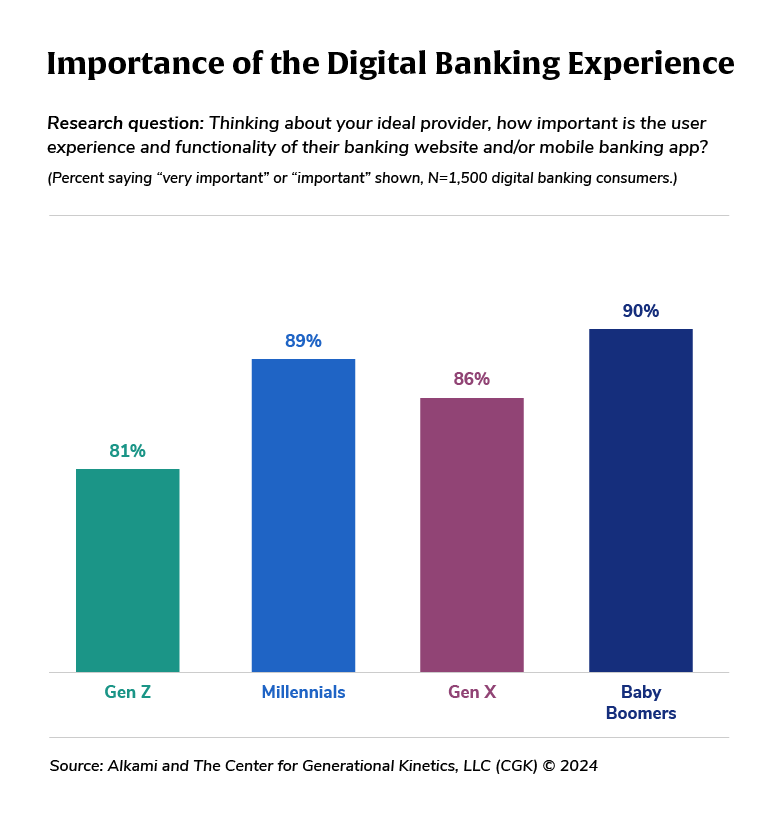

Financial institutions looking to attract younger generations must create a superior experience within their digital banking solutions. Millennials demand seamless, personalized experiences–58% of them are likely to switch financial providers if a competitor offers a better digital banking experience. Meanwhile, both millennials and baby boomers rank the digital banking experience as a key factor in their choice of primary financial institution. Banks and credit unions must adopt innovative digital marketing strategies to engage, retain, and expand their account holder base. This post explores key strategies in financial services marketing automation to help institutions drive engagement, increase product adoption and deliver a superior account holder experience.

Personalization: The Key to Financial Services Marketing Automation

One of the most significant trends in marketing for financial institutions is personalization. Account holders expect tailored experiences that cater to their specific needs and preferences. By leveraging data analytics in banking, financial institutions can gain insights into account holder behavior, allowing them to create tailored experiences that foster deeper relationships.

How to Automate Personalization at Scale

To make informed recommendations at the right time within digital banking solutions, deep account holder insight is required. Here are a few ways financial institutions can effectively gather and analyze data, transform into a data-informed digital banker and execute targeted marketing messages that provide personalized banking experiences.

- Advanced data analytics tools: Combine core banking and transaction data to understand life events, financial behaviors and engagement trends for tailored digital experiences.

- Intelligent account holder segmentation: Categorize account holders based on behavioral and transaction patterns to create highly relevant campaigns.

- Real-time behavioral insights: Monitor spending habits, savings trends and online activity to trigger automated marketing messages for personalized product recommendations.

- Feedback and survey-driven automation: Collect direct feedback through surveys, reviews and customer service interactions to understand account holder preferences and pain points. Use these insights to fine-tune marketing campaigns and enhance account holder satisfaction.

- Omnichannel data integration: Combine data from various sources such as digital banking solutions, websites, and offline interactions to create a comprehensive view of the account holder.

