In the ever-evolving landscape of digital banking, a common misconception persists: the notion that the size of a financial institution directly correlates with its level of digital maturity. It’s easy to assume that larger banks, with their vast resources and extensive account holder bases, lead the charge in adopting cutting-edge technologies and digital practices.

However, the reality is far more nuanced and reveals a fascinating paradox. The “Digital Sales & Service Maturity Model” research report provides compelling insights into this wide spectrum of financial institutions that are exploring growth, to the pacesetters challenging traditional perceptions, highlighting the multifaceted nature of digital maturity in the banking sector.

Digital maturity extends beyond the mere presence of digital banking solutions. It encompasses the depth and breadth of these offerings, how seamlessly they integrate with consumers’ lives, and the degree to which they enhance the overall account holder experience. This includes the sophistication of online banking platforms, mobile banking capabilities, speed of digital account opening, talent and culture, AI-driven personalized services, and the agility to adapt to emerging technologies.

To assess maturity within the industry, researchers utilized advanced analytics techniques to categorize respondents into four segments:

| Patiently Exploring – Primarily smaller institutions, focused on high-touch in-person interaction while relying on third-party digital solution providers |

| Innovation-Ready – Mostly mid-sized organizations starting to invest in technology with a priority on the user experience with a great interface; the next step for this group is speeding up their account set-up experience |

| Digital-Forward – Heavily invested in digital technology, understanding the value of technology have automated a lot of back-end processes; this group is above average in digital maturity with their account set-up experience among the best in the business for account holders and non-account holders; they aim to be a true data-driven organization |

| Data-First – Tends to be larger, full-service banks or credit unions and fully embraces a data-driven mindset, using it for nearly every decision; considers technology their competitive advantage and pushes vendors to innovate or they build in-house |

Customer-centricity is the common ground among all segments, but the most digitally mature financial institutions specifically focus on returns from their investments and rely on data rather than intuition for strategic business decisions.

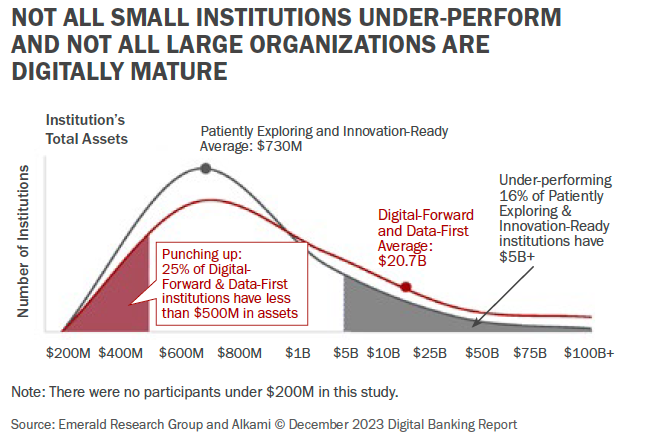

At first glance, the argument seems straightforward: larger banks have more resources, therefore they can invest more in digital transformation. This perspective, however, oversimplifies the dynamics at play; not all small institutions under-perform

and not all large organizations are digitally mature. Digital maturity is not solely a product of financial investment but involves a complex interplay of strategy, culture, talent acquisition, technology adoption, and account holder engagement.

One of the most striking revelations from the “Digital Sales & Service Maturity Model” research report is the digital nimbleness of smaller financial institutions. Without the cumbersome legacy systems that often plague larger institutions, smaller banks and credit unions can adopt and implement new technologies with surprising speed and efficiency. Their size allows for more flexible decision-making processes, quicker implementation of innovative digital banking solutions, and a closer, more responsive relationship with their customers or members. Regardless of size, the below attributes taken from the report distinguishes the fast movers:

These overachievers architect much of the digital blueprint, and behave aggressively towards digital growth and evolution.

Digital maturity is as much about culture and leadership as it is about banking technology. A financial institution’s ability to foster a culture of innovation, retain high performers, provide continuous development, and create customer-centricity plays a critical role in its digital evolution. Leadership commitment to digital transformation, reflected in strategic investments in talent and technology, can propel even the smallest institutions to high levels of digital maturity.

Lessons and Insights Beyond Digital Banking Solutions

The insights from the “Digital Sales & Service Maturity Model” research report serve as a powerful reminder that digital maturity is not a one-size-fits-all metric. It challenges banks and credit unions of all sizes to reassess their digital strategies beyond digital banking solutions, emphasizing the importance of agility, customer engagement, and a commitment to tech innovation. For smaller financial institutions, it highlights an opportunity to leverage their size and flexibility as strengths in the digital arena.

The correlation between size and digital maturity in the banking sector is far from straightforward. As the research report illustrates, some smaller banks are thriving digitally, offering lessons on visionary leadership, nimble operations, a creative mindset and embody how culture and philosophy can outweigh budget. In the digital age, it’s not the size of the financial institution that determines its success, but how effectively it can adapt, engage, and pioneer in the face of changing technologies and consumer expectations.