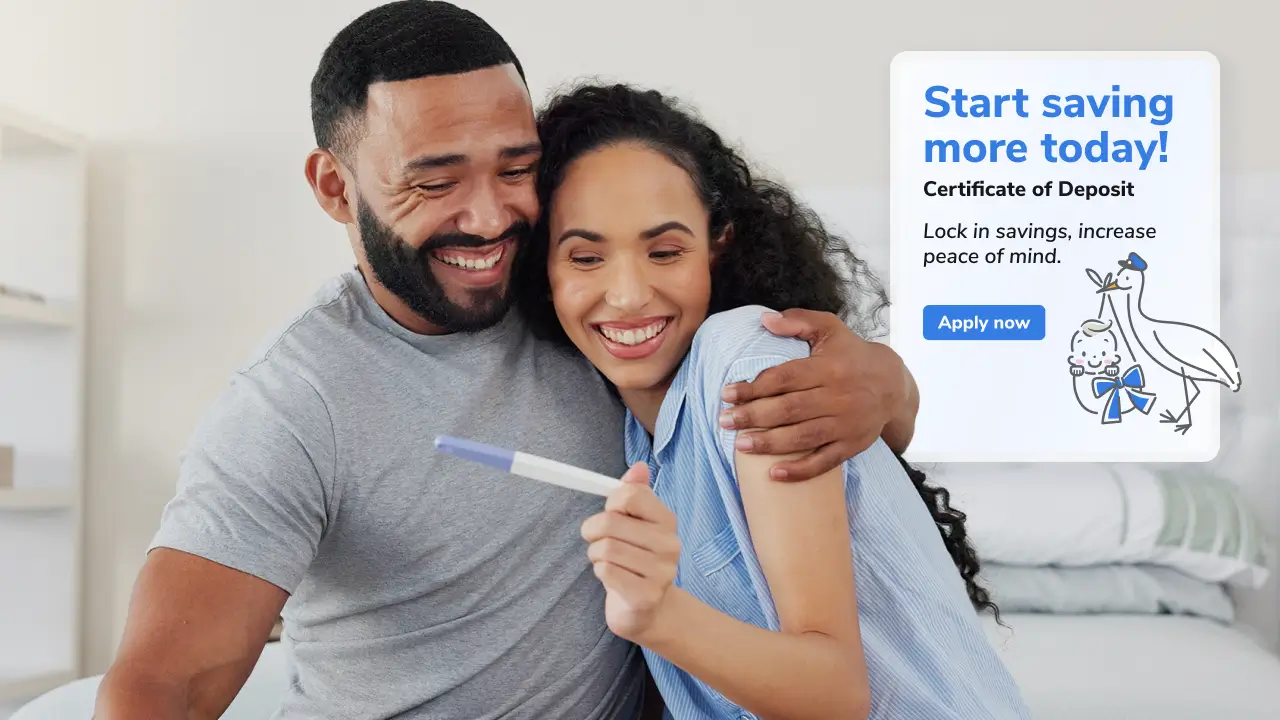

Personalized Financial Services Marketing Automation in Action

Imagine a financial institution detects account holders regularly using other payment methods instead of the institution’s debit card. With financial services marketing automation, a triggered email campaign could highlight debit card rewards and exclusive cashback offers–encouraging account holders to re-engage with the institution’s debit card and digital banking solutions.

Expand Digital Engagement

With the prevalence of smartphones and constant internet access, a strong digital presence is non-negotiable. Financial services marketing automation ensures that messaging is consistent, timely and optimized for each digital channel.

How to Grow Channel Engagement with Marketing Automation

Below are ways banks and credit unions can expand messaging, outreach and traffic using financial services marketing automation.

- Content marketing: Creating valuable and informative content is an excellent way to establish authority and trust. Schedule and distribute blogs, articles, videos and infographics that educate account holders about financial products, money management tips and market trends. Use social media platforms to maximize reach.

- Email marketing: Despite being one of the oldest forms of digital marketing, email remains highly effective. Use behavioral data tags to send personalized emails at key moments, such as welcome journeys, loan pre-approvals or upsell offers.

- Display ads: Using display ads across digital platforms can help financial institutions reach a broader audience. Deploy data-driven ad targeting to reach account holders with relevant promotions based on their recent digital banking activity.

- Mobile app push notifications: Deliver real-time alerts for account updates, promotional offers and personalized financial insights.

Maximize Your Website

A financial institution’s website is a high-impact marketing channel. It serves as a central hub where account holders can learn about products, access services and engage with the brand. It should work in sync with automated campaigns to drive engagement and conversions.

How to Enhance Your Website with Financial Services Marketing Automation

Here are some strategies to optimize the financial institution’s website for marketing success:

- Data-driven content recommendations: Dynamically serve blog posts, frequently asked questions (FAQs), and product recommendations based on a visitor’s browsing behavior. Educational resources can help account holders make informed decisions.

- Search engine optimization (SEO): To attract organic traffic, the website must be optimized for search engines. This includes using relevant keywords, creating high-quality content and ensuring mobile-friendliness.

- Secure digital banking solutions: Highlighting the security features of digital banking solutions can build trust. Ensuring account holders feel safe while conducting transactions online is required for retention and satisfaction.

- Cross-channel integration: The website should seamlessly integrate with email marketing and other digital channels for financial services marketing automation. Connect website behavior data with email, mobile and social campaigns for a seamless digital experience.

Case Study: Meritrust Credit Union Speeds Results with Financial Services Marketing Automation

Meritrust Credit Union transformed its marketing strategy automating data-driven campaigns–allowing for faster execution, stronger segmentation and higher engagement rates.

—Leeah Webb, Growth Strategies Analyst, Meritrust Credit Union

Watch the full interview to see how financial services marketing automation drives real results.

Power Financial Services Marketing Automation with Digital Channel Personalization

Financial services marketing automation is about more than just promoting products. It’s about understanding and meeting account holder needs through personalized experiences, leveraging digital channels and building trust through transparency and security. By adopting these strategies, financial institutions can thrive in an increasingly competitive environment where consumers have many choices for financial products and services.

Embracing technology and innovation while keeping the account holder at the heart of all efforts is key to unlocking success in financial services marketing automation. As digital technologies continue to evolve, staying agile and adaptable will ensure sustained growth and account holder loyalty. Financial institutions that prioritize a superior digital experience will be well-positioned to attract and retain all generations, securing their place in the future of banking.

Amplify your digital financial services marketing